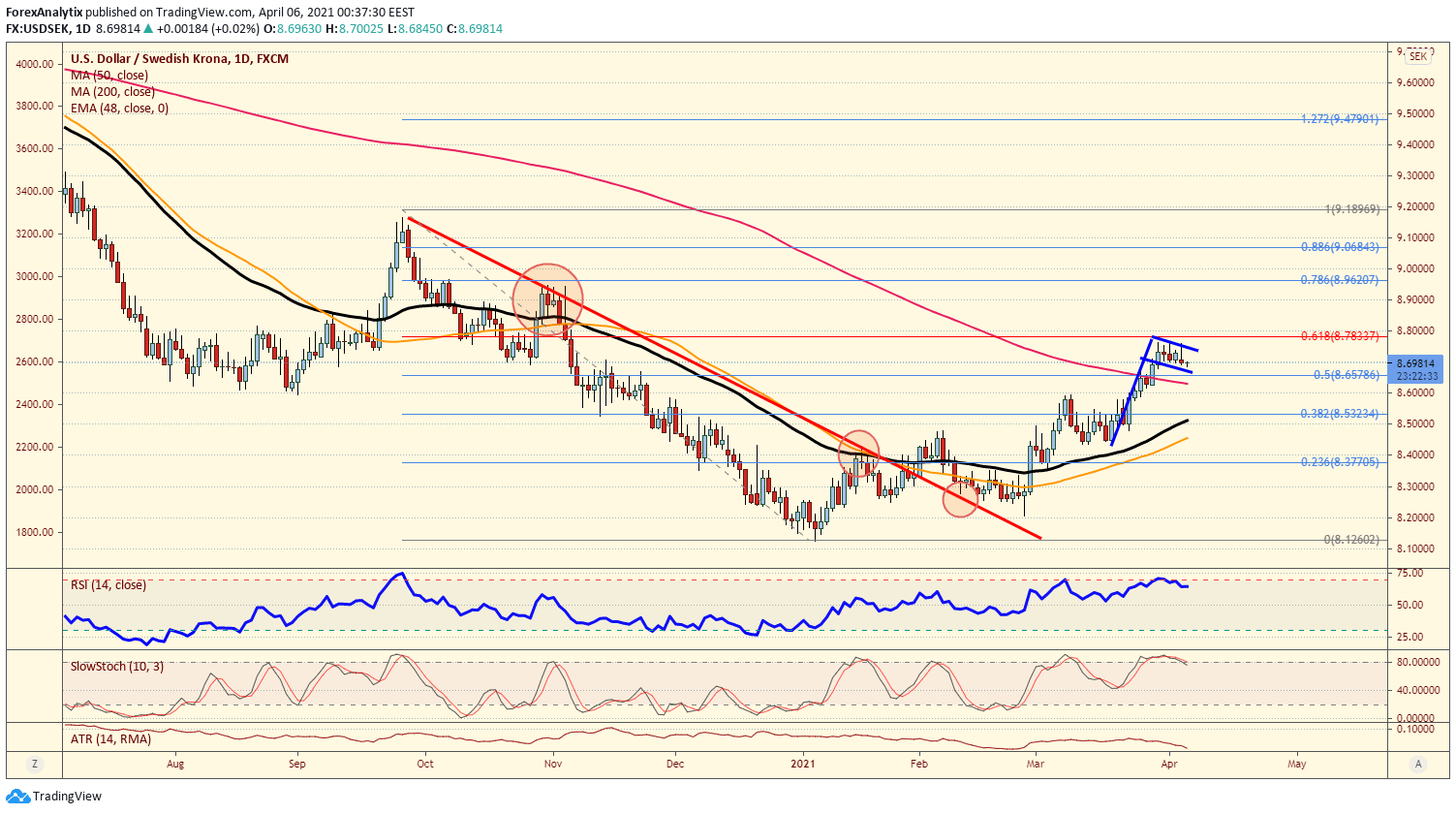

Chart of the day: USD/SEK

On March 1st, our "Chart of the Day" was the USD/SEK and we were looking for a break higher towards the 200dma back then. Well, we got that move (and some) and now this bullish move looks set to make another move higher near term. As long as we hold above the 200dma the risk may be for a breakout above the 61.8% Fibonacci retracement level at the 8.7833 level to target closer to the 9.000 level and the 78% retracement. RSI is working off being overbought and looks set to make another move higher.

Author

Blake Morrow

Forex Analytix

Blake Morrow spent most of his professional career as the Chief Currency Strategist for Wizetrade group for 15 years, and then the Senior Currency Strategist for Ally Financial after the acquisition of Tradeking which owned the Wizetrade Group.