Australian Quarterly CPI Preview: Upside surprise could save the day for the AUD bulls

- Australian CPI is seen decelerating in Q4 after last quarter’s positive surprise.

- RBA to stay on hold next month after strong employment data.

- Upside surprise in inflation figures to save the day for AUD/USD.

The Australian Bureau of Statistics (ABS) will publish the Q4 2020 CPI early Wednesday. The CPI is expected at 0.7% QoQ in the fourth quarter, falling sharply from the previous 1.6%. The 12-month CPI rate is seen steady at 0.7% in Q4. The Reserve Bank of Australia’s Trimmed Mean CPI is expected at 0.4% QoQ while on an annualized basis the figure is likely to come in at 1.2%. On both the timeframes, the CPI rate is seen unchanged from the Q3 reading.

The expectations of slowing price pressures are likely to drag the OZ economy further away from the central bank’s 2-3% target band. With the improvement in the Australian employment sector, the jobless rate having fallen to 6.8% in November, the RBA is likely to keep the key rates just above 0% at least until 2022.

The low-interest rates regime is unlikely to stoke inflation, as low wage growth keeps price pressures subdued. It’s worth noting that the Australian wages grew just 0.10% in Q3, registering the slowest pace on record.

The Minutes of the latest central bank’s meeting showed that board members believe that a “substantial tightening" in labor market is needed to lift wage growth and inflation. The RBA, however, added that they will not raise rates until inflation sustainably in 2-3% target range.

Fresh restrictions in Queensland, Victoria and South Australia due to the rapid spread of the coronavirus second-wave seemingly hit consumer demand, adding to the downside pressure on the prices.

The CPI disappointment could prompt the RBA at hinting a potential extension to it quantitate easing (QE) program beyond April, which could save the day for the AUD bulls. An upside surprise to the data could also benefit the Australian dollar amid improving economic prospects. Meanwhile, the market sentiment amid renewed US-China tensions and US stimulus uncertainty could play a key role in the aussie’s price action on the data release.

AUD/USD Technical outlook

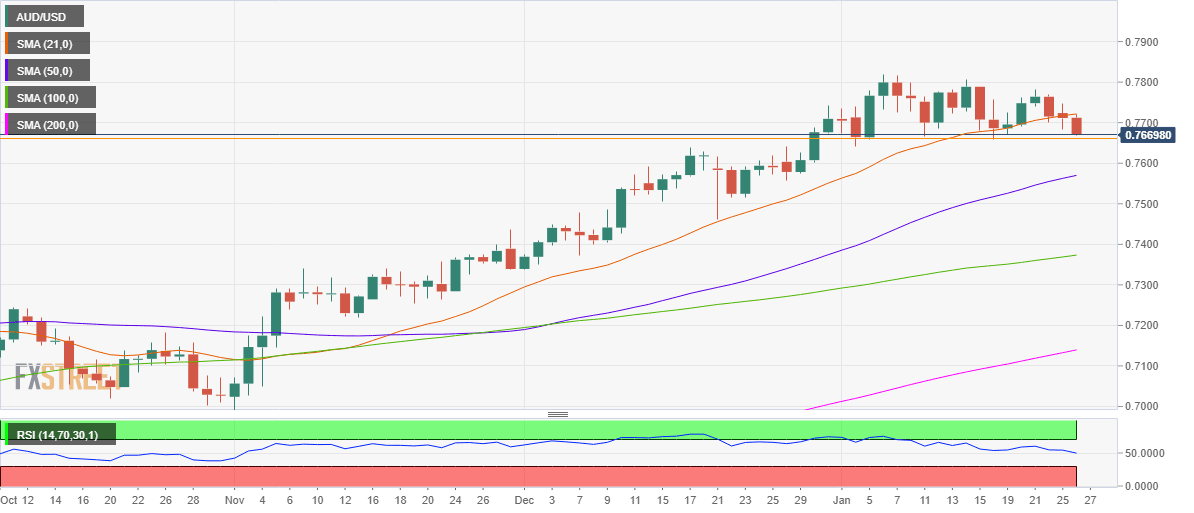

AUD/USD: Daily chart

Looking at the daily chart, AUD/USD has given a closing below the critical 21-daily moving average (DMA) on Monday, warranting caution for the bulls. The price extends the break to the downside and heads towards 0.7650, as of writing.

Despite the decline, the buyers remain hopeful, as the Relative Strength Index (RSI) still holds above the midline. Immediate support awaits at the 0.7600 round number, below which the upward-sloping 50-DMA at 0.7570 could be put to test. On the flip side, recapturing 21-DMA at 0.7721 is critical to reviving the upside momentum in the spot. The next relevant resistance is seen at Monday’s high of 0.7748.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.