- Bitcoin toying with dangerous levels as purchases don't appear.

- EOS in a similar position, while Ripple paves the way for them.

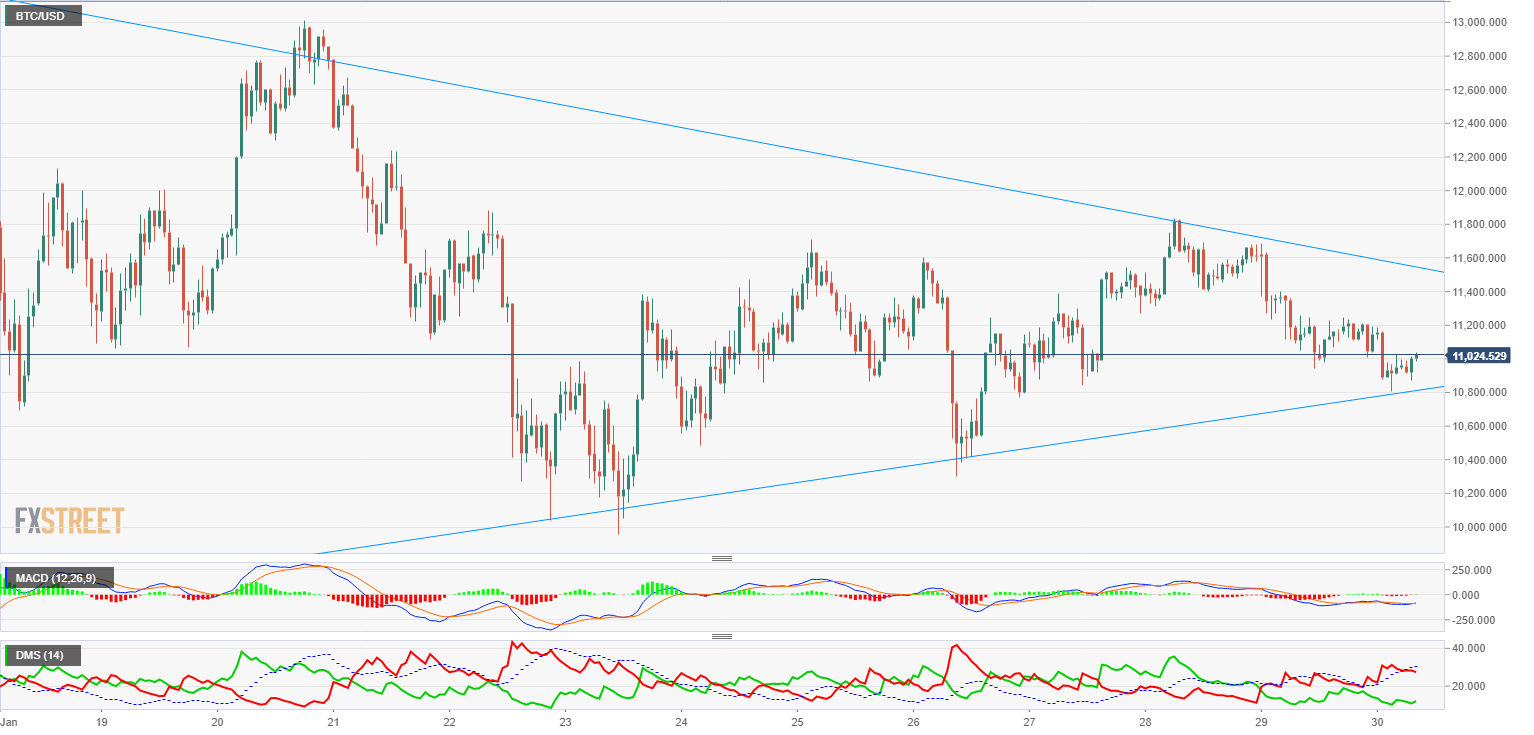

BTC/USD lacks room and must take a decision

BTC/USD 240 min

The current standings in the crypto board demand the highest attention and clear thinking. In a technical analysis, maintaining its validity until the price says otherwise is as important as reconsidering the situation and assuming a new analysis that may contradict our previous beliefs. Lacking the ability to reassess in time is the fastest way to the abyss.

Right now, the BTC/USD bullish prediction is still valid, especially taking into account the unquestionable upside long-term trend and the apparent normalcy of the current retreatment from all-time highs. Nonetheless, we must be aware that the support levels are really close to the current price. A closing below $10,800, just a few points below the current price, would force us to reassess the scenario.

