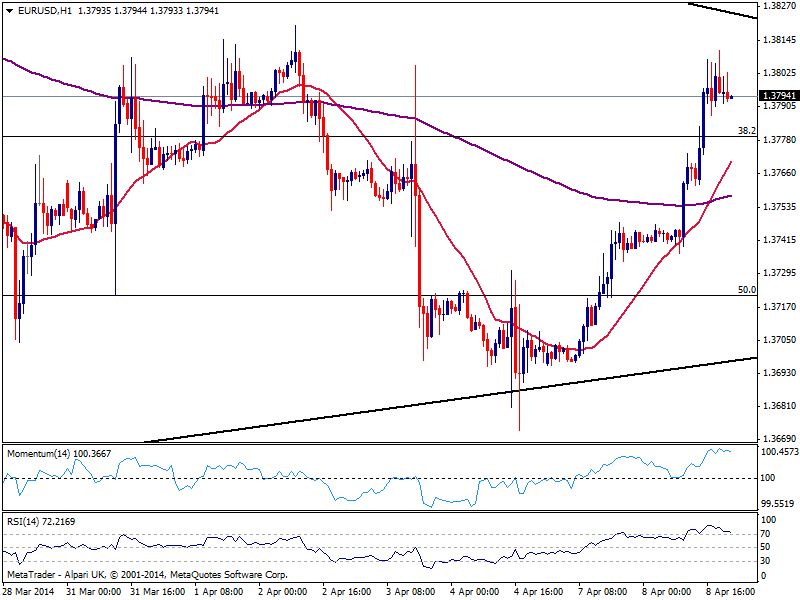

EUR/USD Current price: 1.3796

View Live Chart for the EUR/USD

The picture has changed 180° degrees for the greenback, in this second trading day of the week: having approached to breakout levels particularly against its European rivals last Friday, the rally succumbed to falling stocks and macro news favoring dollar counterparts. The forex market looks finally lively, but the EUR/USD may not be the best choice nowadays: the pair has again halted around the messy area right above 1.3800 on news the ECB “Stands ready to act if needed to stop euro zone inflation getting stuck at low levels†according to Bundesbank chief Jens Weidmann.

The EUR/USD is among the worst performers of the day, considering it maintains its latest weeks range. Still the bounce from the long term ascendant trend line is not a minor technical data, is just that seems not enough just yet. Short term, the hourly chart shows indicators exhausted in overbought levels still not suggesting a bearish correction, while 20 SMA heads strongly up well below current price. In the 4 hours chart technical readings maintain a strong bullish tone while price recovered above its 200 EMA all of which suggest more gains are likely: a technical confirmation will come with a break above 1.3830, a daily descendant trend line coming from 1.3966 this year high.

Support levels: 1.3780 1.3750 1.3720

Resistance levels: 1.3830 1.3865 1.3910

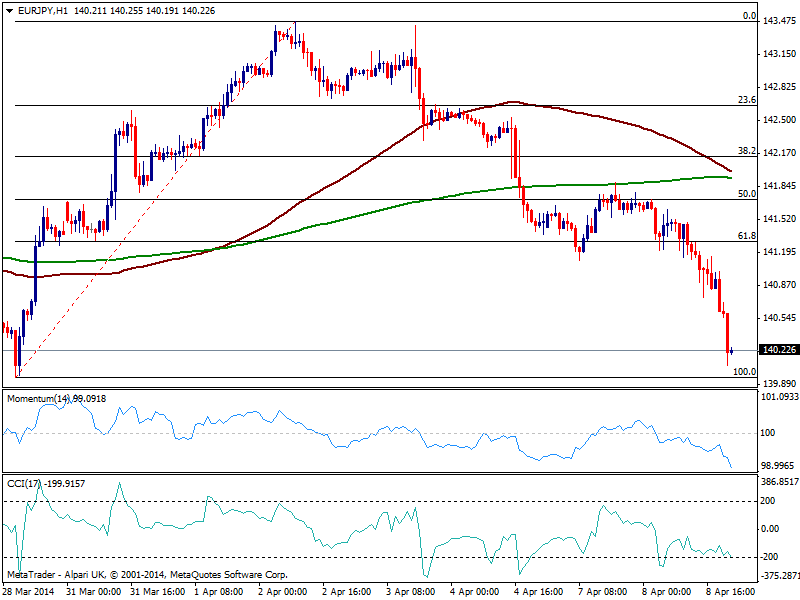

EUR/JPY Current price: 140.22

View Live Chart for the EUR/JPY

BOJ inaction has been the kick start of a yen rally that extended all through this Tuesday, feed also by falling stocks. In the US, indexes managed to recover most of the lost ground in a modest rebound after these last days’s selloff. But yen maintains its strength against most of its rivals, not willing to give an inch: the EUR/JPY has retraced almost 100% of its latest bullish run and trades a few pips above the 140.00 figure, maintaining a strong bearish tone in its hourly chart: 100 SMA added a strong bearish slope and converges with 200 one around 142.00, while momentum maintains the bearish bias. In the 4 hours chart technical readings also present a clear bearish tone, while the daily candle points for a close below 100 DMA first time since early February. A break below the 140.00 level, should signal a steady downward continuation, eyeing in the short term 138.80 price zone.

Support levels: 139.90 139.35 138.80

Resistance levels: 140.40 140.90 141.30

Updates for Asia on GBP/USD, USD/JPY and AUD/USD

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.