Trading strategy For the very large traders and high risk traders

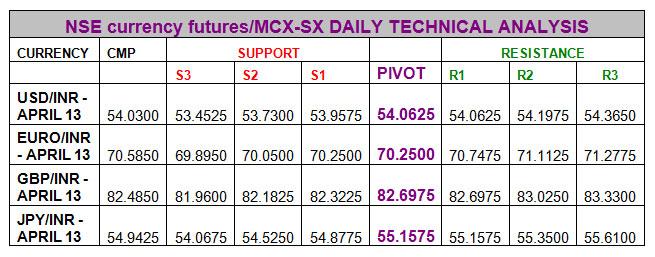

- USD/INR APRIL 2013: Sell below 54.03 stop loss 54.13 for 53.9225-53.7225

- EURO/INR APRIL 2013: Sell on rise with a stop loss of over 71.22 for Monday

- GBP/INR APRIL 2013: Watch 82.60 and trade accordingly

- JPY/INR APRIL 2013: Buy if and only if jpy/inr trades over 55.0600

TECHNICAL VIEW

US-DOLLAR – INDIAN RUPEE (USD/INR) APRIL 2013 – (CURRENT PRICE 54.0375)

Bullish over 54.0675 with 54.3025-54.6025 as price targetBearish below 53.9225 with 53.7725 and 53.5650 as price targetNeutral Zone: 53.9225-54.0675

- 54.06 is the key support and there will be another wave of selling below 54.0600

- Key weekly support is at 54.0600

EURO-INDIA RUPEE (EUR/INR) APRIL 2013 – (CURRENT PRICE 70.5850)

Bullish over 70.8300 with 71.2775 and 71.7625 as price targetBearish below 70.5425 with 70.2250-70.0675 as price targetNeutral Zone: 70.5425-70.8300

- Euro/inr needs to break and trade over 70.8300 else it will fall to 70.2725-69.9025

- We prefer a sell on rise strategy as long as euro/inr trades below 71.3200

UK POUND -INDIA RUPEE (GBP/INR) APRIL 2013 – (CURRENT PRICE 82.4850)

Bullish over 82.6975 with 83.0225 and 83.5675 as price targetBearish below 82.2225 with 82.0950 and 81.6900 as price targetNeutral Zone: 82.2225-82.6975

- Cable needs to trade over 82.6975 to target 83.32-83.75

- There will be another wave of selling only below 82.5650

JAPANESE YEN -INDIA RUPEE (JPY/INR) ARPIL 2013 – (CURRENT PRICE 54.9425)

Bullish over 55.0675 with 55.3025 and 56.0125 as price targetBearish below 54.4850 with 54.0975 and 54.0225 as price targetNeutral Zone: 54.4850-55.0675

- Key long term support for May futures is at 54.06 and long as yen may futures trades over 54.06 we prefer a buy on dips strategy.

- Only a break of 55.0675 will resume the uptrend.

Happy profitable trading & Trade without emotions

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.