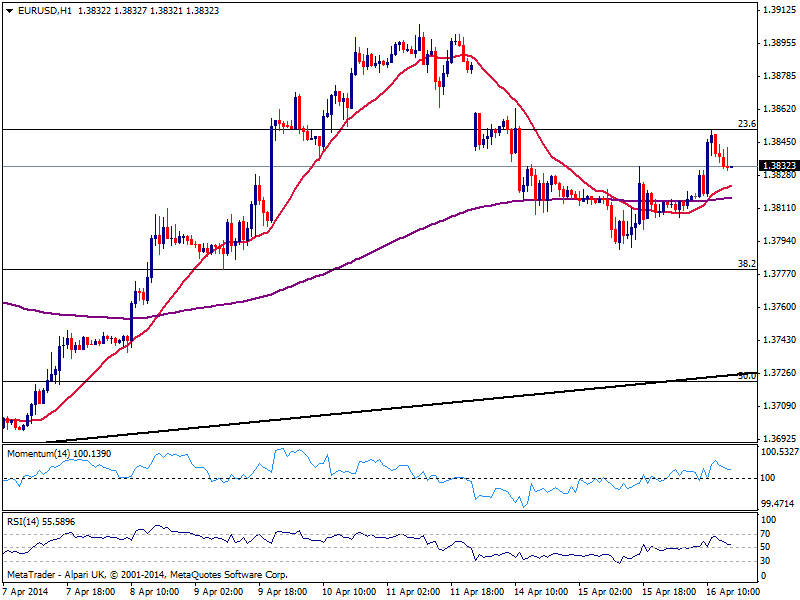

EUR/USD Current price: 1.3829

View Live Chart for the EUR/USD

The EUR/USD is having a good day as the common currency recovers ground, rising up to 1.3850 against its American counterpart, on the back of rising stocks all over the world: Asian indexes soared giving the lead, while European ones follow and so do US futures. These last, may be affected by slightly disappointing housing data n the US just released, that missed expectations. Nevertheless, market is moving mostly on sentiment, and even gold is recovering some from yesterday’s free fall.

Technically, the EUR/USD hourly chart shows price consolidating above 1.3820 immediate support, with 20 SMA heading slightly higher below current price around the same level and indicators turning lower still above their midlines. In the 4 hours chart technical readings present a slightly negative tone, with current candle opening right below a bearish 20 SMA and indicators retracing from their midlines. Nevertheless, the pair may extend its recovery particularly if stocks maintain the bid tone, with a break above 1.3850 favoring a run towards 1.3890 price zone.

Support levels: 1.3820 1.3780 1.3750

Resistance levels: 1.3850 1.3890 1.3925

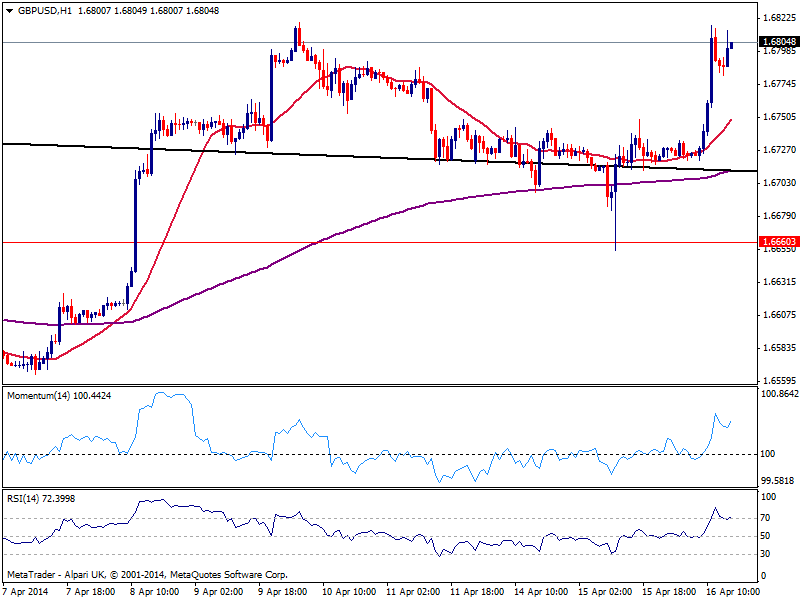

GBP/USD Current price: 1.6804

View Live Chart for the GBP/USD

Pound maintains its early strength, having flirted with the year high of 1.6821 against the greenback, following better than expected employment figures in the UK. The pair corrected lower afterwards, finding buyers in the 1.3780 level now immediate intraday support. Technically, the hourly chart shows indicators resuming the upside after correcting overbought readings, with 20 SMA gaining bullish slope below current price, while the 4 hours chart also presents a strong upward tone. Price however, halted around the year high of 1.6821 and a break above it is required to confirm further gains today, eyeing 1.6870 as next probable bullish target.

