WTI defends $87 amid OPEC+ output cuts, impending bear cross

- WTI consolidates the three-day rally above the $87 mark on Thursday.

- Investors digest the 2M barrels/day OPEC+ output cuts and EU price cap on Russian oil.

- Drawdown in EIA crude stockpiles also supports the black gold amid a weaker US dollar.

WTI has entered a phase of upside consolidation while defending the $87 mark so far this Thursday, moving slightly away from three-week highs of $87.78.

The retreat in the black gold could be attributed to profit-taking after a three-day staggering rally. Also, bulls take a breather ahead of the all-important US Nonfarm Payrolls release, which could have a significant impact on the dollar valuations, and eventually affect the USD-sensitive oil.

Further, a Wall Street Journal (WSJ) report that the US intends to ease sanctions against Venezuela, allowing Chevron to resume oil production, is exerting bearish pressures on WTI.

The US oil has gained roughly 10% so far this week, with the recent upside fuelled by the OPEC+ output cuts announced on Wednesday. Joint Ministerial Monitoring Committee (JMMC) of the OPEC and allies including Russia, known collectively as OPEC+, agreed to cut oil production by 2 million barrels per day, per Reuters.

In response to the OPEC+ move, the White House said that US President Joe Biden is disappointed by the OPEC+ group's 'shortsighted decision'.

The black gold also found some support from a decline in the US crude oil and fuel stockpiles, according to the weekly data published by the Energy Information Administration (EIA). US commercial crude oil stocks dropped by 1.356 million barrels against expectations for a build of 2.052 million barrels.

Further, the European Union’s (EU) agreement to impose a price cap on Russian oil also boded well for the commodity price. Looking ahead, geopolitical tensions and the US employment data will hold the key to a fresh trading impetus in oil price.

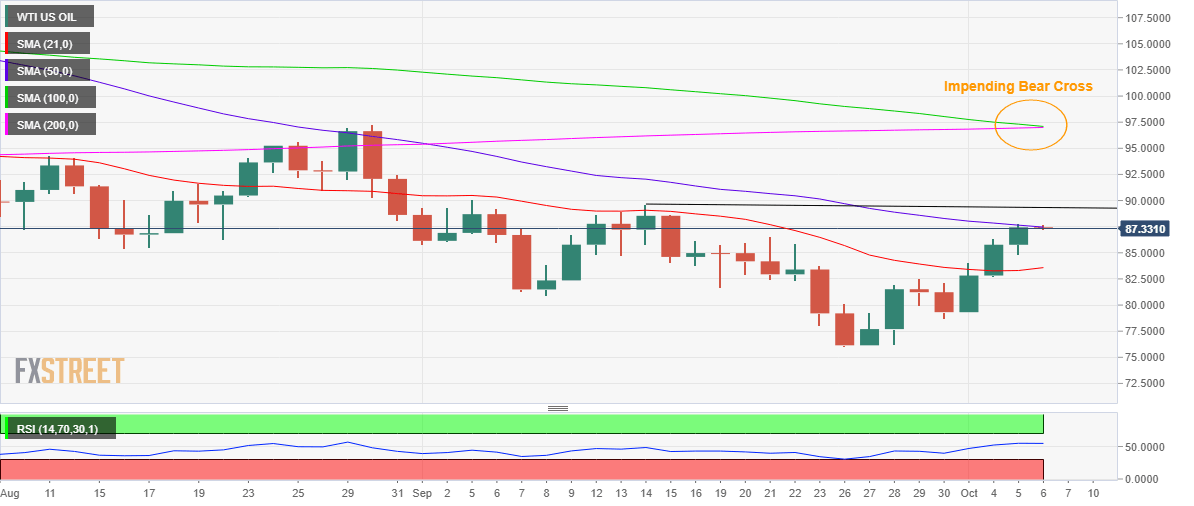

On a daily timeframe, WTI is battling the bearish 50-Daily Moving Average (DMA) located at $87.45. Daily closing above the latter will kick in a fresh upswing towards the next horizontal trendline resistance placed at $89.65.

The 14-day Relative Strength Index (RSI) is holding firmer above the midline, suggesting that there is more room to the upside.

However, a potential 100 and 200 DMAs bearish crossover could temper the upbeat momentum. In case the bear cross materializes, then the price could drop back towards the $85 mark.

WTI: Daily chart

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.