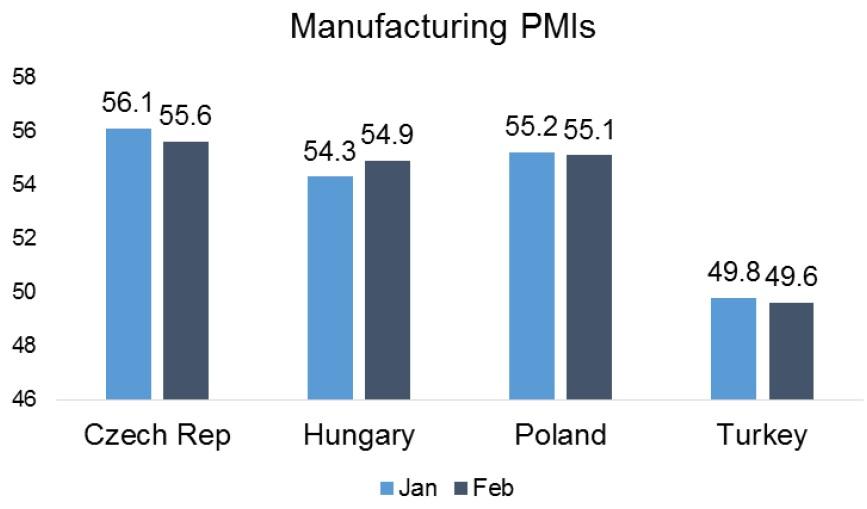

Chart of the Day:

CEE & TR PMIs: Manufacturing PMIs in the CEE region (CZ, HU, PL) came in around 55 points, signaling that the industrial sector is still well in expansion mode. In Turkey, however, the figure has been struggling this year to increase above 50 points, which marks the border of contraction/expansion. In Poland, where the figure was just a touch lower (55.1) than the reading in January, a positive signal from the manufacturing sector could be an arguments for hawks against a rate cut this week. Today, the MPC starts its two-day rate decision meeting, but the outcome will be known only on Wednesday. The MPC members will know the new inflation projection and we believe that, at the end, “growth arguments” will not be decisive and a substantial downward revision of the inflation forecast will help the forming of a majority that supports a cut. Markets should remain stable until the announcement but from a medium term perspective we still see room for yields to drop (10Y POLGB at 1.7% by mid- 2015).

Traders’ Comments:

CEE Fixed income: Hetar was naturally the focus in Austrian financials yesterday and the sector suffered because of it. Raiffeisen saw some widening in senior bonds (ca. 25 bps) but we saw buying at the wider levels. Subs drifted wider but with little pressure on prices to the downside. Erste remained fairly stable. The insurance names came under more pressure than the banks as investors attempted to glean how much exposure they have to Hetar. UQA was off most but appears to have only minimal exposure whereas VIGAV was steady although they are more exposed but seem to have already provisioned for losses. Spreads and prices recovered later on in the day as the fear of contagion was repriced. Overall flows were low and RAGBs were underwhelmed. This may, obviously, be down at least in part to the ECB meeting on March 5 where more detailed plans related to QE are expected but the price of the Bund started to drop around about 4 pm CET yesterday and the yield on USTs rose 8 bps around about the same time with no obvious catalyst. The steepening in CZGBs is notable given that CZGBs are the safehaven of CEE and the steepening stands in sharp contrast to the bull flattening visible in all other CEE local currency government bond markets. US Non-Farm Payrolls this Friday will be eyed closely for clues to the timing and magnitude of the widely anticipated hike in US rates and CEE bonds will be pushed and pulled between the dual effects of a rise in yields in the US and the dampening effect on yields via QE in the Eurozone.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.