AUD/USD Forecast: Resilient aussie en route to extend gains

AUD/USD Current Price: 0.6977

- AUD NAB’s Business Confidence is expected to improve to 7 in July from 1 in the previous month.

- Chinese Trade Surplus reached $101.26 billion in July, beating market expectations.

- AUD/USD remains resilient but still struggling to advance beyond 0.7000.

The AUD/USD pair trimmed Friday’s losses and surged to 0.7008, retreating modestly in the US afternoon to end the day around 0.6980. The aussie benefited from the broad dollar’s weakness but also from upbeat Chinese data released at the beginning of the day. According to official releases, the July Trade Balance posted a surplus of $101.26 billion, much better than the $90 billion expected. The Australian dollar was also backed by the positive tone of Wall Street, although retreating US indexes ahead of the close pushed the pair lower.

Australia will publish on Tuesday, July NAB’s Business Confidence, foreseen at 7 from 1 in June, and NAB’s Business Conditions for the same month, expected at 15 from 13 in June.

AUD/USD short-term technical outlook

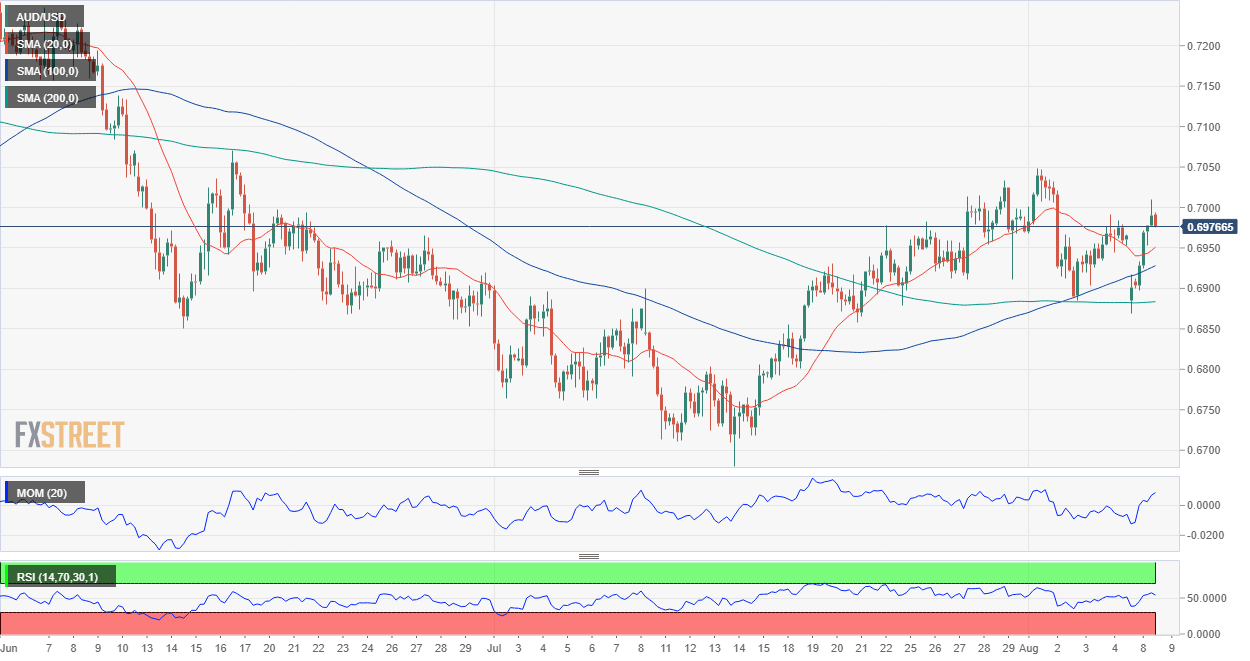

The AUD/USD pair hovers around the 50% retracement of its 0.7282/0.6680 slide at 0.6980. The daily chart shows that the pair finds buyers around a bullish 20 SMA, which converges with the immediate Fibonacci support at 0.6910. The Momentum indicator eased within positive levels but remained within positive levels, while the RSI indicator advanced within positive levels, keeping the downside limited.

The 4-hour chart offers a neutral-to-bullish stance, as technical indicators remain directionless within positive levels, while the pair develops above all of its moving averages, which present upward slopes. The critical resistance level is 0.7050, the 61.8% retracement of the aforementioned rally, as once above the latter, the bullish case will be clearer.

Support levels: 0.6955 0.6910 9.6875

Resistance levels: 0.7010 0.7050 0.7090

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.