EUR/USD Current price: 1.3064

View Live Chart for the EUR/USD

Market was all about ECB this Thursday, with the EUR/USD holding pretty well around 1.3200 after a 0.25% rate cut and Draghi dovish statement. But when during the press conference he said that the Central Bank was “technically ready” to cut deposit rates to negative, the pair succumbed and fall as low as 1.3036 before bouncing slightly higher. While in the bigger picture, the pair maintains the range and trades in the 1.30/1.32 area, another failure at the high and the strong slide breaking below the Fibonacci level at 1.3115, increases chances of a break lower, again.

Far from the bottom of the range around 1.2970, the hourly chart shows a tight range, as investors are now waiting for the last major event of the week, US NFP figures on Friday. Expected around 146K after a disappointing 88K reading last month, a positive number may fuel dollar gains, as it will suggest QE may come to an end in the US this year. Another negative number will see the pair back nearing highs well into the 1.31 area. As for the short term, indicators remain in oversold territory, but the inability of price to recover, exposes the downside, with immediate support at 1.3040. Bears will lead now as long as price holds below mentioned 1.3115 level.

Support levels: 1.3040 1.3010 1.2970

Resistance levels: 1.3080 1.3115 1.3150

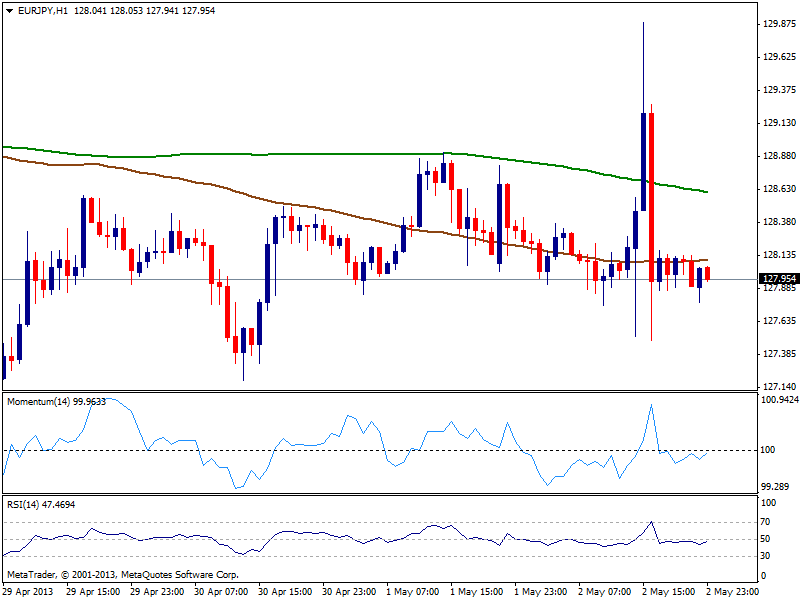

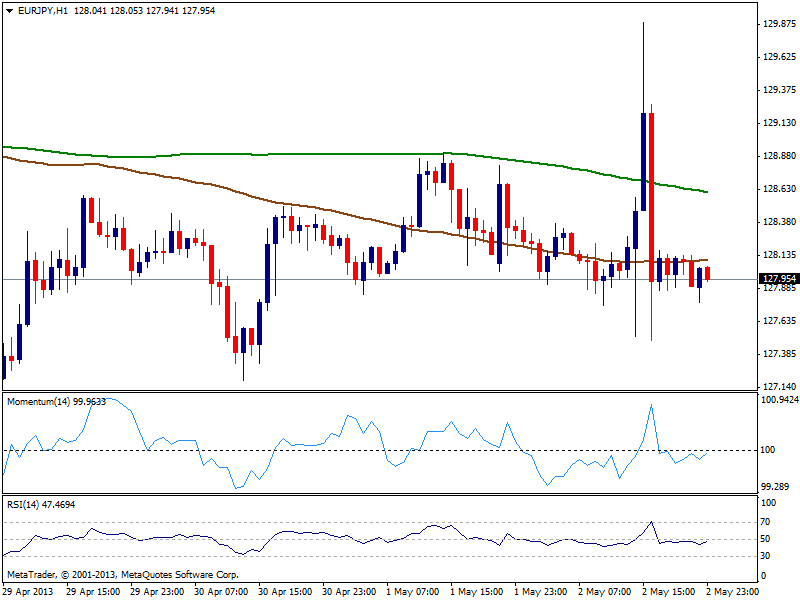

EUR/JPY Current price: 127.96

View Live Chart for the EUR/JPY (select the currency)

Will movements around early news ended up with the pair again stuck around 128.00. The hourly chart shows price below 100 SMA and indicators below their midlines, still favoring the downside in the short term. In the 4 hours chart technical readings remain flat, offering a neutral outlook, with 127.50, daily low now as key support ahead of the 126.00 area.

