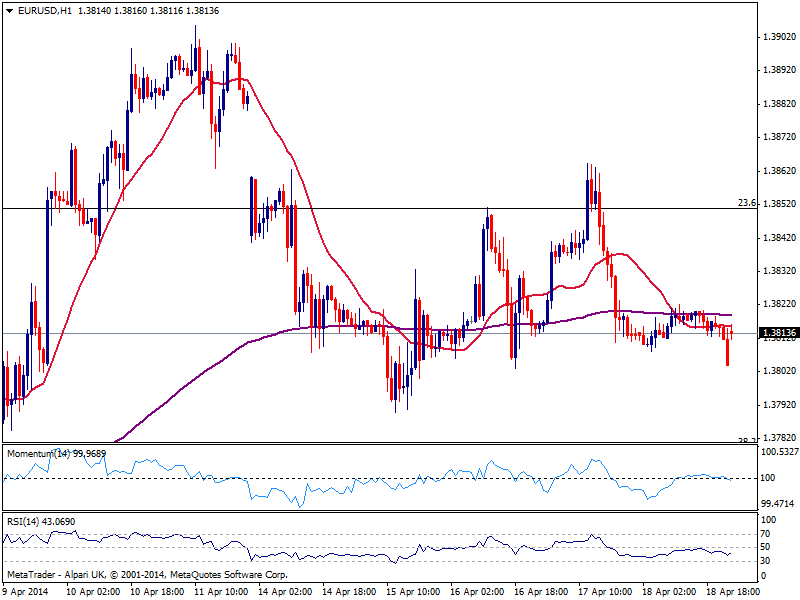

EUR/USD Current price: 1.3813

View Live Chart for the EUR/USD

With Australia and New Zealand closed for Easter Monday, market will actually kick start later today, with Japan; European stocks will also be off with the US finally opening. Overall, there had not been much forex related news over the weekend besides continued tension in the Ukraine/Russia conflict. So far, the situation has not been enough to trigger a run to safety albeit the risk of such is pretty high, and should not be disregarded.

As for the EUR/USD the pair closed Friday right above the 1.3800 level, gapping slightly higher with this new weekly opening. The technical short term picture is quite neutral after the holidays, and will likely remain so over the upcoming hours; immediate support comes at 1.3780 strong Fibonacci level, while 1.3825 caps the upside in the short term. A break of either extreme will probably favor some short term continuation in the set direction, although thin Monday should not see any critical breakout across the board.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3825 1.3860 1.3890

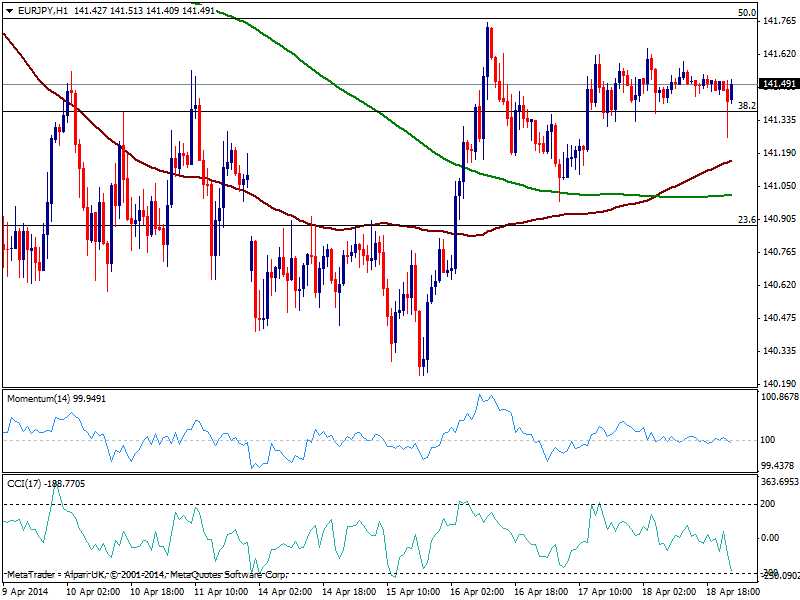

EUR/JPY Current price: 141.49

View Live Chart for the EUR/JPY

Yen weakness from early past week left the EUR/JPY consolidating above the 141.00 figure, having found sellers around the 50% retracement of its latest bearish run at 141.75, and buyers around the 38.2% of the same rally at 141.36 immediate short term support. The hourly chart shows price above 100 and 200 SMAs and indicators flat around their midlines, reflecting recent consolidative stage. In the 4 hours chart indicators lost the upward potential and stand near their midlines, still far from suggesting a bearish run. Japanese Trade Balance to be released today may bring some action to yen crosses, with the pair probably following Nikkei over current session.

