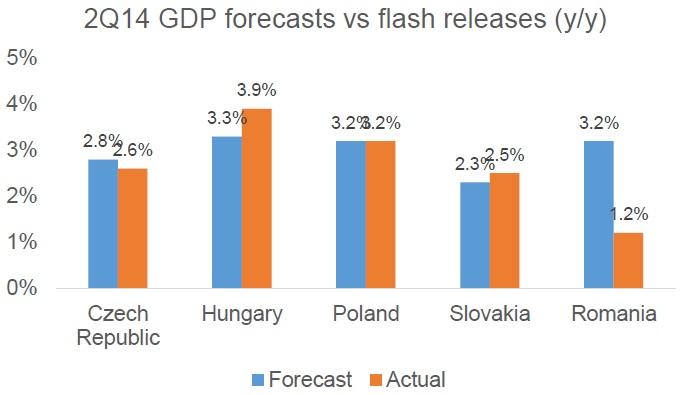

Chart of the Day:

CEE 2Q14 GDP releases: Flash releases for the 2Q14 GDP figures from last week provided a mixed picture. Albeit Hungary and Slovakia delivered a positive surprise, Romania stands out as the negative outlier. In the latter, we now clearly see downside risks to our call of a 3% yearly average GDP growth (in 1Q14, the yearly expansion was still 3.9% in Romania). As for Hungary, however, we decided to increase our forecast for the yearly growth figure from 3% to 3.3%. This still means a slowdown vs. 1H14 (in the first two quarters, growth averaged 3.75% in Hungary). Yearly growth figures should decline in 2H14 in CEE as the European economic expansion seems to remain quite modest at best, while the intensification of Ukrainian-Russian tensions and the subsequent economic sanctions can bite into growth more strongly in the second half of this year.

Analysts’ view:

PL Macro: The deadline concerning pension reform in Poland elapsed at the end of July, when individuals had to decide between staying in private pension system or switch to a public one, roughly 20% of people decided to stay with OPF. As this is mostly higher income group the percentage equivalent on contributions may be even higher (as this group's contribution is most likely above average). The news is neutral for bond and FX market.

TR Macro: Moody’s said on Friday that it is concerned that the structural reforms in Turkey would take a backseat until the political outlook becomes more stable and that Turkey would remain susceptible to the global sentiment. We had the impression that these statements could probably be a sign that Moody’s is closely monitoring the developments rather than issuing a warning for a downgrade. Moody’s next prescheduled review date for Turkey is December 5 after S&P on November 21 and Fitch on October 3. The 12-month forward looking CPI expectation rose to 7.35% in August from the previous month's 7.27%. The deterioration in inflation expectations, the signs of dismal pricing behavior in the July inflation data along with the depreciation pressure on the TRY pose risks to our 25bps rate cut expectation for the rest of the year.

TR Politics: On Thursday August 21 Current Prime Minister and President Elect Recep Tayyip Erdogan is expected to unveil Turkey’s next prime minister who will be in charge following Erdogan’s exit. Current Foreign Minister Ahmet Davutoglu is widely perceived as the strongest candidate, but the media is mentioning other names as well..

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.