- Sky-high valuation of $1.5 billion has some analysts skeptical.

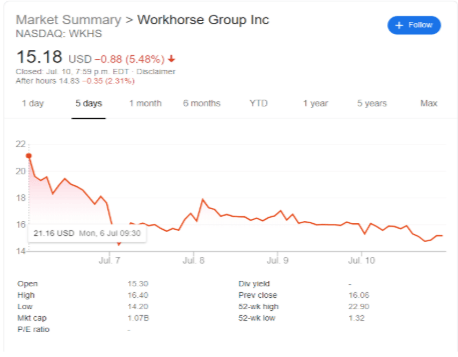

- Share price slid from $21.18 down to $15.18 this past week.

- Workhorse may fall short in their bid for a contract with USPS.

NASDAQ:WKHS has been the target of some analysts over the past week, with claims that the $1.5 billion market cap is strongly inflated due to the recent surge of the EV industry. While investors are desperately searching for the next Tesla (NASDAQ:TSLA), it should be noted that Workhorse’s customer base is significantly different. Their C-Series Electric Van is targeting the delivery sector, already having sold 1000 of the model to UPS (NYSE:UPS).

Workhorse Group news

While the Electric Van industry is definitely in need of some competition, Workhorse Group Inc. still managed less than $100,000 in revenue last quarter and even still, Workhorse shares were up an astounding 328% since February of this year, even though the heart of the Covid-19 pandemic in America. The share price inflation comes even after Workhorse posted a 119.28% decrease in earnings from the Q4.

Social media group Hindenburg Research also gives the company a ‘virtually zero’ chance at winning the USPS contract to supply electric vans around the country. The group also points to insiders within the company dumping their shares over the last few months, as the share price continued to rise. This is usually something investors should note as it generally follows that insiders sell their shares in the company when they believe the future price of the stock will be lower.

This past week saw a near 30% dip in the share price of Workhorse as analysts in the industry pointed out that not all EV companies are built equally. The future for Workhorse could be even bleaker when rival Nikola Motors (NASDAQ:NKLA) finally launches their electric delivery trucks. The share price may be retreating as some of the momentum from Tesla’s skyrocket has worn off for some of the EV companies in the market. Workhorse will have to put together some profitable quarters if they want to prove they are worthy of that valuation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

AUD/USD drops below 0.6600 after RBA policy announcements

AUD/USD stays under bearish pressure and trades deep in negative territory slightly below 0.6600. The RBA left the policy settings unchanged as expected but Governor Bullock said that there was no necessity to further tighten the policy.

Gold price turns red amid the renewed US dollar demand

Gold price trades in negative territory on Tuesday amid the renewed USD demand. A downbeat US jobs data for April prompted speculation of potential rate cuts by the Fed in the coming months.

Bitcoin miner Marathon Digital stock gains ground after listing by S&P Global

Following Bitcoin miner Marathon Digital's inclusion as an upcoming member of the S&P SmallCap 600, the company's stock received an 18% boost, accompanied by an $800 million rise in market cap.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.