India is set to take a major step tow and currency internationalization with World Bank plans to double its offshore rupee bond program to $2 bn and push leading Indian companies to raise global rupee-linked debt for the first time. This implies more inflows into India.

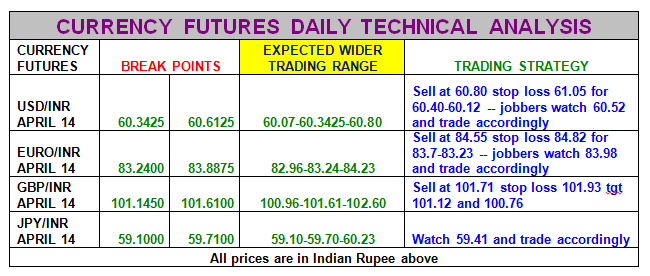

Usd/Inr April 2014: Resistance is at 60.8025 and till Monday only a break of 60.8625 will result in further gains. In case usd/inr does not break 60.8025 by Tuesday, then it will fall to 60.10 and 59.86.

Euro/Inr April 2014: Only a consolidated break of 84.23 will result in further gains to 84.76-85.02. Initial support is at 83.92 and there will be sellers only below 83.92

Gbp/Inr April 2014: It can rise to 102.15 and 103.07 as long as it trades over 101.29. There will be sellers only if cable trades below 101.29 in UK session.

Jpy/Inr April 2014: Resistance is at 59.71 and only a break of 59.71 will result in 60.14-60.57. Support is at 59.41 and there will be sellers only below 59.41

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.