WTI Price Analysis: Teasing head-and-shoulders breakdown on 1H chart

- WTI consolidates the downside before the next leg lower.

- US oil charts a potential head-and-shoulders pattern on hourly chart.

- Trades below all major HMAs, with bearish RSI.

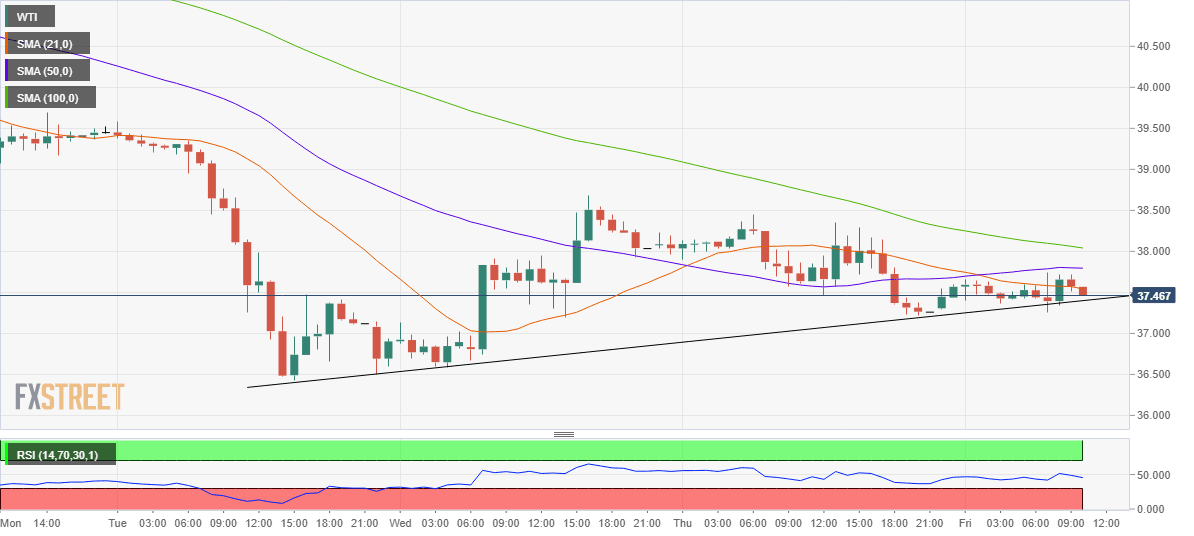

The choppy trading in WTI (futures on Nymex) over the few days has carved out a head-and-shoulders pattern on the hourly sticks.

The price is on the verge of a pattern breakdown, as it flirts with a neckline at 37.39. A sustained closing below the latter will open floors for a test of the pattern target at 35.50.

On its way to the pattern target, the bears could challenge multi-month lows at 36.42.

Alternatively, any bounce will confront the horizontal 50-hourly Simple Moving Average (HMA) at 37.80.

Acceptance above the latter could add legs to the corrective bounce towards the 100-HMA at 38.05.

The hourly Relative Strength Index (RSI) remains in the bearish territory, pointing south at 45.15, indicative of the further declines.

WTI: Hourly chart

WTI: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.