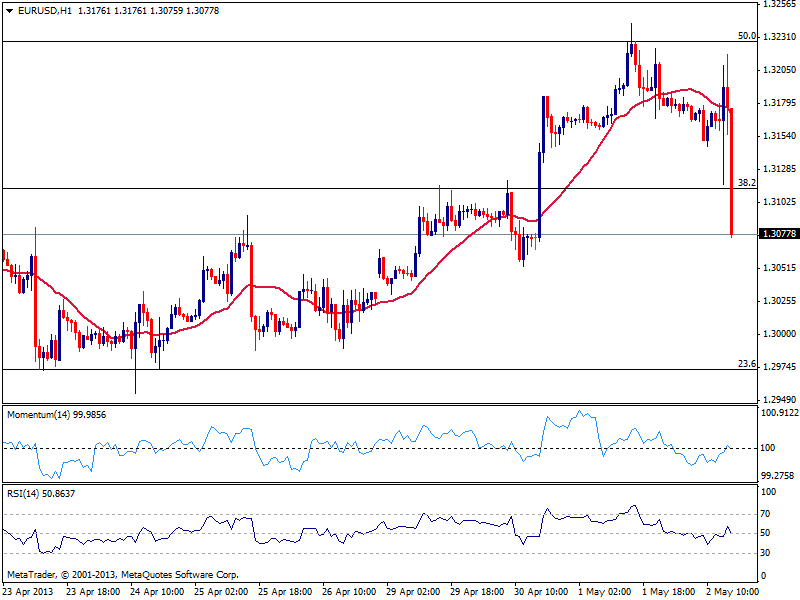

EUR/USD Current price: 1.3078

View Live Chart for the EUR/USD

The ECB cut rates by 0.25% as expected, and the EUR/USD maintained the positive tone, posting intraday gains above the 1.3200 level, and looking for an upward continuation. However, failure to overcome 1.3225 resistance, and Draghi’s words regarding the possibility of negative rates was enough to trigger a selloff in the pair towards current daily lows. The fact is that the bank did not announced negative rates, and barely considered them as a possibility. However, that was enough to set market mood. Moreover, confirms the pair is trading range bound in the 1.30/1.32 area, as now approaches to the base.

The hourly chart shows a strong break below the 38.2% retracement of the latest daily fall, around 1.3115, now key resistance, as bears will lead as long as below it. Despite the wide move, the pair has still more room for slides, with 1.2970/1.3000 as probable bottom for today.

Support levels: 1.3050 1.3010 1.2970

Resistance levels: 1.3115 1.3150 1.3185

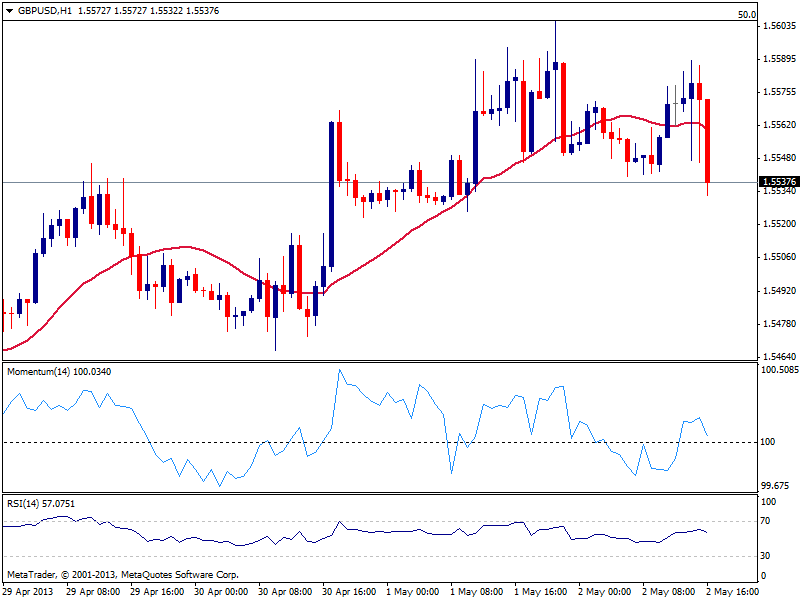

GBP/USD Current price: 1.5539

View Live Chart for the GBP/USD (select the currency)

Pound is being weighted by EUR slide, although price is holding above the 1.5520/40 static support area. The hourly chart shows price hovering around a flat 20 SMA as technical indicators turn bearish and approach their midlines, although with no strength. In the 4 hours chart the pair maintains the positive tone, with 20 SMA offering dynamic support around current levels. With dollar on demand, there are not much chances of a strong recovery, yet the upside remains limited by 1.5605 Fibonacci resistance for today.

Support levels: 1.5530 1.5490 1.5450

Resistance levels: 1.5580 1.5610 1.5650

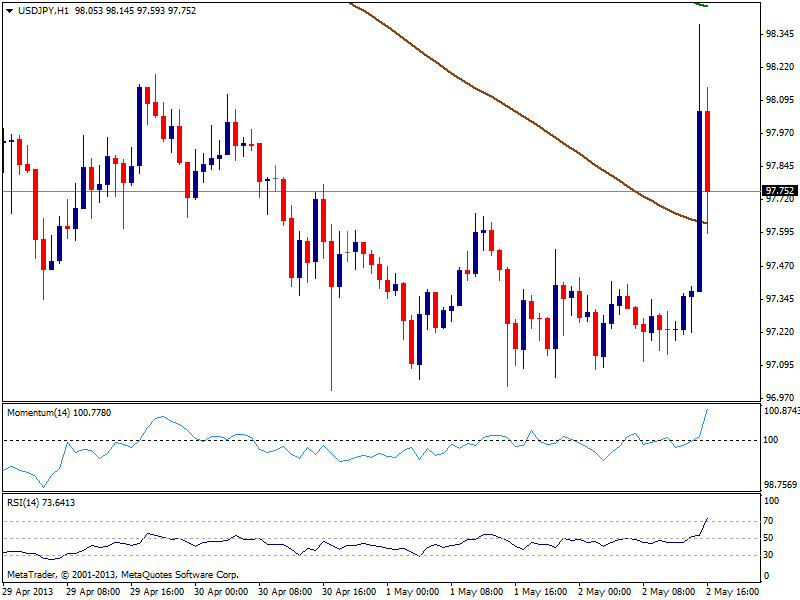

USD/JPY Current price: 97.75

View Live Chart for the USD/JPY (select the currency)

The USD/JPY trades back lower after testing 98.38 with the ECB, capped in the short term by 200 SMA. The hourly chart shows price finding now some buyers around former resistance of 97.50, while indicators continue heading higher in positive territory. In the 4 hours chart technical readings remain neutral, and a break above 98.40 resistance is now required to confirm and advance towards 98.80/92.00 area.

Support levels: 97.50 97.10 96.70

Resistance levels: 98.20 98.40 98.80

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.