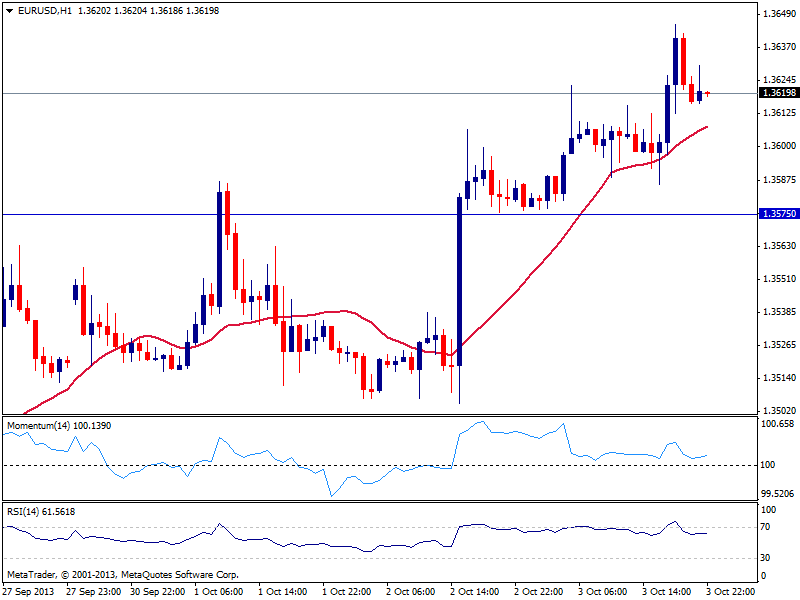

EUR/USD Current price: 1.3619

View Live Chart for the EUR/USD

As the US government goes through its third day of shut down and technical default becomes more real, the greenback erosion extends across the board: the EUR/USD advanced up to 1.3645 this Thursday, levels not seen since past February, helped by worse than expecting US macro data. Stocks continued diving, while gold extended its recovery, not going too far away from $1300/oz. Earlier today, news agencies confirmed there will be no employment data released tomorrow, which take down any chance of tapering for this year, which only means more dollar weakness. As for the EUR/USD the hourly chart shows price held above 20 SMA that continues grinding higher, while indicators stand in positive territory. Main bullish target continues to be 1.3710, this year high, while 1.3570/80 area will likely attract buyers if reached, halting attempts to break lower.

Support levels: 1.3570 1.3535 1.3490

Resistance levels: 1.3620 1.3660 1.3710

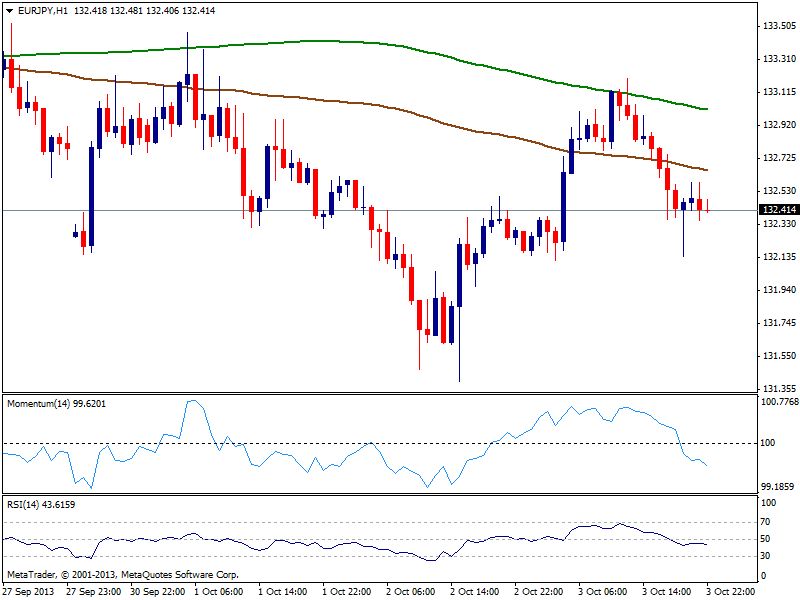

EUR/JPY Current price: 132.42

View Live Chart for the EUR/JPY

The EUR/JPY rallied all the way up to 133.20 before yen strength overcame EUR, sending the pair to current levels. The hourly chart shows the rally was halted around 200 SMA, with price now also below 100 one and indicators heading strongly south below their midlines, suggesting risk remains to the downside. Bigger time frames present a more neutral stance, giving not much clues on what’s next for the pair, yet with share markets in selling mode, there’s little room for sustained gains today.