The MACD is extremely flat and in the equilibrium zone. The key insight is a lack of advantage from any side. No deviations, no extrema: dead calm.

The Directional Movement Index delivers juicier information. Purchases have decreased during the last bearish term as much as sales have increased. The downward trend keeps accelerating, and given the small room in the current geometric structure, a break à la Ripple must be laid on the table.

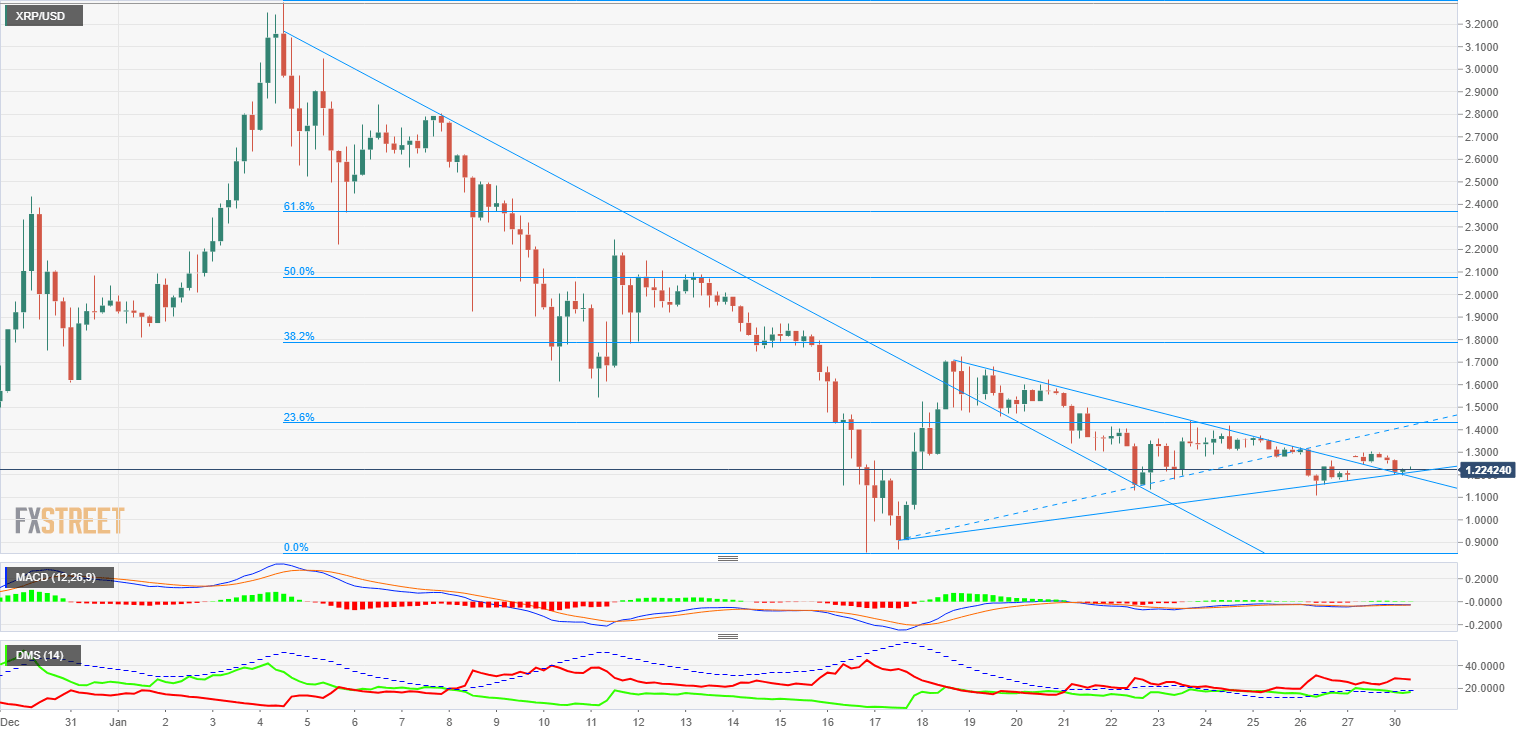

Ripple, lacking the force to leave the support behind, keeps moving laterally

XRP/USD 240 min

In the past days, Ripple has been in the same position the BTC/USD is today. Keeping a slightly upside trendline, it has broken the triangular structure to enter an expansive environment that, given its narrowness, is very unlikely to provide any tranquility to buyers. The chances that Bitcoin follows the same route as Ripple are quite high.

