WTI Price Analysis: Oil under pressure after rejection at channel hurdle

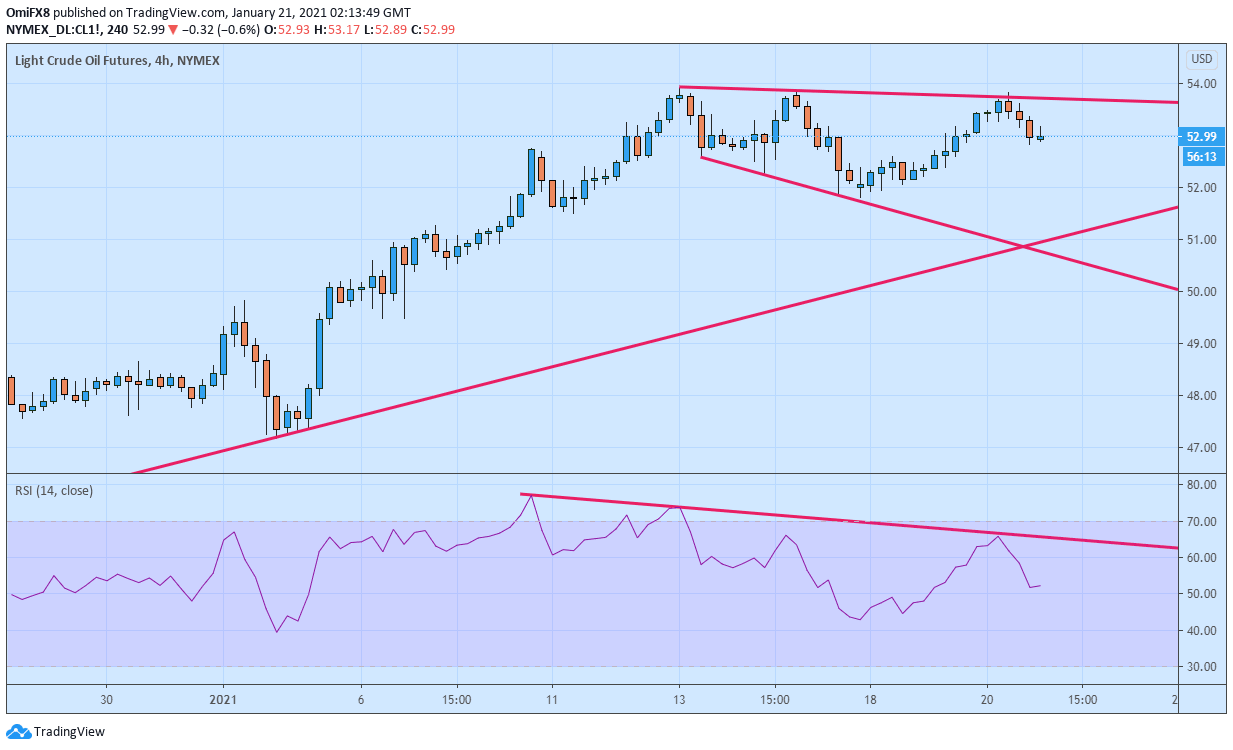

- WTI is trapped in an expanding channel on the 4-hour chart.

- Wednesday's rejection at the channel hurdle has put the bears in the driver's seat.

West Texas Intermediate (WTI), a North American oil benchmark, is currently trading 0.45% lower on the day near $53.00 per barrel.

The losses come a day after prices failed to take out the upper end or resistance of the 4-hour chart expanding channel identified by trendlines connecting Jan. 13 and Jan. 14 highs and lows.

The rejection at the channel hurdle is backed by lower highs (bearish pattern) on the 4-hour chart Relative Strength Index. As such, a deeper drop could be seen while heading into the weekend.

Support is located at $51.81 (Jan. 17 low), followed by $51.00 (multi-month ascending trendline support).

4-hour chart

Trend: Bearish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.