- WTI has held in familiar resistance territories ahead of the Federal Reserve.

- Most economists in Reuters polls were worried about new variants of the coronavirus.

US West Texas Intermediate (WTI) was around 0.6% down into the closing bell on Wall Street as investors fret around the risks in the new global wave of the coronavirus Delta variant to energy demand.

At the time of writing, WTI is trading at $71.75 and had travelled between a high of $72.30 and $71.10 into early Asian trade.

Even though supplies are tightening and vaccination rates rising, oil cannot shake off the prospects of fresh economic shutdowns and the negative ramifications for the energy complex.

In Europe, where the spread is feard to be the worst of all, Britain reported its highest number of deaths and people in hospital with coronavirus since March.

The virus is still present in almost every part of the world, but the focus has slowly shifted from Asia to Europe and then America.

In repose to the European spread, the United States issued travel warnings to Spain and Portugal.

Meanwhile, the International Monetary Fund on Tuesday maintained its 6% global growth forecast for 2021, upgrading its outlook for the United States and other wealthy economies.

However, the IMF has cut estimates for a number of developing countries struggling with surging COVID-19 infections.

''The divergence is based largely on better access to COVID-19 vaccines and continued fiscal support in advanced economies, while emerging markets face difficulties on both fronts, the IMF said in an update to its World Economic Outlook,'' Reuters reported.

Overall, global economic growth prospects remained strong, even though most economists in Reuters polls were worried about new variants of the coronavirus.

Analysts tracking mobility data remain confident about fuel demand, counting on vaccinations.

Global oil markets are expected to remain in deficit despite a decision by the Organization of the Petroleum Exporting Countries (OPEC) and allies, collectively known as OPEC+, to raise production.

''While the delta-variant continues to spread in the US, it is unlikely to meaningfully tighten mobility restrictions and derail the recovery in energy demand. Elsewhere, road traffic in Asia continues to recover while air travel is also rising at a fast clip, particularly in Europe, but with the US and China also continuing to post gains,'' analysts at TD Securities said.

In recent trade, the Inventory data from the American Petroleum Institute (API) had little impact on the market:

- Crude -4.728M.

- Cushing -0.126M.

- Gasoline -6.226M.

- Distillate -1.882M.

Meanwhile, the pending risk events are the Federal Reserve and the US Energy Information Administration on Wednesday.

Analysts polled by Reuters expected the data to show US crude stocks fell by about 2.9 million barrels and gasoline stocks fell by 900,000 barrels in the week to July 23.

As for the Fed, anything could happen, but the market is positioned for a hawkish hold and some acknowledgement of the Delta variant risks in which both should be supportive of the greenback and not a surprise for the markets.

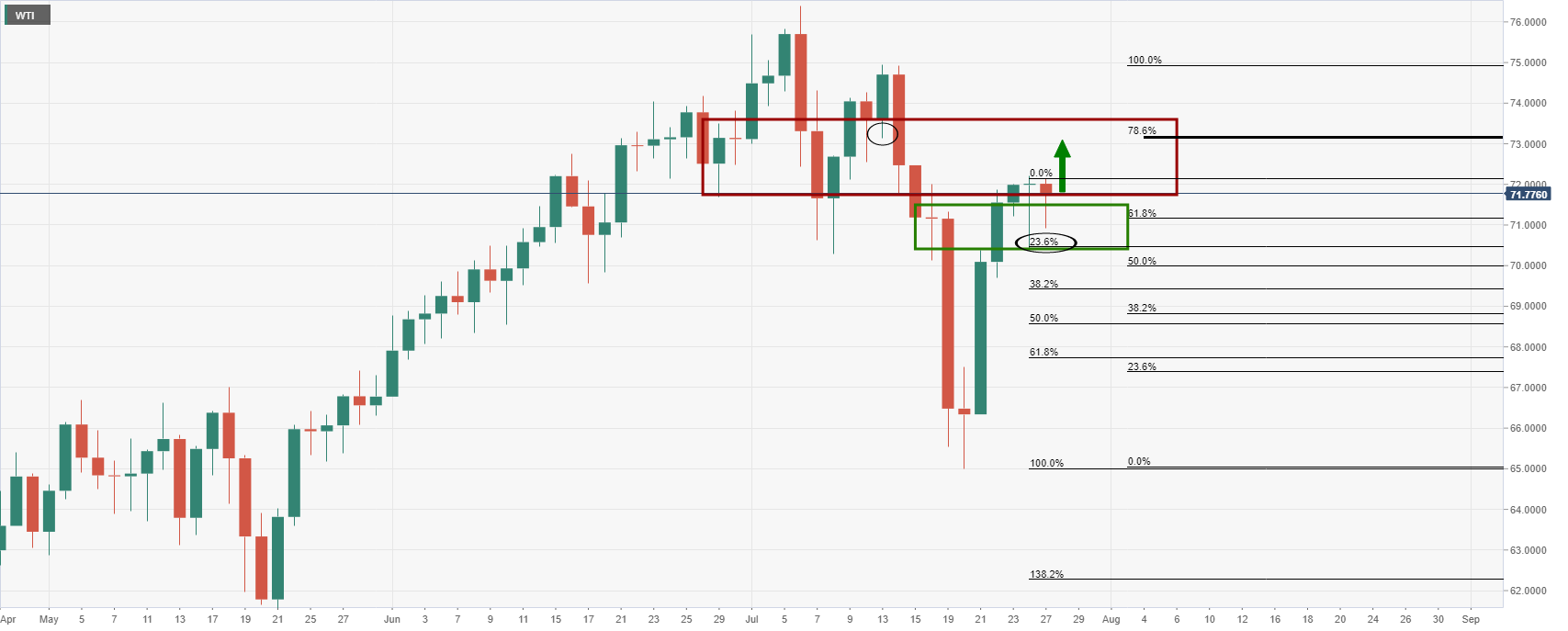

WTI technical analysis

The price is supported by the 23.6% Fibonacci retracement of the current daily impulse near 70.50.

The bulls can target the 78.6% Fibonacci retracement of the prior bearing impulse that has a confluence with the 13 July lows at 73.13.

With all that being said, there could be a deeper correction first of all to test the bullish commitments at the 38.2% Fibo near 69.50 and below the psychological 70 level.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.