- Yesterday's closings make the technical setting dangerous and difficult mid-term predictions.

- The main cryptos are in different situations but the prospective scenarios are similar.

Bullish continuation hindered by sudden shift that brings cryptos to tricky situation

As we mentioned in yesterday's post, the technical setting developed in the morning by the bullish breaks was conditional to the session closing. Eventually, the upward hopes were not confirmed. We saw a typical move by professional traders, with sales increasing in the late American session that caused a closing below the reference lines. The change surely left many positions in bad condition.

As a result, the technical configuration has worsened and most cryptos are trading in highly conditioned environments.

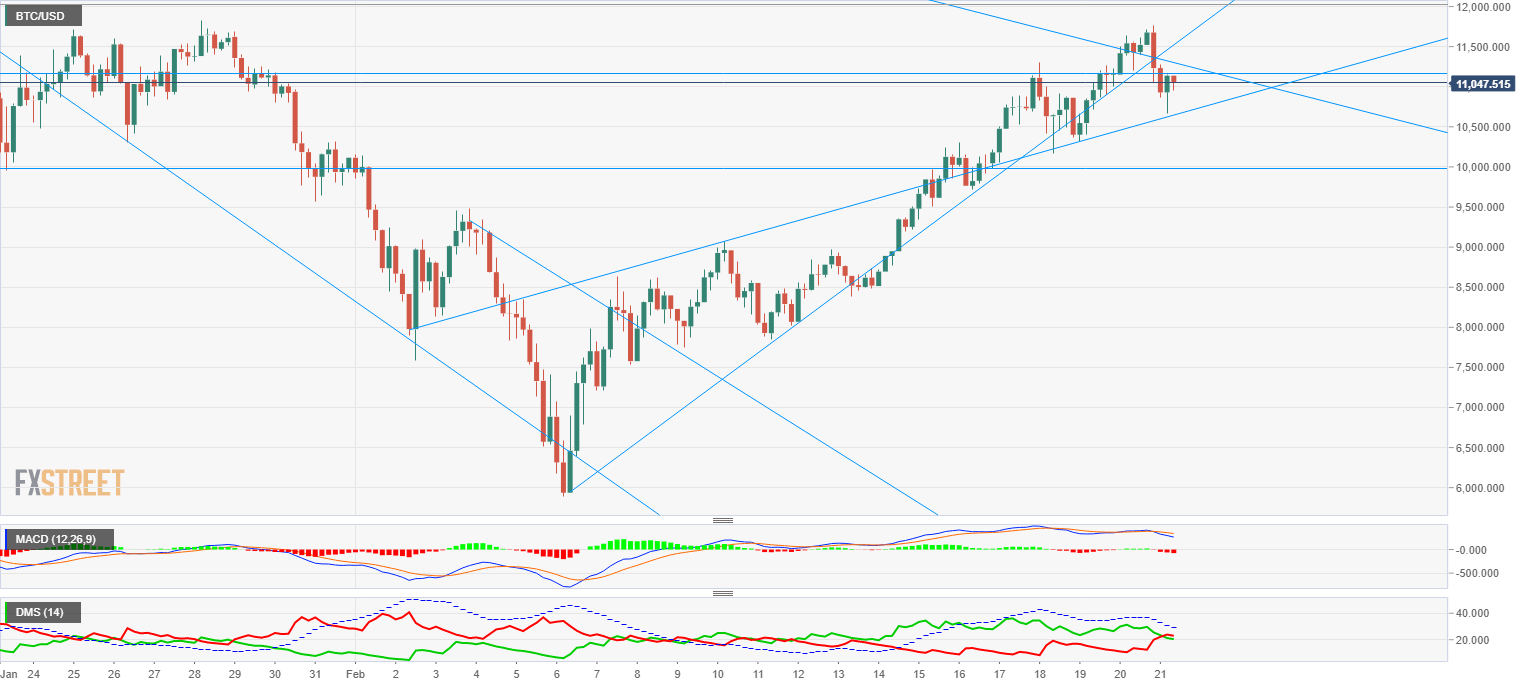

BTC/USD 240 min

Bitcoin holds on above $11,000 in what we consider the only good news for the main crypto. On the bad side, the situation has become complicated both from trendlines and indicators points of view.

BTC/USD is moving in the early American session in a small triangle drawn by the intersection of several trendlines. The figure narrowness implies that the situation should be solved in the short-term.

The MACD diverges from yesterday's maximum, a clear sign of weakness that doesn't suggest a positive move. It is flat, slightly downwards but still undecided.

The Directional Movement Index shows how sales appeared suddenly yesterday, while the purchases decreased at a similar rate. The D- exceeds the D+ narrowly, and suggests a bearish character for today's session. This kind of technical pattern tends to change sides as the forces fight for the price direction.