Support levels: 132.10 131.55 131.00

Resistance levels: 132.60 133.00 133.40

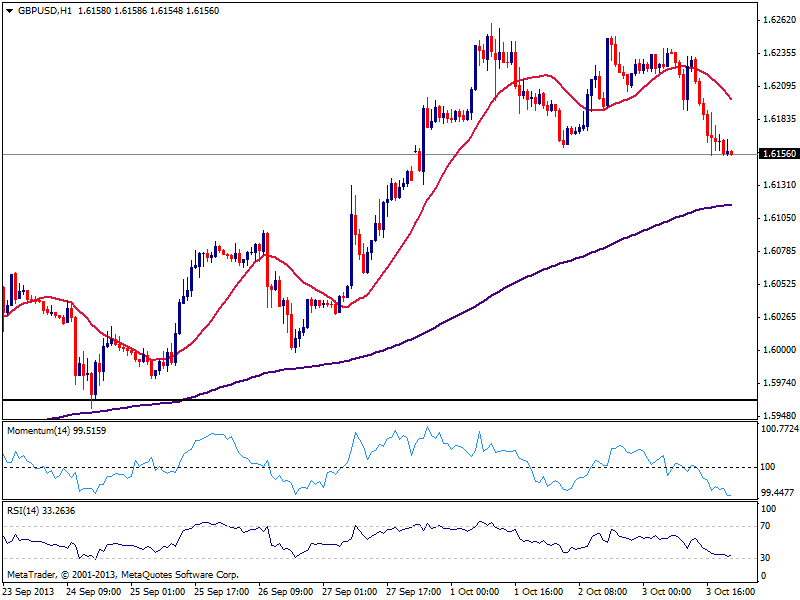

GBP/USD Current price: 1.6156

View Live Chart for the GBP/USD

The GBP/USD trades at its daily low right below 1.6160, having been under pressure for most of the day no matter what. Seems market players had decided to accelerate the profit taking after recent approach to the 1.6300 figure. As Asian session quick in, the hourly chart maintains a pretty bearish tone, with indicators approaching oversold readings and 20 SMA gaining strong bearish slope above current price. The 4 hours chart also presents a strong bearish tone, suggesting more bearish corrective movements ahead. In the long run however, price can fall down to 1.5970 without actually harming the dominant bullish trend.

