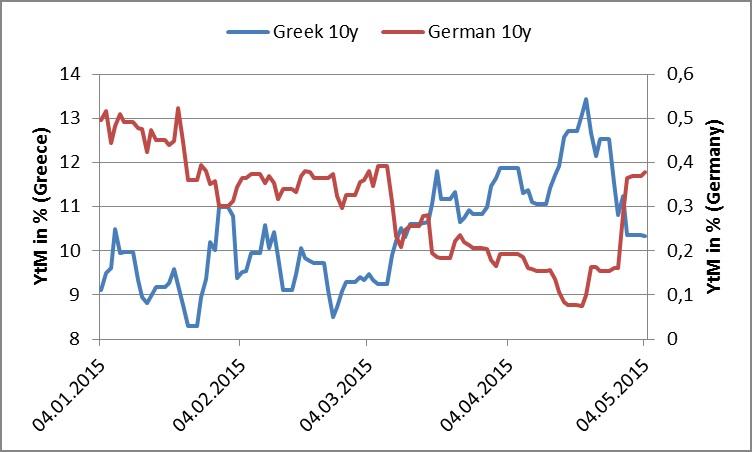

Chart of the Day:

Is the Crisis Over? Greek 10y bond yields collapse just as safe haven Bunds sell-off.

Analysts’ View:

Looking Ahead in CEE This Week: After the previous week’s basically empty macro schedule, the coming week offers much more excitement. The Romanian and the Polish central bank are scheduled to decide on rates on Wednesday, while the CNB will have its regular meeting on Thursday - we expect all of them to keep rates on hold this time. As the month starts, we will have the new PMI readings today and other important economic readings from CEE and Turkey as well. After last week’s yield increases, which now create upside risks to our bond yield forecasts, we are closely monitoring for any further evidence of improving economic activity and inflation in the region.

RS Fiscal: According to media reports, PM Vucic made very upbeat statements about the economy amid a possible softening of the current IMF program last week. According to him, the IMF will increase expectations for GDP for this year. He also told journalists that he is confident that he can agree with the Fund to let he Government reverse expenditure cuts by raising public wages and pensions, as the budget deficit narrowed more than expected but the country’s recession does not seem to be easing yet. Vucic told the press that the government deficit for the first four months of the year will be some 70% below the level agreed with the IMF, meaning roughly EUR 420 m (more than 1% of GDP) in savings. Other data shows, however, that the trade deficit was widening further and industrial output declined too. As the youngest agreement was reached only as late as February this year, we think it will be a difficult task to have the IMF agree to a softening of the programme. We continue to see the EURRSD at 122.5 at the end of this year.

Traders’ Comments:

CEE Fixed income: Many of our markets were closed on Friday and the UK is out today so conditions have been and will be thin, possibly accentuating recent market moves that have taken place on very low turnover. Yields are higher on the week in all of our markets in the sovereign space, most notably in Hungary. The weakness in the HUF and PLN mirrors the sell-off in fixed income and Piotr Marczak, head of public debt department at the Polish Finance Ministry, noted that foreign investors had reduced their holdings of POLGBs in April.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.