AUD/USD Forecast: Bulls remain side-lined

AUD/USD Current Price: 0.7750

- The Reserve Bank of Australia will publish the Minutes of its latest meeting.

- US indexes trimmed intraday losses ahead of the close, helping AUD/USD.

- AUD/USD posted a lower low daily basis, which skews the risk to the downside.

The AUD/USD pair trades in the 0.7750 price zone, pretty much unchanged on a daily basis. The pair fell to 0.7705 during US trading hours, following the lead of Wall Street. US indexes trimmed intraday losses, and so did AUD/USD ahead of the close. Trading was dull across the FX board as investors await first-tier events to take place later in the week.

Australia published February HIA New Home Sales, which were up 22.9% in the month, much better than the previous -69.4%. This Tuesday, the RBA will release the Minutes of its latest meeting, while Australia will publish the Q4 House Price Index.

AUD/USD short-term technical outlook

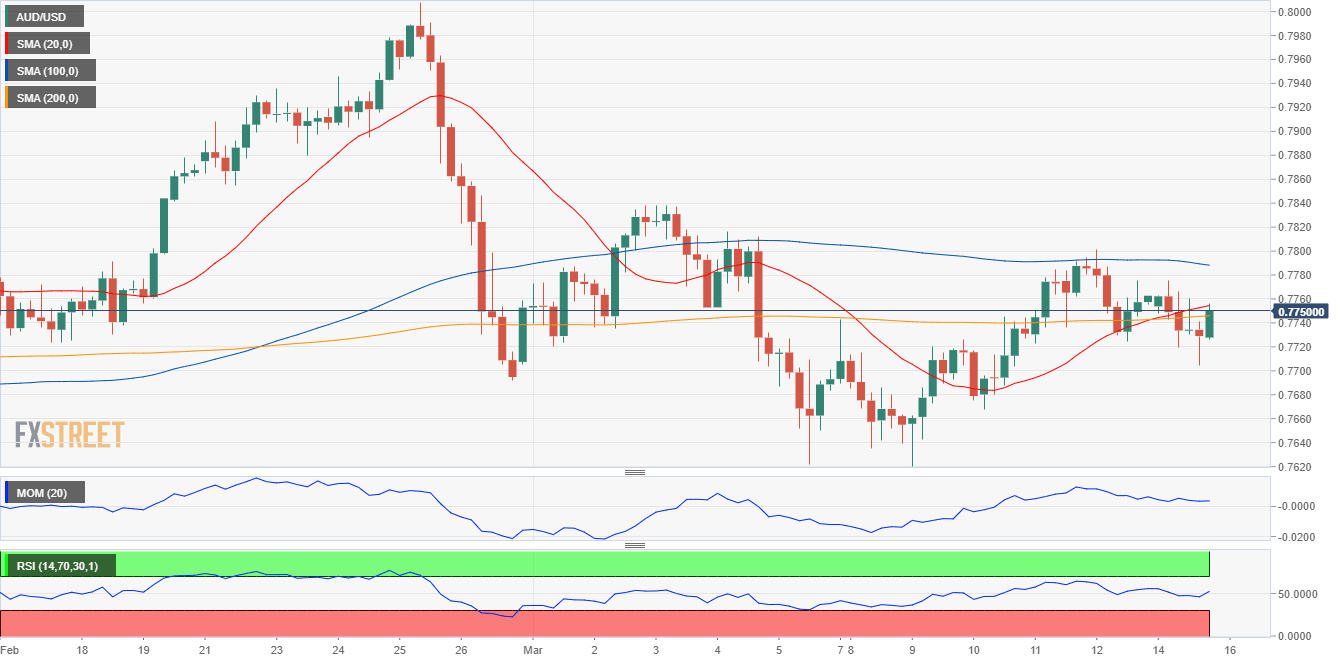

The AUD/USD pair has posted a lower low daily basis, which skews the risk to the downside. In the 4-hour chart, the pair is unable to advance above its 20 SMA while seesawing around the 200 SMA. Technical indicators are recovering modestly within neutral levels but lack momentum enough to confirm an upcoming advance. The immediate resistance is 0.7780, but bulls will have better chances should he pair advance beyond 0.7820.

Support levels: 0.7730 0.7690 0.7650

Resistance levels: 0.7780 0.7820 0.7855

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.