Support levels: 1.6780 1.6745 1.6710

Resistance levels: 1.6820 1.6870 1.6915

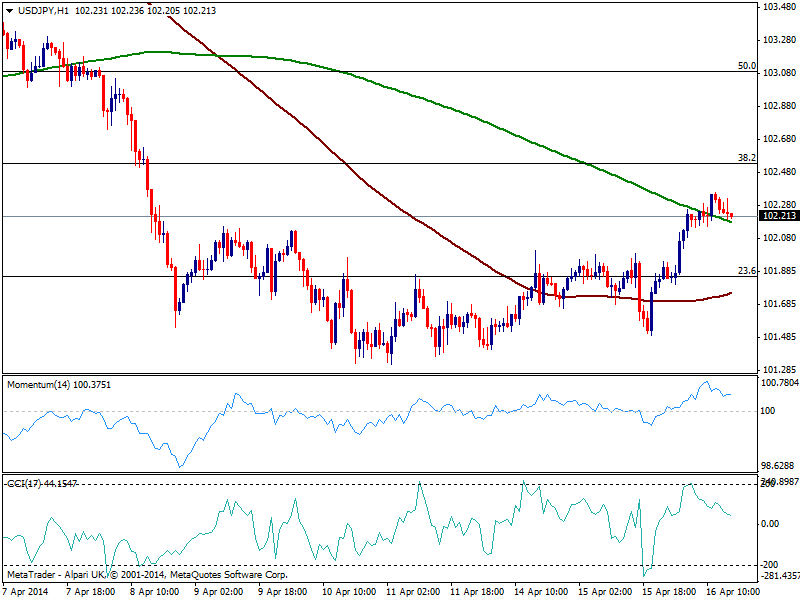

USD/JPY Current price: 102.21

View Live Chart for the USD/JPY

The USD/JPY broke higher in Asian hours, advancing up to 102.36 to post a fresh 7-day high on strong equities. Adding to that, BOJ’s governor Kuroda said Japanese economy had continued to recover moderately, leaving doors open for further easing in the upcoming future. Holding above the 102.00 figure ahead of US opening, the hourly chart shows price finding short term support in a still bearish 200 SMA while indicators lose upward potential in positive territory. In the 4 hours chart indicators turn lower near overbought readings, albeit remain far from suggesting a downside movement in the short term. Next strong resistance lies in the 102.50/60 price zone, probable top for today in case of more gains.

Support levels: 102.00 101.55 101.20

Resistance levels: 102.35 102.60 102.95

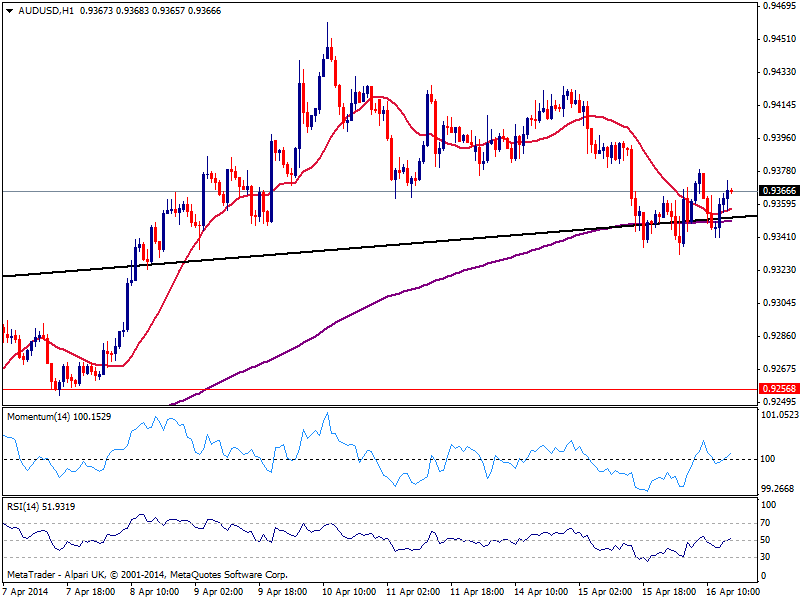

AUD/USD Current price: 0.9366

View Live Chart for the AUD/USD

Australian dollar managed to bounce some after posting a low yesterday of 0.9331, presenting a slightly bullish tone ahead of US opening, still in risk of a downward extension: the hourly chart shows price barely holding above a flat 20 SMA while indicators are heading higher right above their midlines, still pretty neutral. In the 4 hours chart a slightly bearish tone prevails with resistance now around 0.9390, 20 SMA in this latest chart.

Support levels: 0.9330 0.9290 0.9260

Resistance levels: 0.9390 0.9445 0.9485

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.