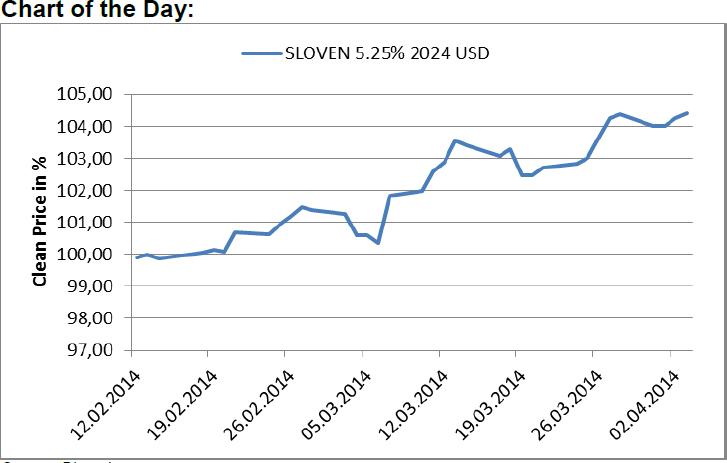

SI Bonds: The hunt for yield continues and Slovenia is a beneficiary.

Analysts’ Views:

SI Bonds: After the successful 3Y and 7Y bond issues on Tuesday, Slovenia may consider buying back some shorter maturities, or execute bond switches to swap short term debt for longer dated government paper, Reuters reported yesterday, citing unnamed sources. The country has already managed to collect the necessary cash to finance this year’s redemptions, and even prefinanced some of the debt falling due next year. However, due to its still shaky fundamentals (the weak growth outlook and a fragile banking sector potentially implying additional capital), the financing outlook remains demanding also in the upcoming years, which is a reason to smooth out the redemption pattern and mitigate some of the risks. Around one third of Slovenia's EUR 24bn of debt falls due over the next three years, with a hefty EUR 4bn (11% of GDP) in 2016 alone. The exact bonds affected by potential buybacks or switches were not named. Near-term financing concerns have receded while mid-term funding stability is contingent on a continuation of fiscal consolidation and a long-term solution for the vulnerabilities of the banking sector. Hopefully, the encouraging market sentiment will not foster policy makers‘ complacency.

TR Rates: The CBT is organizing an investor meeting in London today. We expect the Bank to signal a limited macroprudential easing to be introduced at its April meeting. If the CBT also indicates that it could ease liquidity management, this may lead to a decline in short-term yields. We continue to see the two year bond at around 10.5% by year-end.

Traders’ Comments:

CEE Fixed Income: CEE fixed income markets consolidated yesterday with profit-taking in government bonds and a move from bid-only to 2-way trading in the cash corporate space. All eyes will be on the ECB today and then the US Non-Farm payrolls tomorrow. Barring any big surprises from these two events, it looks like the path of least resistance for all the excess liquidity currently sloshing around in the system is toward the purchase of higher-yielding assets.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.