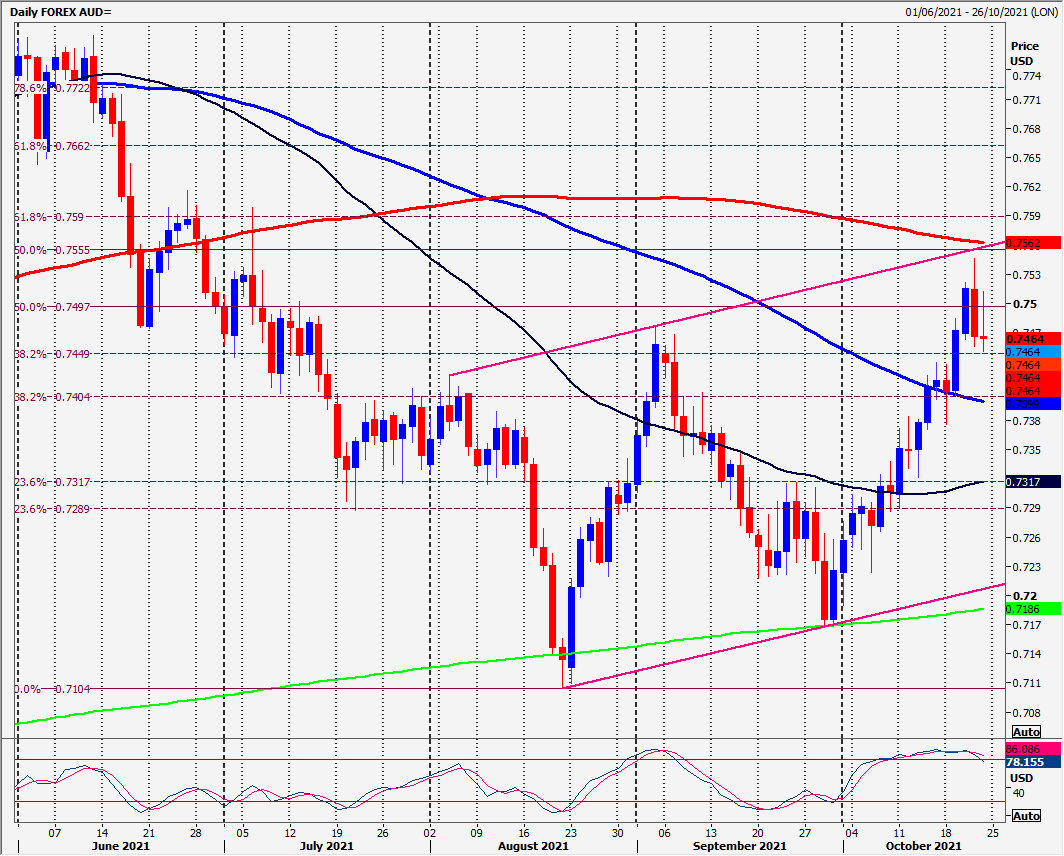

AUD/USD: Longs at 7475/55 stop below 7445

AUD/USD, NZD/USD, AUD/JPY

AUDUSD longs at good support at 7475/55 worked perfectly with a low for the day here & a bounce to our target of 7490/7500. (A high for the day just 12 pips above).

Thursday’s bearish engulfing candle remains a sell signal for this week.

NZDUSD topped out on Thursday as predicted leaving a bearish engulfing candle for a sell signal. However longs at 7140/30 worked on Friday hitting 7180/90 for profit-taking. A high for the day here in fact.

AUDJPY saw a high for the rally at Thursday’s high of 8624 as predicted leaving a bearish engulfing candle for a sell signal. Our longs at 8510/8490 worked perfectly hitting the 8540/50 target for profit taking & in fact this was the high for the day before prices sold off to 8460.

Daily analysis

AUDUSD held good support at 7475/55 & it could be worth trying small longs here again targeting 7490/7500 for profit-taking. Gains are likely to be limited but a break above 7515 allows a recovery to 7530/35. Strong resistance at 7555/65 should be a big challenge. It is unlikely we will reach this far but if we do, try shorts with stops above 7580.

Longs at 7475/55 stop below 7445 (so the risk is very small). A break lower is a sell signal targeting 7410/7390, perhaps as far as 7360/50.

NZDUSD longs at first support at 7140/30 could work again targeting 7180/90 for profit-taking. Gains are likely to be limited now. If we retest 7200/7220, try shorts with stops above 7240. BUT be ready to sell again at very strong resistance at 7255/75. Stop above 7300.

Longs at first support at 7140/30 must stops below 7120 so the risk is very small. A break lower is a sell signal targeting 7090/80 probably as far as 7040/30.

AUDJPY expected to test first support at 8460/40. This may hold on the first test only for a bounce to 8500 but gains are likely to be limited after the sell signal. Unlikely but further gains meet a selling opportunity at 8540/50. Stop above 8570. I would sell again at 8620/40 with stops above 8660.

A break below 8420 is the next sell signal targeting 8370 & 8345/35.

Chart

Author

Jason Sen

DayTradeIdeas.co.uk