Above, there is a first resistance at yesterday's maximum at $11,764, followed by $12,884. The head and shoulders bottom pattern is still valid but remains deactivated.

Below, the first support is at the triangle's bottom side, at $10,707, followed by $9,958. If these supports are broken, Bitcoin's price could go down to the channel's base.

Litecoin finds its way and keeps momentum despite losing an important level

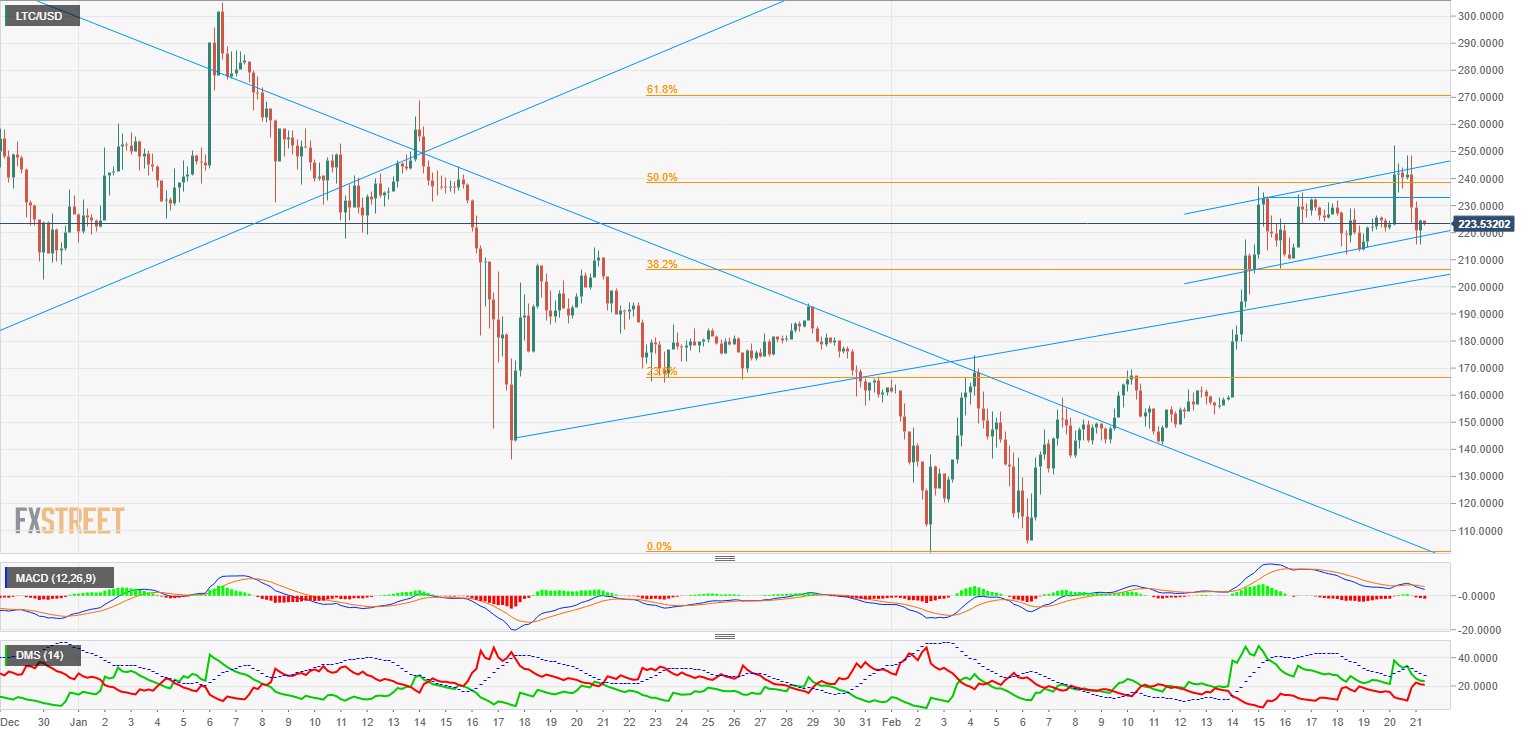

LTC/USD 240 min

Litecoin failed its try to conquer the 50% retreat level, and went down it again in yesterday's evening. It is in a narrow bullish channel, supported at $220. Technically, it hasn't got as worse as Bitcoin, and it is still in good shape to keep raising.

The MACD is in a similar position to BTC/USD and has changed with respect to yesterday's move.

The Directional Movement Index does diverge from Bitcoin's. Purchasers haven't managed to overcome the sellers, although the gap's narrowness suggests a volatility increase in the short-term.

