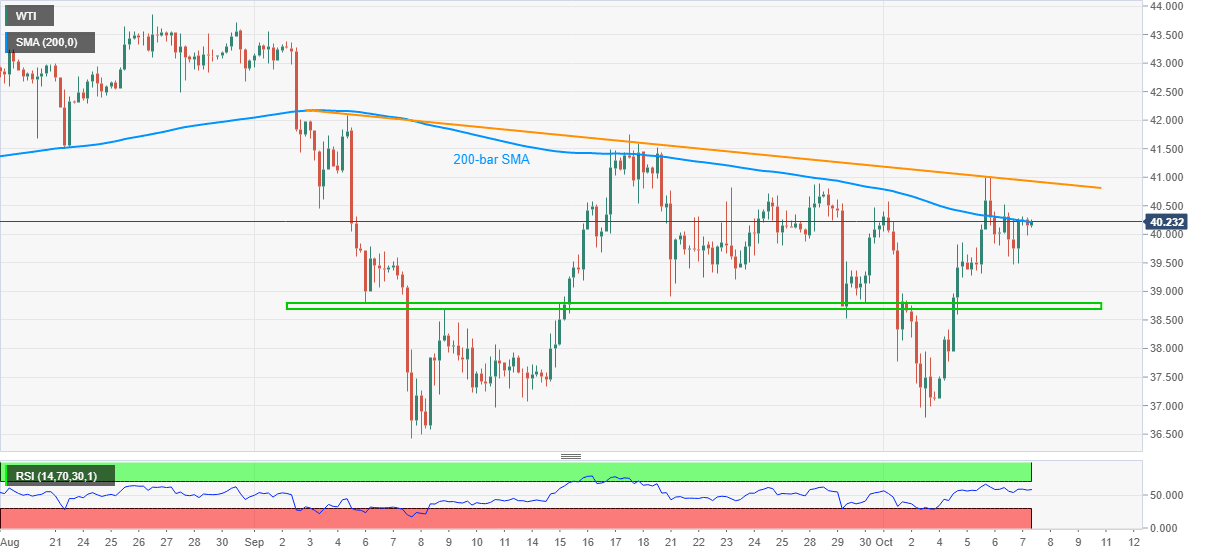

WTI Price Analysis: Clings to 200-bar SMA around $40.00 in Asia

- WTI struggles to extend recovery moves from $39.48.

- Falling trend line from September 04 also challenges the oil bulls.

- Five-week-old horizontal support will lure bears below the $39.00 threshold.

WTI picks up bids near $40.23 while heading into Thursday’s European session. In doing so, the black gold confronts 200-bar SMA after its positive performance on Wednesday.

While normal RSI conditions and risk-on mood favors the commodity to cross the immediate upside hurdle near $40.25, it’s further advances will be tamed by a falling trend line from the early September, currently around $40.95.

During the quote’s break past-$40.95, the $41.00 round-figure and September 18 top close to $41.45 can entertain the oil buyers.

On the contrary, a downside break of yesterday’s low of $39.48 can quickly direct WTI sellers toward a horizontal region between $38.70 and $38.80 that comprises multiple technical levels since September 04.

Also acting as the key support will be the monthly low of $36.79 and the September month’s bottom surrounding $36.40.

WTI four-hour chart

Trend: Further recovery expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.