Canadian Jobs Preview: Why expectations may be too high and the loonie could suffer

- Economists expect Canada to report an increase of 100,000 jobs in November.

- Rising coronavirus cases, a slowdown in the recovery and a miss in GDP hint of a downside surprise.

- The Canadian dollar's impressive rally may come to an end.

In Canada, winter comes earlier than most other countries – and that is only one reason to doubt the high expectations from November's jobs report. The economic calendar is pointing to an increase of 100,000 positions last month, above 83,600 gained in October.

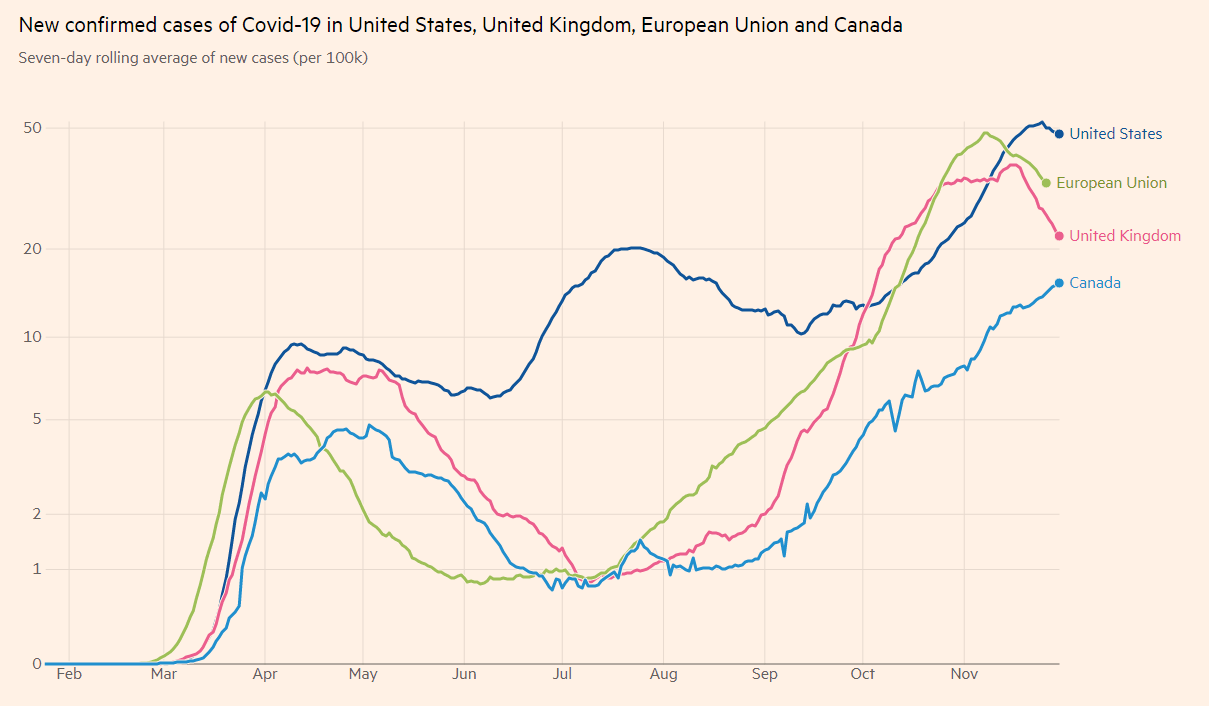

Colder Canadian temperatures come and go every year, but with COVID-19 raging, staying indoors has a larger impact on consumption. While the EU and the UK have turned a corner against the second wave of coronavirus, Canada's covid statistics remain on the rise.

Source: FT

Apart from the local increase in coronavirus infections, the disease has hit the US – on which Canada heavily depends on for its exports. The virus alone is one reason to doubt a faster increase in employment rather than a slowdown.

Another reason to lower expectations stems from the reduced pace of the recovery. Job restoration was initially quick in the summer, but now, the low hanging fruit is gone, with further expansion of the employment market likely to be much slower – in Canada and everywhere else.

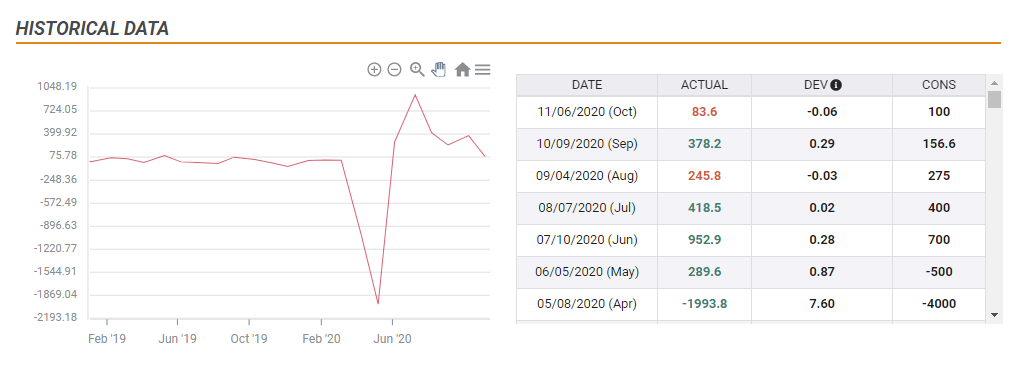

Source: FXStreet

While the chart above shows that most of the most actual figures are in the green, the most recent one disappointed. Another major Canadian data point also fell short of estimates – Gross Domestic Product grew by 40.5% annualized in the third quarter, below 47.6% forecast.

Has the consensus moved from underestimating the Canadian economy to overestimating its performance? Another miss could weigh break the loonie's back. However, the story is more complicated when it comes to Dollar/CAD.

USD/CAD Reaction

If the theory above is correct and Canadian job growth has been more moderate, the C$ has room to fall and USD/CAD could jump. The currency pair has been trending lower and a weak statistic may trigger an upside correction.

On the other hand, other factors are in play. South of the border, the parallel US Nonfarm Payrolls report is released at the same time and may prompt wild movements in the greenback. A substantial surprise in the American figure could overshadow any loonie price action.

Another factor to keep in mind is the fluctuation in oil prices. At the time of writing, OPEC+ has failed to reach a definitive accord on production cuts. If higher levels of output resume, it could put a lid on petrol prices and drag CAD lower. Any agreement to keep cuts intact could boost the loonie.

Conclusion

There are several reasons to expect disappointing employment figures from Canada, which could weigh on the loonie. USD/CAD price action also depends on jobs figures from the US and developments related to oil prices.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.