Support levels: 1.6120 1.6080 1.6030Resistance levels: 1.6210 1.6260 1.6300

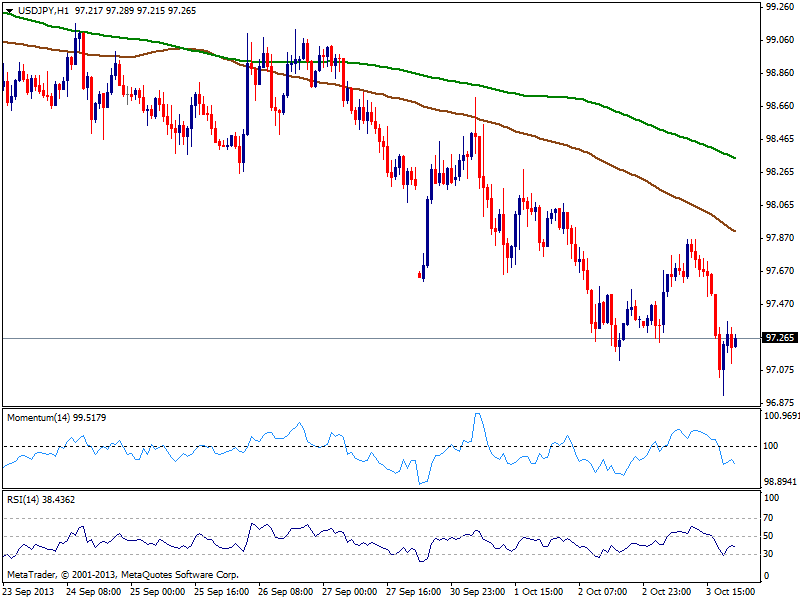

USD/JPY Current price: 97.26

View Live Chart for the USD/JPY

The USD/JPY succumbed to negative US data falling down to 96.92 before bouncing some. However, the bearish tone prevails, and the hourly chart suggest more slides for current session, as indicators head south after correcting oversold readings. The daily chart shows 200 SMA around 96.50 acting as strong dynamic support, as price has held above it since late November last year. If the level gives up, the pair may enter a midterm bearish trend, eyeing 93.70, 38.2% retracement of the 77.12/103.72 rally.

Support levels: 96.90 96.50 96.20

Resistance levels: 97.50 98.00 98.40

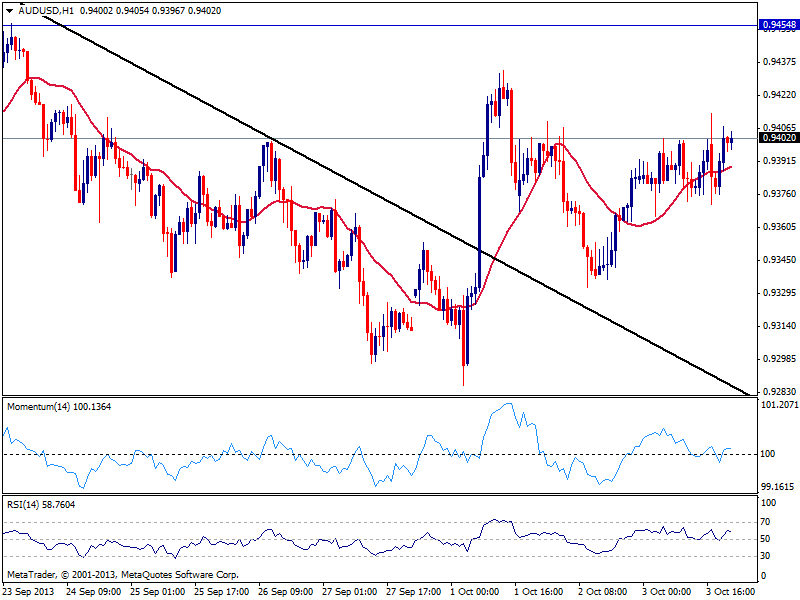

AUD/USD Current price: 0.9402

View Live Chart for the AUD/USD

The AUD/USD continues pushing higher, but holds around 0.9400, having advanced less than 40 pips in the day. The lack of upward momentum is clear in the hourly chart despite the positive tone of technical readings, situation that repeats in the 4 hours chart. As comment on previous updates, there’s little to do here, as a break above 0.9450 is still required to confirm a continued advance.

Support levels: 0.9370 0.9335 0.9280

Resistance levels: 0.9410 0.9450 0.9490

Recommended Content

Editors’ Picks

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

GBP/USD hovers around 1.2500 on the stronger US Dollar, focus on BoE rate decision

The GBP/USD pair trades on a softer note around 1.2500 on Wednesday during the Asian session. The USD Index recovers modestly to 105.40, which drags the major pair lower. Investors focus on the upcoming Bank of England's monetary policy meeting.

Gold price recovers its recent losses, despite a firmer US Dollar

Gold price attracts some buyers during the Asian trading hours on Wednesday. Safe-haven demand, fueled by geopolitical tensions and uncertainty, as well as ongoing central bank purchases, might contribute to a rally in gold.

Ethereum resume sideways move as Grayscale files to withdraw Ethereum futures ETF application with the SEC

Ethereum is hinting at a resumption of a sideways movement on Tuesday after seeing inflows for the first time in seven weeks. Grayscale withdrew its application for an Ethereum futures ETF, and the SEC’s Chair Gary Gensler has also called most crypto assets securities.

No obvious macro catalysts to steer the bus

The US data calendar remains relatively light, with initial jobless claims and the University of Michigan survey being the key focus. However, these releases may not provide a significant catalyst for the next directional move in the US Dollar.