Ripple's MACD is, as Bitcoin's, extremely flat and thus giving no insights about the trending projections. In this case, the news is that there isn't news.

The Directional Movement Index shows a more advanced pattern than Bitcoin's. The purchases have risen together with the extension movement as sales have decreased.

The situation is tricky, since it should be solved without any volatility increase. At the current levels, the supports would not resist higher price ranges.

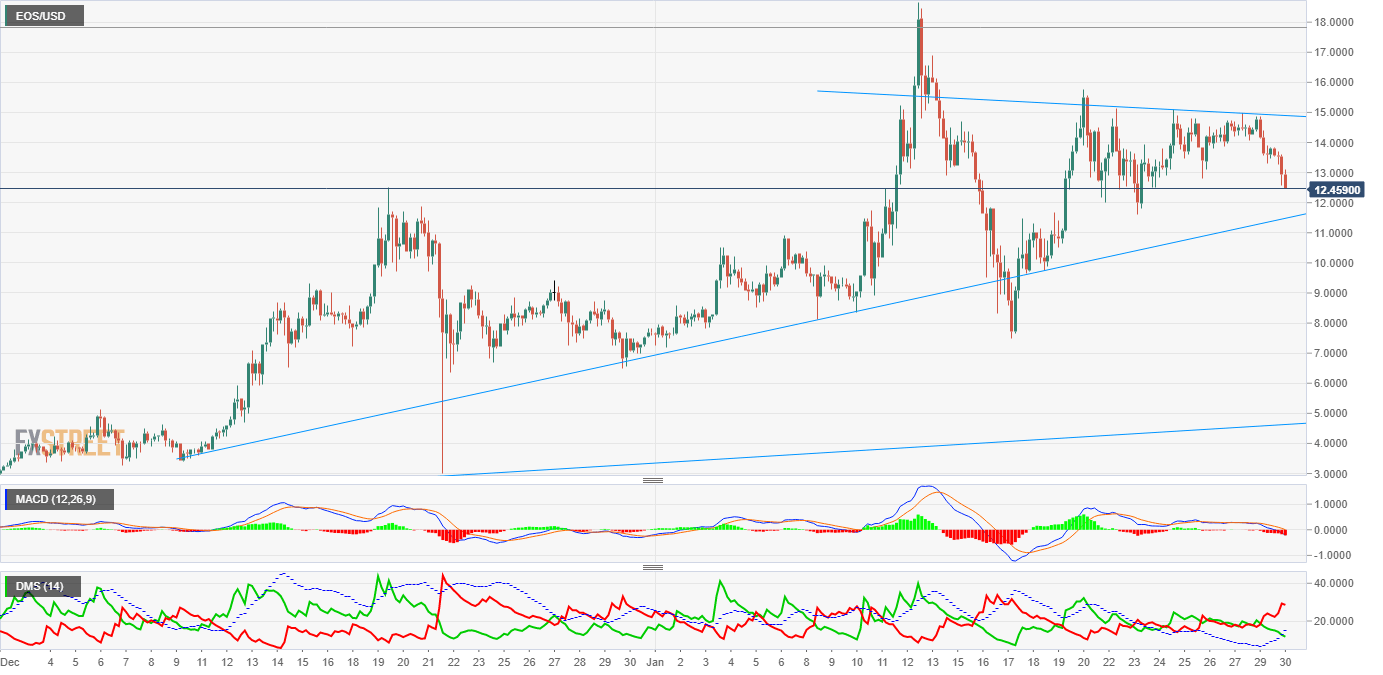

EOS on watch. Accelerates its decrease and approaches the support with no brakes

EOS/USD 240 min

EOS is in a fragile position. Although there's still some room until it reaches the trendline support, its downside move keeps accelerating and the sales have increased a considerable amount.

The MACD is moving in the negative zone, with a decreasing continuity profile that is set to be valid in the short term.

The Directional Movement Index shows the sales increasing significantly, as purchases decrease and the decreasing trend accelerates. The projection is threatening the price development in the next sessions. It is very likely that the price break the support, something that we have already seen in EOS.

Conclusion

The situation is still of uneasy calm, with all the crypto board in limiting positions, very close to supports and casting doubts on the bullish perspectives. As we mentioned in yesterday's report, this kind of situations, in which very few traders are brave enough to buy, conceal some of the best opportunities. However, we must take into account that there are chances of closing the position in losses. Only by keeping this in mind we can avoid being caught up without control of our position.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.