Support levels: 141.35 140.90 140.40

Resistance levels: 141.70 142.20 142.60

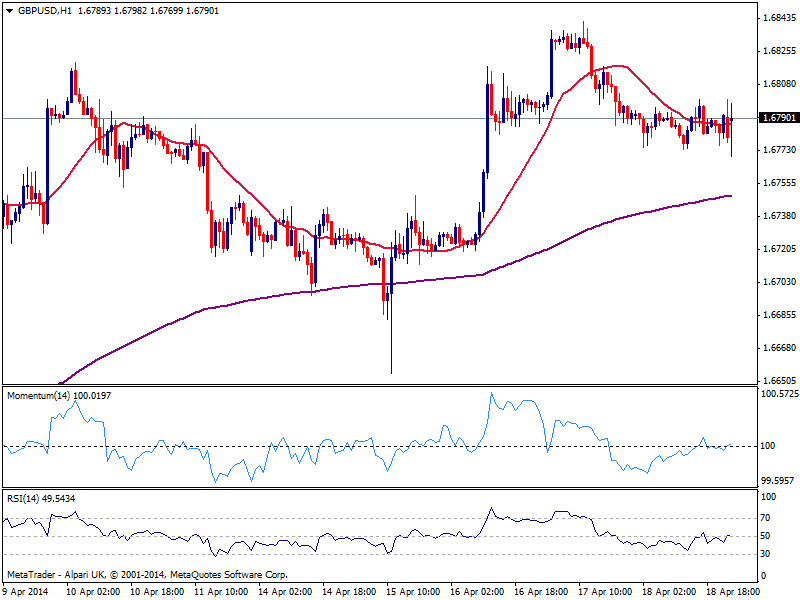

GBP/USD Current price: 1.6790

View Live Chart for the GBP/USD

The GBP/USD downward corrective movement after posting a fresh year high of 1.6841, held so far above the 1.6770 level, immediate short term support. As a new day starts, extremely modest by the way, the pair advances some approaching the 1.6800 figure and with a slightly bullish short term tone comes from the hourly chart, as price stands above its 20 SMA and momentum aims higher in neutral territory. In the 4 hour chart price stands also above a strongly bullish 20 SMA, while indicators are flat around their midlines. Despite the lack of action, the bullish trend remains well in place with buyers probably defending 1.6745 price zone, in case of short term slides.

Support levels: 1.6770 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

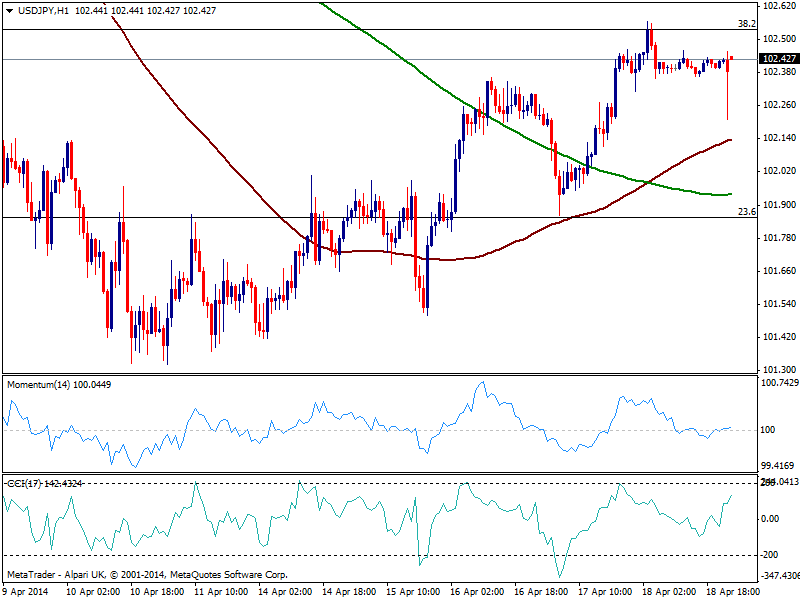

USD/JPY Current price: 102.42

View Live Chart for the USD/JPY

The USD/JPY continues to trade below the 102.60 static resistance area, with a mild positive tone according to the hourly chart that shows price above its moving averages and CCI heading north in positive territory. The latest recovery of the pair has been pretty much contained, with not much buyers around despite stocks strong recovery over the last few days. Above mentioned resistance the pair may extend towards 103.00 area yet further gains seem limited for now.

Support levels: 102.35 102.00 101.55

Resistance levels: 102.60 102.95 103.20

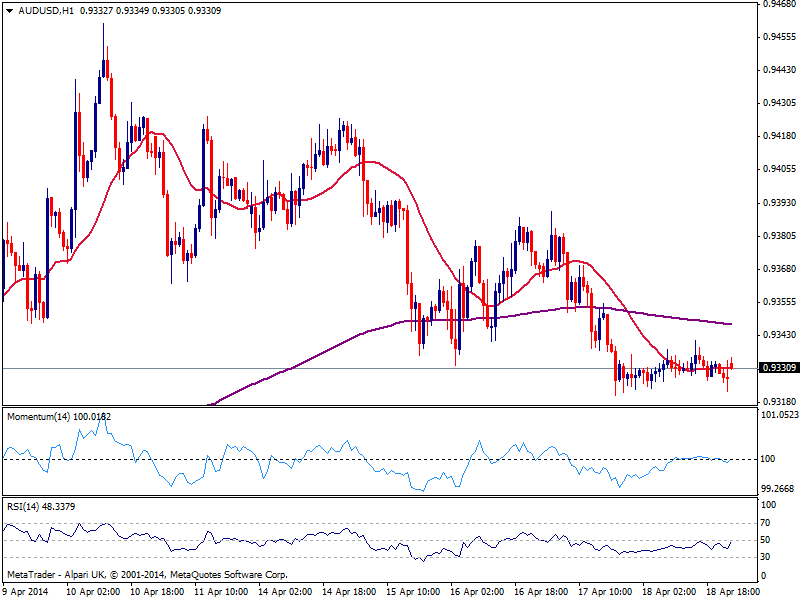

AUD/USD Current price: 0.9331

View Live Chart for the AUD/USD

Consolidating near its recent lows, AUD/USD has found it hard to maintain the bullish tone after flirting with 0.9460 earlier this month, short term neutral but still mild bearish in term. A break below 0.9320 should lead to a downward extension towards key .09260 strong midterm support. So far, stocks upward momentum has prevented the pair from falling big, but has not been enough to favor a recovery. If stocks turn red over the upcoming days, the pair can become more clearly bearish with a break below mentioned 0.9260 favoring a test of the 0.9000 figure.

Support levels: 0.9320 0.9290 0.9260

Resistance levels: 0.9355 0.9390 0.9445

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.