Can Consensus Exchange Rate Forecasts Be Profitably Traded?

For just on two years, forecasts of exchange rates for major currency pairs by a select group of market analysts have been made available on fxstreet.com each Friday. Forecasts are provided for one week, one month and one quarter ahead for EURUSD, GBPUSD, USDJPY, USDCHF, AUDUSD, USDCAD, NZDUSD, GBPJPY, EURJPY and EURGBP. Last week for EURUSD 16 analysts provided their views one week ahead, 28 forecast one month ahead and 34 provided their forecast for one quarter ahead.

There is a growing body of research across a number of disciplines that a consensus of experts will give the most accurate estimate of a variable for which imperfect knowledge exists. Given the number and calibre of analysts polled by fxstreet.com, it seems reasonable to think that the consensus of their forecasts could be a good a source on which to base a profitable forex trading strategy.

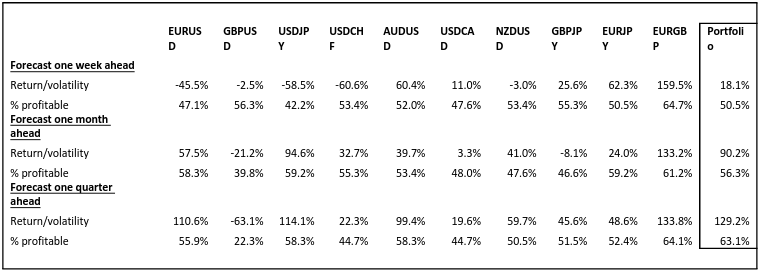

We tested a strategy of trading each currency pair at closing prices on the day (Friday) the forecasts are published. The trading rule was: if the forecast was higher than the current close, go long and go short if the converse applied. Initially, the holding period for the trades was aligned with the period of the forecast. The p&l for each trade (before trading costs) was tracked and the summary results for the period of 104 weeks from w/e 7/6/2013 are shown in the table below:

The “portfolio” column shows results for an equally-weighted portfolio of the positions taken each week on the basis of the rule described above. (Because of imperfect correlation, the return/volatility for the portfolio will be higher than the arithmetic average of the return/volatility of the individual currency pairs).

The best benchmark we can find for the return/volatility results is the Barclays Currency Traders Index which indicatively showed a return/volatility of 113% over the period covered by the above table. The portfolio results, at least for quarterly forecasts, appear to be in the vicinity of this benchmark.

Of significant interest is the improvement in results as the period of the forecast increases – portfolio return/volatility improves from 18.1% for forecasts for one week ahead to 90.2% for one month forecasts to 129.2% for forecasts one quarter ahead. The % of profitable trades similarly improves.

For one month forecasts, all but two currencies (GBPUSD and GBPJPY) show positive trading returns and all but GBPUSD show positive returns for one quarter periods. EURGBP comes out the best, with consistent results, for all forecast periods. However, to minimize the risk of overoptimisation, we suggest trading the portfolio rather than “cherry picking” on the basis of past results.

We also tested whether there was any correlation between the “conviction” of the forecast (increasing with the size of the gap between the forecast and then-prevailing spot rates), and the trading outcomes.

When trades were only put on when the gap exceeded 1.1%, the return/volatility for forecasts one week ahead improved from 18% (all trades taken irrespective of gap as above) to to 161% and was generally above 100% for higher percentage gaps. For one month forecasts, the best results were achieved when all trades were taken ie. no gap filter was applied. For one quarter forecasts, some modest improvement in results was achieved when trades were taken at gap filters of between 0.2% and 0.7%.

Again, care must be taken not to over- optimize in this area.

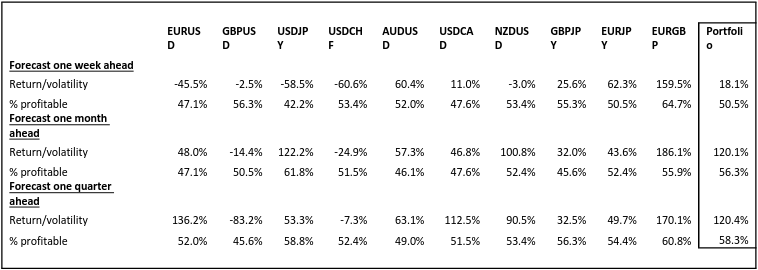

Finally, we found that holding trades for the one month and one quarter forecasts for shorter periods than the forecasts produced good results. The table below shows the outcomes from holding the trades based on the one month and one quarter forecasts for one week:

As can be seen, trading for one week periods basing the trading rule on the one month and one quarter forecasts produced similar results at the portfolio level, which were substantially better than using the one week forecasts.

Trading for one month periods using the one quarter forecasts in the trading rule would have improved the portfolio return/volatility from 90.2% to 116.5%.

Welcome to our website. If you continue to browse and use this website you are agreeing to comply with and be bound by the following disclaimer, together with our terms and conditions of use. The information contained in this website is for general information purposes only and is provided by fairvalueonline.com. While we endeavour to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk. You need to make your own enquiries to determine if the information or products are appropriate for your intended use. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arising out of, or in connection with, the use of this website. Through this website you may be able to link to other websites which are not under the control of fairvalueonline.com. We have no control over the nature, content and availability of those websites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them. Every effort is made to keep the website up and running smoothly. However, fairvalueonline.com takes no responsibility for, and will not be liable for, the website being temporarily unavailable due to technical issues beyond our control.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.