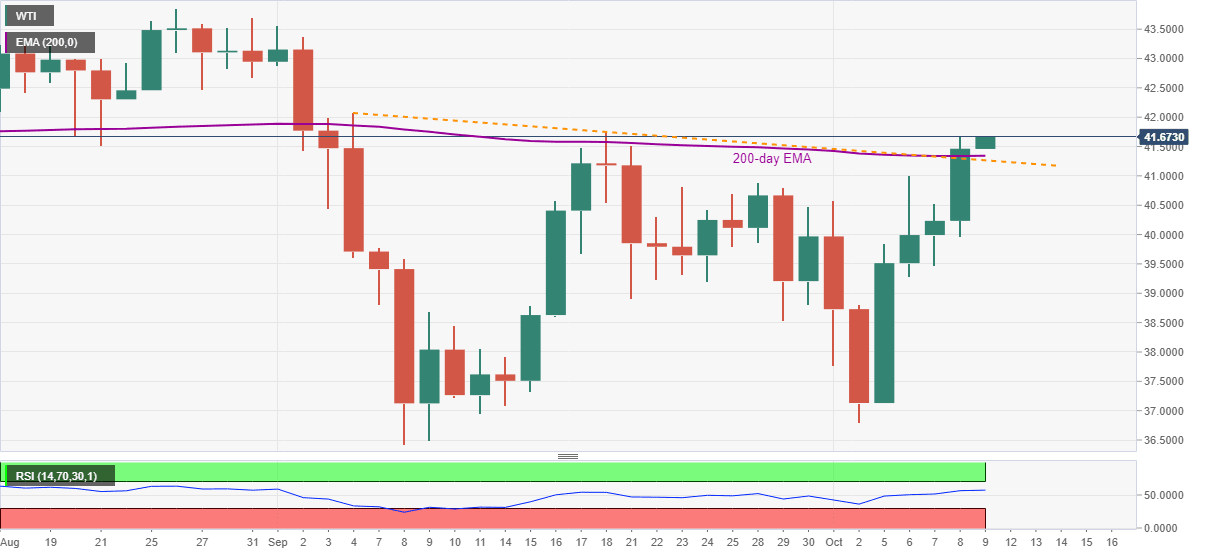

WTI Price Analysis: Cheering upside break of 200-day EMA to eye $42.00

- WTI refreshes three-week high while carrying the run-up beyond key EMA, falling trend line from September 04.

- Normal RSI conditions add to the bulls’ power in targeting the five-week top.

- Bears will have a bumpy road unless breaking the $40.00 round-figure.

- US sanctioning of 18 Iranian banks offer fundamental strength.

WTI extends Thursday’s heavy rise towards challenging the September 18 top, currently around $41.70, during the initial Asian session on Friday. In doing so, the energy benchmark respects the upside break of 200-day SMA and a five-week-long descending resistance line, now support.

The upside momentum also gains support from an absence of overbought RSI conditions. That said, oil prices are currently targeting the $42.00 round-figure ahead of September 04 top of $42.07.

Should energy bulls manage to cross $42.07, highs marked during September and August, respectively around $43.55 and $43.85, will be in the spotlight.

On the downside, 200-day EMA and the immediate support line, previous resistance, will restrict WTI’s immediate declines above $41.25. Also offering immediate support could be the September 28 peak surrounding $40.85 and the $40.00 psychological magnet.

I f at all the oil bears sneak in around $40.00, there are multiple supports around $38.70, $38.00 and near $37.00 that can challenge the black gold’s further weakness.

Other than the technical indicators, the US State Department’s announcement of levy fresh sanctions on 18 banks from Iran also suggest a disturbance in the oil supply and play positive for the quote.

WTI daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.