Late January, ECB's President Mario Draghi dropped sort of a bombshell, as the announcement was largely anticipated, launching an open-ended bond-buying program of €60 billion a month, starting this March, and extended at least to September 2016. Open-ended means the Central Bank can decide to continue with it beyond this date. Totaling €1tn in assets, including government and private sector bonds, in the form of purchases of sovereign debt, asset-backed securities and covered bonds, but not corporate bonds, the program is aimed to boost economic recovery, but overall, help inflation to reach the Central Bank target of 2%.

When it comes to talk about the imbalances between the ECB, and other Central Banks, as the FED, the immediate highlight comes at the bad timing the European authorities had always have: decisions came always being too little, too late, and whilst most big economies have been working on stimulus measures since 2008, and have already removed them, or are about to do so, the ECB is just starting.

But there is another huge difference between the ECB and any other Central Bank: with Europe being an union, the European Central Bank has a limited objective that is, to keep inflation under control, while it also has to deal with all its members' different governments. Is well known that Germany presented a fierce opposition to embark in quantitative easing, amid fears the troubled countries in the region will discontinue reforming their economies, and affect the whole EZ economic developments in the long term.

Anyway, with inflation at record lows and falling month after month since mid 2014, Draghi had no much of a choice. And the day has come: the ECB is expected to start its program as soon as next Monday, March 9th. So far, the immediate effects of the decision have been

- A strong rally in European stocks that drove German DAX to all-time highs, on hopes the easy money coming from the ECB will replicate the effects of QE in US indexes;

- Troubled country bond yields fell to record lows, having posted a tepid bounce this week ahead of the news;

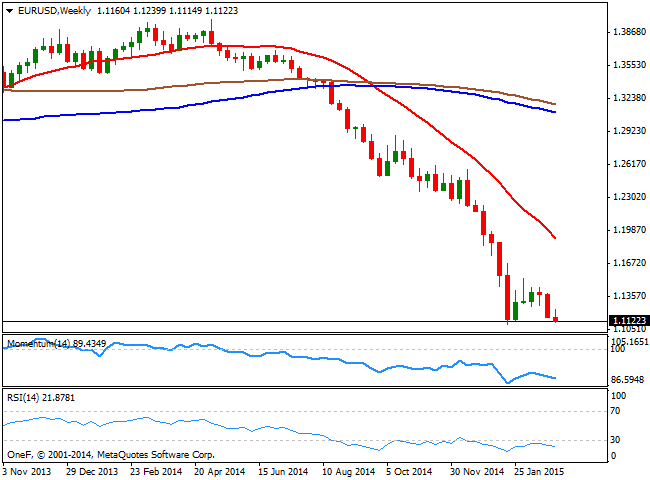

- The EUR/USD trades at multi-year lows around the 1.1100 figure.

The beginning of QE this week will have another significant effect: the ECB will remain on hold for a long, long time after this. Chances of new announcements this year, will be quite limited, and if something, the ECB may react with some additional measures if and after, the FED moves rates. But consider that ECB meetings will become pretty uneventfully in the upcoming months.

EUR/USD probable targets

Trying to anticipate markets' movements ahead of this news is quite risky, as the EUR/USD pair may bounce sharply on relief following the announcement, particularly considering shorts remain near record highs and the weekly chart is showing that the pair is extremely oversold. But then again, the bearish dominant trend remains firm in place, and the excess of EUR offered will tend to push the pair lower, especially if the US continues to advance in the tightening path. Selling interest will likely surge after the bounce, with the immediate resistance around 1.1250. If the price reaches the level and begins to retreat, it will likely resume the downside, eyeing fresh multiyear lows below 1.1000.

If somehow the pair manages to advance beyond the mentioned 1.1250 area, the recovery, boosted by some profit taking, can extend up to 1.1400/40, the ultimate level from where the bearish trend can resume, as a break above it should see the pair correcting further up on a panic run.

If on the other hand the initial reaction pushes the pair lower, the main target will be the 1.1000 figure, but further declines are unlikely for Thursday, as the market players will wait for Friday's US employment figures, before taking another step. As said above, the pair is extremely oversold, and would need a strong reason to extend its bearish run sharply this week, named a strong Nonfarm Payroll reading. Once 1.1000 gives up, and if the week ends with the price below such level, 1.0760 August 2003 monthly low, comes as the next bearish target for the weeks ahead.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.