Chart of the Day:

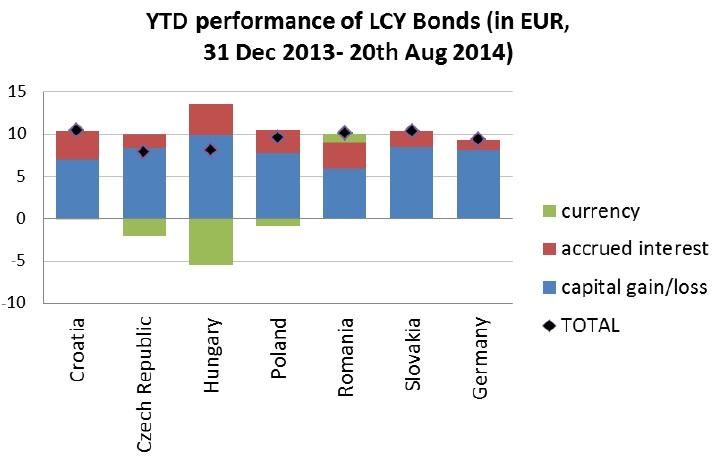

CEE bond yields – Yields on CEE government bonds reached a new all-time low in Czech Republic, Poland and Slovakia this week. CEE bonds have been performing very well, the total flat returns from holding LCY bonds measured in EUR climbed to 8-10% if bonds were bought at the beginning of this year. It is true that it is at pair with Bunds which gained too, but with lower prospect to perform well or generate juicy accrued interest in upcoming period which would justify risk of capital loses if yields move up.

Analysts’ view:

PL Macro: Industrial output grew 2.3% y/y in July, slightly above market expectations. Thus, the data may not not seem that disappointing, but it fits the recent overall tendencies, suggesting that the economy is indeed slowing. In our view, the MPC has every argument to lower the policy rate. At this point, September seems too soon, as not all MPC members are convinced that such a move is necessary, but we should see further easing in November, at the latest. Expectations of a maximum 50bp cut support the low level of yields (10Y close to 3.4% at the end of 3Q14).

Traders’ comments:

Yesterday was more of a consolildation day with no major moves in yields with the exception of Croatia. In Crotian local currency bonds bids dominated the local curve with CROATE 16 outpeforming ending the day 15 bps tighter in yield. While the long end of the Croatian EUR curve traded weaker with yields rising slightly for CROATI 22. In macro data for this morning, the focus will be on markit manufacturing and services surveys from France, Germany and the Eurozone while in Croatia the unemployment rate. In the second part of the day market focus will shift to US with IJC, US markit manufcturing and US exiting home sales in the spotlight.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.