The UK manufacturing PMI overview

The UK manufacturing PMI is due for release today at 0830GMT and is expected to show that the pace of contraction in the activity accelerated further in June after reaching thirty-four-month lows in May. The index is expected to arrive at 49.4 versus 49.4 booked previously.

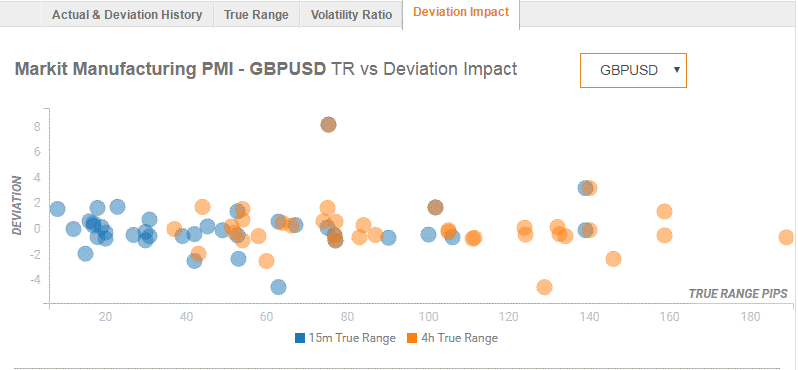

Deviation impact on GBP/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 50 pips in deviations up to 1.65 to -2.50, although in some cases, if notable enough, a deviation can fuel movements of up to 80 pips.

How could affect GBP/USD?

At daily lows near 1.2670, the pair looks to extends the slide towards 1.2650 psychological level amid strengthening US dollar demand across the board, as the GBP markets eagerly await the UK data for fresh trading impetus.

Should the data show a sharper-than-expected contraction, the selling pressure could intensify, drowning the spot further towards 1.2600 (round number), below which 1.2506 (5-month lows) could be targeted.

However, on a positive surprise, the GBP/USD pair could stall its declines and attempt a tepid bounce to 1.2685 (5-DMA), above which 1.2706 (10-DMA) could be tested en route 1.2746 (50-DMA).

Key Notes

UK and Eurozone manufacturing PMIs amongst market movers today – Danske Bank

GBP Futures: neutral/bearish in the short term

GBP/USD forecast: Bearish bias remains amid no-deal Brexit fears, UK/US data eyed for some impetus

About the UK manufacturing PMI

The Manufacturing Purchasing Managers Index (PMI) released by both the Chartered Institute of Purchasing & Supply and the Markit Economics captures business conditions in the manufacturing sector. As the manufacturing sector dominates a large part of total GDP, the Manufacturing PMI is an important indicator of business conditions and the overall economic condition in the UK. A result above 50 signals is bullish for the GBP, whereas a result below 50 is seen as bearish.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD meets support around 1.0650

EUR/USD managed to surpass the key 1.0700 barrier in response to the intense retracement in the US Dollar in the wake of the Fed’s interest rate decision and Chair Powell’s press conference.

Gold surpasses $2,300 as Dollar tumbles

The precious metal maintains its constructive stance and trespasses the $2,300 region on Wednesday after the Federal Reserve left its FFTR intact, matching market expectations.

Bitcoin price reclaims $59K as Fed leaves rates unchanged

The market was at the edge of its seat on Wednesday to see whether the US Federal Reserve (Fed) would cut interest rates during the Federal Open Market Committee (FOMC) meeting.

The market welcomes the Fed's statement

The market has welcomed the Fed statement, and the S&P 500 is higher in its aftermath, the dollar is lower and Treasury yields are falling. There is still only one cut priced in by the Fed.