The UK CPIs Overview

The cost of living in the UK as represented by the Consumer Price Index (CPI) for January month is due early on Wednesday at 07:00 GMT. The key inflation data will be watched closely after the Bank of England (BOE) policymakers have teased upbeat economic recovery off-late.

The headline CPI inflation is expected to ease from 0.6% prior to 0.5% on an annual basis. The Core CPI that excludes volatile food and energy items can also follow the suit with market forecasts suggesting 1.3% YoY print versus 1.4% previous readouts. Talking about the monthly figures, the CPI could reverse the previous +0.3% release with -0.4% prints.

In this regard, analysts at Westpac said,

The CPI is expected to slow to -0.4% in January (0.6%yr), but should gradually pick up as the effects of low energy prices and the sales tax cut unwind.

TD Securities provide details while saying,

We look for UK inflation to continue the trend of upside surprises that we've seen across much of Europe through January, with core CPI picking up to 1.5% y/y (marked expectations1.2%), and headline CPI to 0.7% y/y (market forecast 0.5%). The impact of this year's strange re-weighting procedure is likely to push inflation higher in the UK much as it has elsewhere in Europe, as the basket is adjusted to reflect 2020 consumer spending patterns, which have obviously changed considerably from prior to the pandemic. The BoE will likely look through any impact on the re-weighting, with the expectation that consumer spending will likely return to something closer to normal once social distancing and travel restrictions have been loosened.

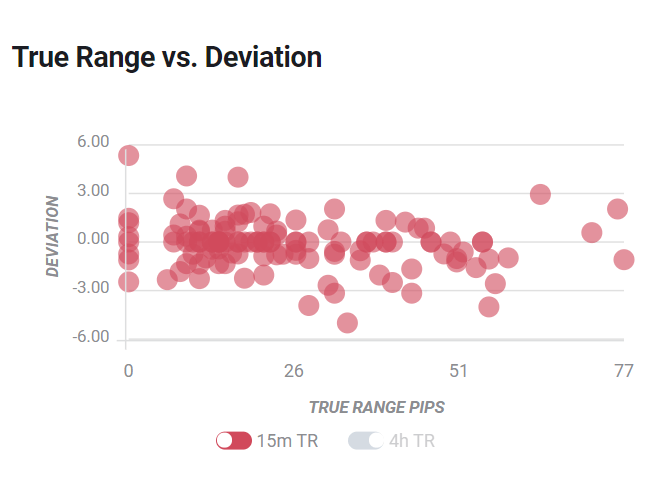

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed, the initial market reaction is likely to remain confined between 15 and 80 pips in deviations up to 2 to -3. The same suggests the importance of the key inflation data for GBP/USD pair traders.

How could it affect GBP/USD?

By the press time of pre-London open on Wednesday, GBP/USD trims early Asian losses while picking up the bids towards regaining the 1.3900 threshold. In doing so, the quote respects the UK vaccine task force team’s confidence in completing the two-jab process by August-September. Also favoring the quote could be the recent pullback in US dollar prices after the heaviest jump in three weeks flashed the previous day.

British policymakers’ huge stimulus keeps the money flow easy and suggests no major challenges to the BOE’s cautious optimism, backed by the recent vaccine news. As a result, today’s UK CPI may help the GBP/USD to regain upside momentum targeting the early 2018 peaks. Meanwhile, any major negatives may take clues from the US dollar gains to extend the pullback moves.

Technically, Tuesday’s Doji candlestick on the daily chart challenges the two-week-old upward trajectory unless the quote rises past-1.3951. However, January top near 1.3755 becomes a tough nut to crack for the bears.

Key notes

GBP/USD extends pullback from 34-month top amid US dollar gains, UK CPI in focus

GBP/USD Forecast: UK inflation data could challenge bulls´ determination

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.