While keeping rates unchanged in September, the FOMC communicated that the Fed could hike rates in any of the remaining three meetings in following months. However, with the US jobs posting a weak print last month, where the US economy added lesser than expected jobs and with August payrolls also revised lower, expectations for an October rate hike are diminishing, while at the same time the markets are starting to doubt if the Fed will be able to hike in November or December.

The Fed funds rate hike expectations, which has been one of the main reasons for the rally in the US Dollar has taken a hit as a result, which in turn has given the commodity currencies such as the Canadian Dollar, Australian and New Zealand Dollar’s a bit of a respite from the prolonged decline.

Canada – Economic Outlook

In regards to the Canadian economy, the Bank of Canada has so far delivered two rate cuts this year, bringing the benchmark interest rates to 0.5%. The BoC is due to meet on October 21st which is when the BoC could consider changing the interest rates. Canada’s inflation has been largely stable near 1.3% since July 2015 marking the higher end of the range after Canadian inflation briefly dipped to 0.8% in April. Anticipating further declines in Crude Oil prices, BoC kicked off the year with rate cuts, citing it as an ‘insurance’ against further declines in Crude Oil prices. This bet seemed to have paid off as Canada seems more immune to the declines in Crude oil and thus inflation. GDP has been one of the major concerns however, as the quarterly GDP has been contracting at a pace of -0.5% for the quarter. For nearly two straight quarters, the Canadian GDP has been in a contraction and a yet another similar reading in Q3 GDP could put the country in a technical recession. It will be interesting to see how the BoC will decide in its monetary policy meeting later this month.USDCAD – Technical Outlook

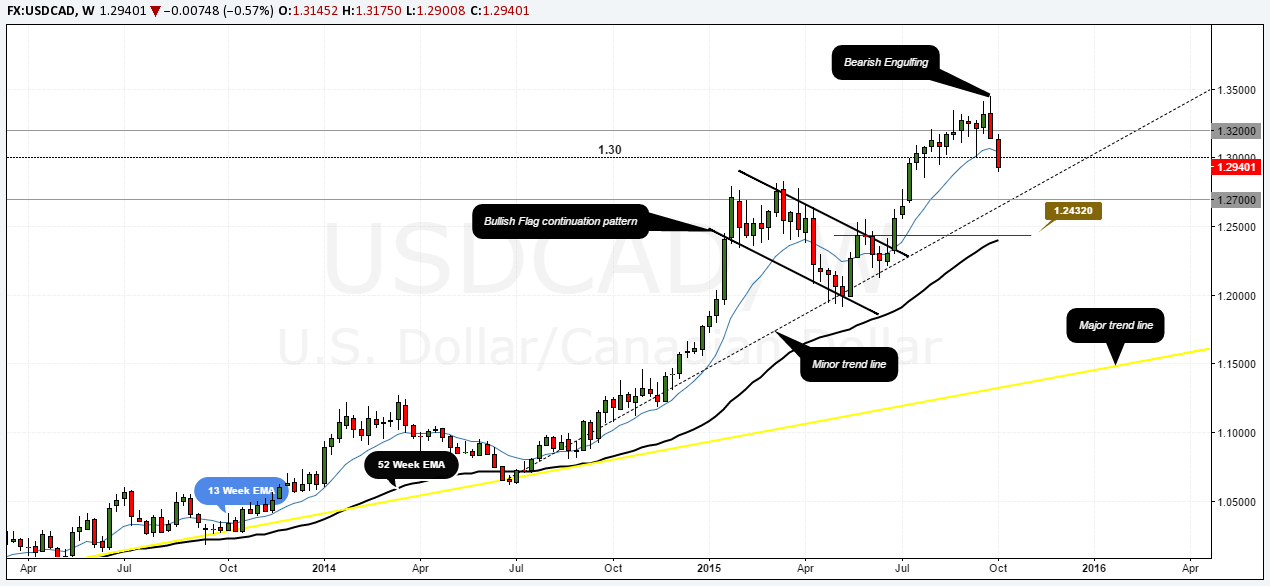

Starting with the weekly chart, USDCAD started its descent after forming a strong bearish engulfing candlestick pattern on the week of 28th September. This bearish pattern was followed through by last week's continued decline as well, closing at an eight week low of 1.294. USDCAD also managed to break below the 1.30 psychological round number with relative ease. There is scope for a potential retest back to 1.30 in the near term. If resistance is established at 1.30, we could anticipate further declines in USDCAD. Prices have so far managed to close below the 13 week exponential moving average, while the 52 week EMA currently sits at a dynamic support of 1.24.

USDCAD Weekly Chart Technical Analysis (Source: Tradingview.com)

Also on the weekly chart, we notice the bullish flag continuation pattern off which, prices broke out during the week of 29th June. The breakout from the bullish flag pattern saw prices clearing the resistance highs at 1.2775. The lack of any retest to the breakout or even the resistance high at 1.2775 is indicative that the current pullback to the uptrend is a correction. As such, this aspect reveals the fact that USDCAD remains a buy into the dips.

Technical resistances that could turn to support and ones which are of interest include 1.2775, marking the resistance high of the bull flag pattern and 1.27 round number, which could see a confluence of the minor rising trend line and the round number support. To the downside, a risk of support failure at 1.27 could most likely see USDCAD break the minor trend line, which could see the lower support at 1.2432 being tested.

USDCAD - Conclusion: Considering the fundamental outlook and the technicals combined, we expect a temporary top to have formed in the USDCAD if 1.30 holds out as resistance on any retest. This will see prices most likely range between the levels of 1.30 and 1.27. The currency pair remains in an uptrend however with the current declines being merely a pullback to the uptrend, as long as prices remain above 1.27.

The analysis published by XGLOBAL Markets or its representatives should not be considered as solicitation to trade. Any views, opinions or findings are simple market commentary and only for information purposes. Information in our published content should definitely not be taken as investment advice. XGLOBAL Markets or its representatives shall not be held accountable for any incorrect trading decisions or money lost by individuals that decide to follow our market commentary.

Recommended Content

Editors’ Picks

AUD/USD remains firm above 0.6600 ahead of RBA

AUD/USD maintains its bullish bias well and sound on Monday, extending the multi-session recovery past the 0.6600 barrier ahead of the key interest rate decision by the RBA.

EUR/USD propped up near 1.0750 ahead of European Retail Sales

EUR/USD churned around 1.0770 to kick off the new trading week, with the pair rising after better-than-expected Purchasing Managers Index figures early Monday before settling into familiar chart territory above 1.0750 ahead of Tuesday’s pan-European Retail Sales figures.

Gold holds on to modest gains around $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Bitcoin price holds above $63K as MicroStrategy tops BTC ownership list

Bitcoin (BTC) price recorded a rather bold two days this past weekend in a surge that saw millions in positions liquidated. However, the week is off to a calm start with altcoins sucking liquidity from the BTC market.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.