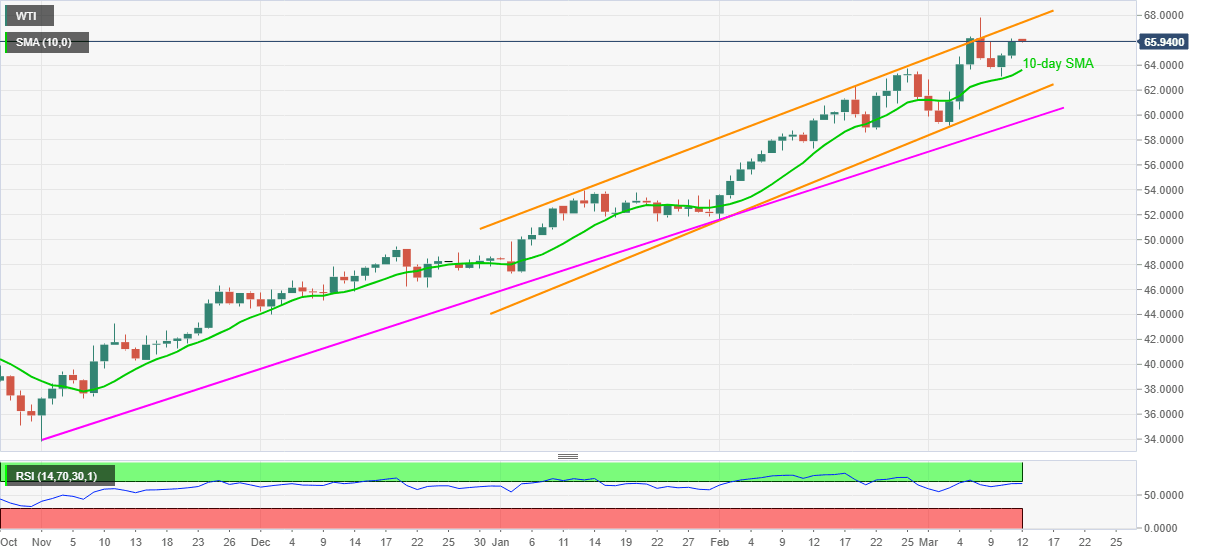

WTI Price Analysis: Overbought RSI tests bulls around $66.00

- WTI snaps two-day winning streak while easing from $66.12.

- Bullish chart pattern, sustained trading beyond immediate SMA support keeps buyers hopeful.

- A daily closing beyond $66.00 becomes necessary before probing the channel resistance.

WTI bulls catch a breather around $66.00, currently down 0.22% intraday near $65.90, amid Friday’s Asian session. In doing so, the energy benchmark drops for the first time in three days while teasing the multi-month tops marked earlier in the week.

Given the overbought RSI and the market’s cautious mood ahead of US President Joe Biden’s speech, at 01:00 AM GMT, the black-gold is likely to consolidate the recent gains.

However, 10-day SMA near $63.60 can test short-term bulls ahead of directing them to the support line of a two-month-old ascending trend channel, at $61.45 now.

It should be noted that the oil’s declines past-$61.45, which defies the bullish chart formation, needs validation from an upward sloping support line from February 01, currently around $59.50.

Meanwhile, the $66.00 theshold offers an immediate upside hurdle to the WTI buyers ahead of directing them to the stated channel’s resistance line near $67.50 and the latest high of $67.86.

It’s worth mentioning that there are multiple barriers around $68.00, marked during late 2018, that could keep the WTI buyers in check ahead of directing them to the $70.00 round-figure.

WTI daily chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.