Above, the first resistance is at the 50% Fibonacci level, at $218.553, followed by the channel's roof at $246.

Below, there is a strong support at $218, the channel's base. If broken, the next support level is at the 38.2% retreat, at $206.36.

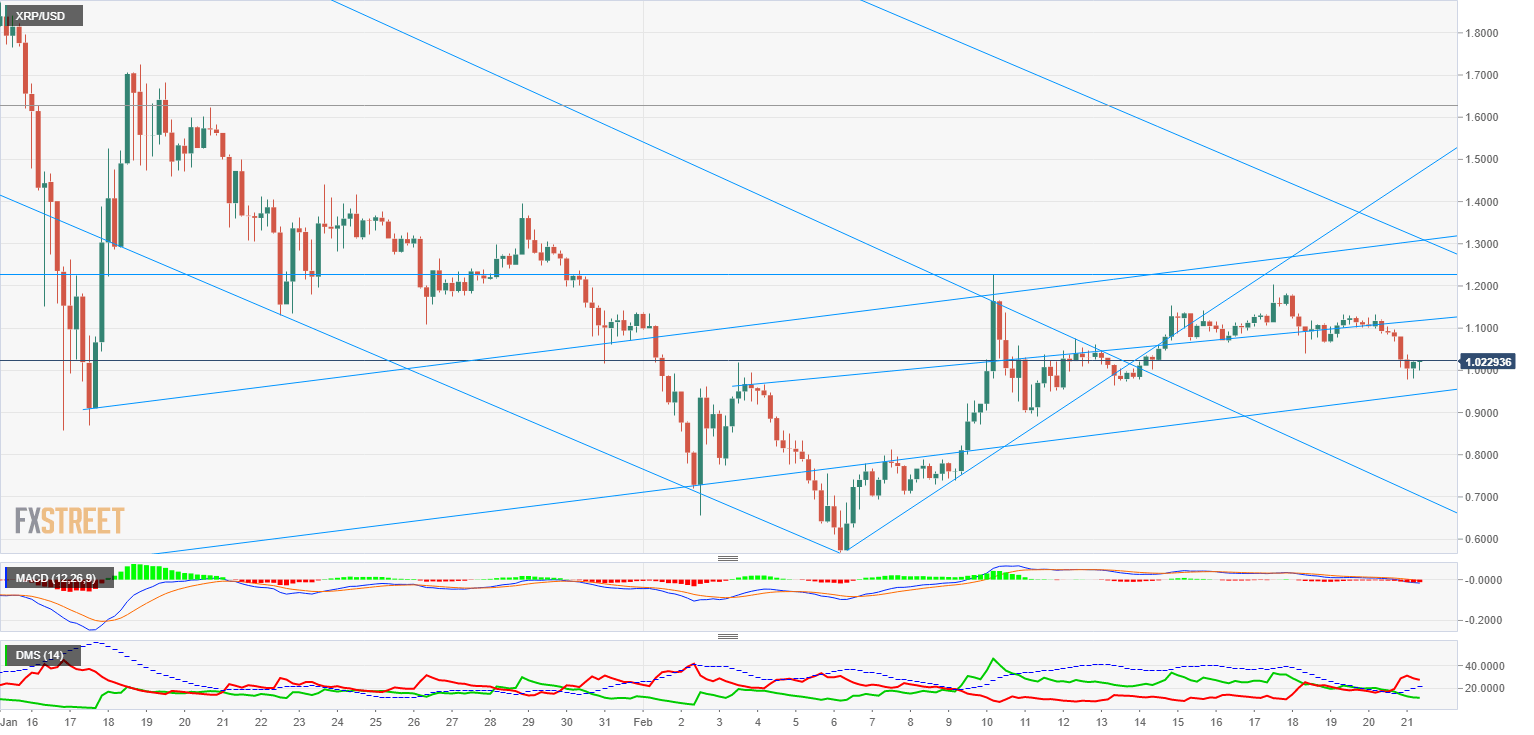

Ripple also suffered from late sales, but keeps the technical setting

The late sales got the XRP/USD to lose the trendline it had been following since February 10. It hasn't broken the figure that contains the price, but it is not trading near the bottom limits. The most negative news is the amount of barriers Ripple should face if it is to move upwards.

XRP/USD 240 min

The MACD has become slightly negative, very flat but following the price development. The only insight is the weakness and indecision.

The Directional Movement Index is much clearer. It shows how the sellers dominate the situation as purchases decreased. Today's development will be key for the mid-term.

Above, the first goal is at $1.1221, followed by $1.2268. If surpassed, it would face a complex structure of resistance between $1.31 and $1.46.

Below, there is a first support at $0.96, which would lead to the downwards trendline at $0.72 if broken.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.