If you think the economy is improving, you better check your facts and some disturbing trends.

Despite the much ballyhooed "strong jobs" economy, things are not what they seem upon closer inspection.

For example, Store-Branded Credit Card Delinquencies Hit 7-Year High.

Advertisement

The share of private-label credit cards with accounts at least 60 days delinquent is 4.65%, up from 4.08% in March 2017, Equifax said Wednesday. That’s the highest since early 2011, the credit reporting agency said.

Some banks have expanded their lending to subprime borrowers as the economy has improved, says Matt Schulz, senior industry analyst for CreditCards.com.

Private-label credit card interest rates are higher than credit cards generally. They have been rising as the Federal Reserve has boosted short-term rates since late 2015, increasing the payment burden on those subprime borrowers. The rate for private-label cards is about 25.5%, up from 24.99% six months ago, according to CreditCards.com. The average rate for all credit cards is 16.73%, up from 16.15%.

Who Can Afford 25% Rates?

Who can afford 25% interest rates with balances rolling over every month?

The answer, of course, is no one.

This leads up to what I will label the logical non-solution.

Logical Non-Solution

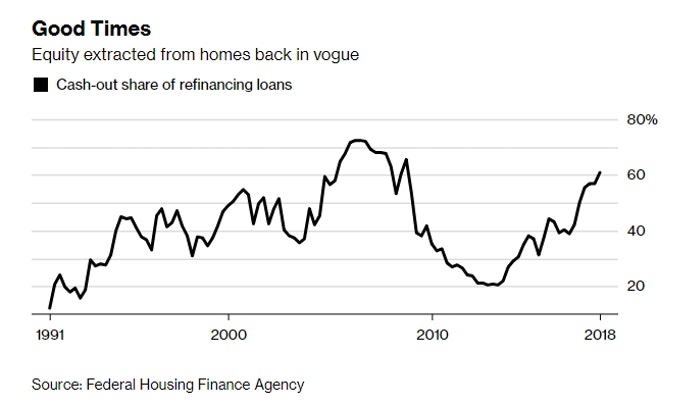

Data from Federal Housing Finance Agency show the Home ATM is Spewing Cash.

Equity pulled from homes to finance consumer spending and property improvements and pay off other debts rose in the first quarter to the highest in almost a decade, according to Federal Housing Finance Agency data.

Good Times

Let the good times roll baby!

The logical non-solution works only so long as home prices keep rising, employment stays elevated, and credit keeps expanding.

I suspect the party is about over.

For further discussion, please see my prior report Housing ATM is Back (But it won't work any better this time).

Related Articles

Housing Peak? Existing Home Sales Drop 2.5%, Down Year-Over-Year Second Month

April New Home Sales Slide 1.5%, March Revised Sharply Lower

This material is based upon information that Sitka Pacific Capital Management considers reliable and endeavors to keep current, Sitka Pacific Capital Management does not assure that this material is accurate, current or complete, and it should not be relied upon as such.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.