Support levels: 127.80 127.50 127.10

Resistance levels: 128.40 128.80 129.50

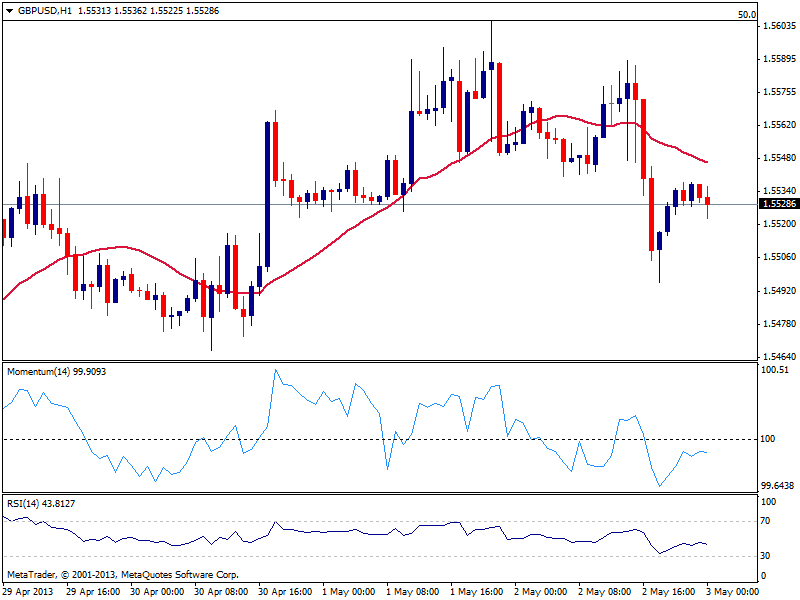

GBP/USD Current price: 1.5528

View Live Chart for the GBP/USD (select the currency)

Pound suffered from dollar strength, easing against the greenback down to 1.5497, but finding some buying interest around. The hourly chart however has turned slightly bearish, with price now capped below 20 SMA and indicators heading lower below their midlines. In the 4 hours chart price stands right below its 20 SMA, while indicators turned flat in positive territory. Despite the daily fall, the pair is far from bearish, as only below 1.5420 bears will take control. However, a break above 1.5605 is now required to confirm a return of the upward trend.

Support levels: 1.5530 1.5490 1.5450

Resistance levels: 1.5580 1.5610 1.5650

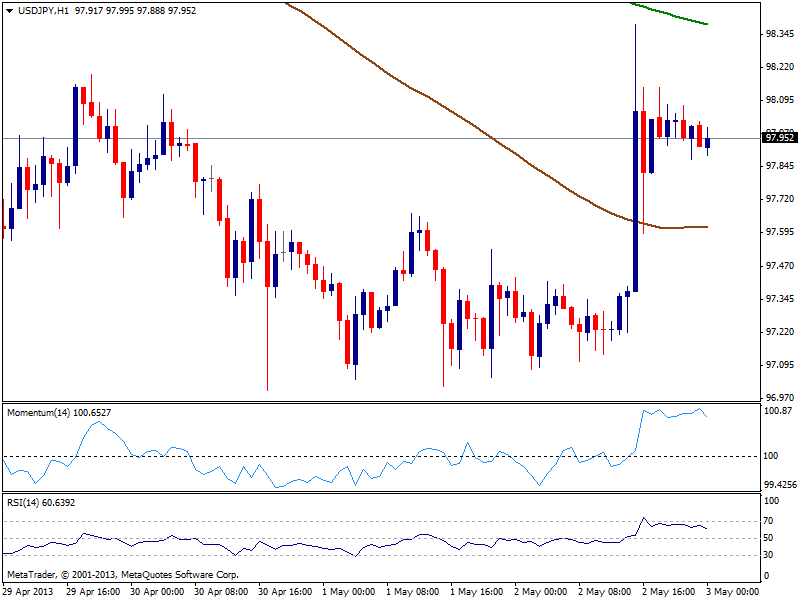

USD/JPY Current price: 97.95

View Live Chart for the USD/JPY (select the currency)

Having been as high as 98.38, the USD/JPY finally settle around the 98.00 level, maintaining a pretty positive stance despite the risk off environment. The hourly chart shows indicators retracing from overbought levels, but price steady in between 100 and 20 SMA’s, with the first offering dynamic support now around 97.20. In bigger time frames, the pair maintains the neutral stance seen on previous updates, with no clues on direction. US employment data may help the pair define a clearer trend with 97.20 and 98.40 as the extremes to break.

Support levels: 97.60 97.20 96.70

Resistance levels: 98.20 98.40 98.80

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.