I am a bit bearish on Indian stock markets and expect a five percent correction in the next one month. The correction in Indian equity markets should come either before the Federal reserve meet on 30th April or before the election results on 16th May. However this time around sharp falls in Indian equity market will not in big weakness for the rupee as the RBI is better prepared to deal with such exigencies.

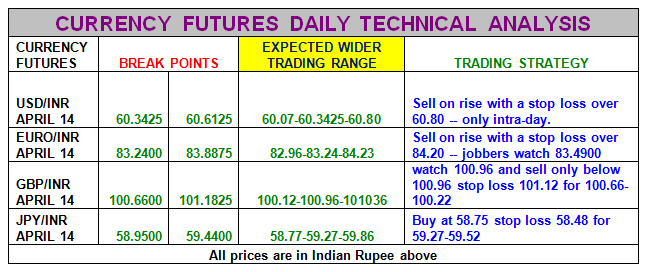

Usd/inr April 2014: It needs to fall below 60.3775 or break 60.6225 for direction. Overalll usd/inr will find sellers on rise as long as it does not break 60.80.

Euro/inr April 2014: Support is at 83.3450 with 83.98 as the key resistance. There will be another wave of selling only below 83.3450. Overall till April future close, we prefer a sell on rise strategy as long as euro/inr does not break 85.23.

Gbp/Inr April 2014: It needs to trade over 100.89 to prevent a fall to 10.66 and 100.12.

Jpy/Inr April 2014: It can fall to 58.96 and 58.69 as long as it trades below 59.27. There will be buyers only over 59.27 today.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.