WKHS Stock News: Workhorse Group Inc.set to resume rises, technically well-positioned

- NASDAQ: WKHS is set to kick off the first full week of October with gains.

- Workhorse Group's stock has been retreating after the Trump bump.

- Friday's close above critical support is a bullish sign.

- Hopes for cashing in on Workhorse's share in Lordstown Motors may fuel more gains.

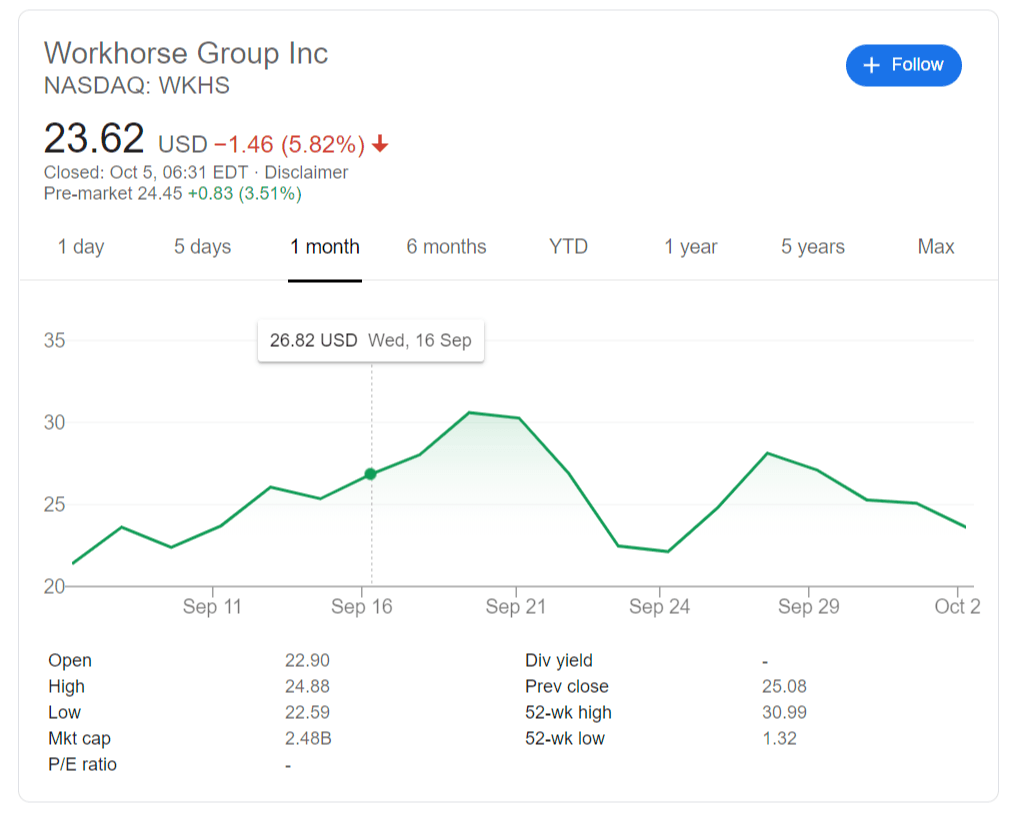

A higher low – and especially on a weekly close – is always an encouraging technical sign. NASDAQ: WKHS shares fell for four consecutive days, gradually eroding the gains made on Monday. However, the close at $23.62 – despite being a daily drop of 5.82% on Friday – still leaves Workhorse Group's shares above the closing price last Friday, which was $22.13

Can it continue higher? The initial upside target is $25, a psychologically significant level. According to pre-market data, WKHS is set to rise by 3.51% to $24.45, nearing that target. The bigger prize is $28.13, Monday's close, followed by the September peak of $30.60. The $22.13 level works as low support.

WKHS stock news

Workhorse Group Inc shot higher last week after President Donald Trump examined a Lordstown Motors truck on the White House lawn. The firm owns a 10% share in Lordstown.

The leader of the world's most powerful country later tested positive for coronavirus and was hospitalized. Shares dropped ahead of that shocking news as the focus shifts to what happens with the stake in the fellow Ohio-based company.

Lordstown Motors may make its way to the stock market via DiamondPeak Holdings – a Special Purpose Acquisition Company (SPAC). Workhorse investors may be wise to follow news of the potential financial move.

As for Workhorse itself, finances still leave much to be desired, but the fuel for its rally comes from drones and electric vehicles it is developing. WKHS shares have room to rise if it is able to deliver its products to the US Postal Service (USPS).

More WKHS Stock News: Workhorse Group Inc seems like a win-win on any election result

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.