The New York Times has reported that the US President-elect, Joe Biden, will deliver a $1.9 trillion plan to the nation Thursday evening.

As part of the covid package, Biden's $2,000 stimulus checks will "come in the form of additional $1,400 stimulus checks, topping up the $600 checks that Congress approved in December," the NYT wrote.

Outline of the plan

- Plan will include $2000 direct payments.

- Includes more vaccines and virus testing.

- Will include aid for state and local governments.

- An extension of supplemental federal unemployment benefits.

- More help for renters.

- Money for schools to open.

Additional information

-

$350 billion to states for front line workers, $50 billion in expanded testing, $160 billion for national vaccine program.

-

$1tln in direct support for households

- Circa $440 bn for business, most-impacted communities

- Stimulus checks to be topped up by $1,400 (so $2,000 in total, the initial $600 + $1,400)

- Supplemental unemployment benefit to $400 / week (its currently $300) and extended to September 2021

- National minimum wage of $15, an end to tipped minimum wage.

- Biden will attempt to get his "American Rescue Plan" passed through Congress in the first weeks of his administration.

WATCH LIVE: Biden to announce COVID-19 economic recovery plan

Biden hopes his multipronged strategy, to be detailed in a Thursday evening speech, will put the country on the path to recovery by the end of his first 100 days.

“It’s going to be hard,” Biden said Monday after he got his second vaccine shot. “It’s not going to be easy. But we can get it done.”

Next Wednesday, when Biden will be sworn in as president, marks the one-year anniversary of the first confirmed case of COVID-19 in the United States.

Market implications

US stocks edged lower Thursday afternoon as investors awaited details of the incoming Democrat administration’s plans for a fresh coronavirus relief package.

The Dow Jones Industrial Average pared earlier gains, falling about 0.1%. The S&P 500 dropped 0.2%, while the Nasdaq Composite hovered around flat.

The markets are counting on additional stimulus to help the economy recoup wide-ranging losses stemming from the coronavirus pandemic and restrictions put in place to fight it.

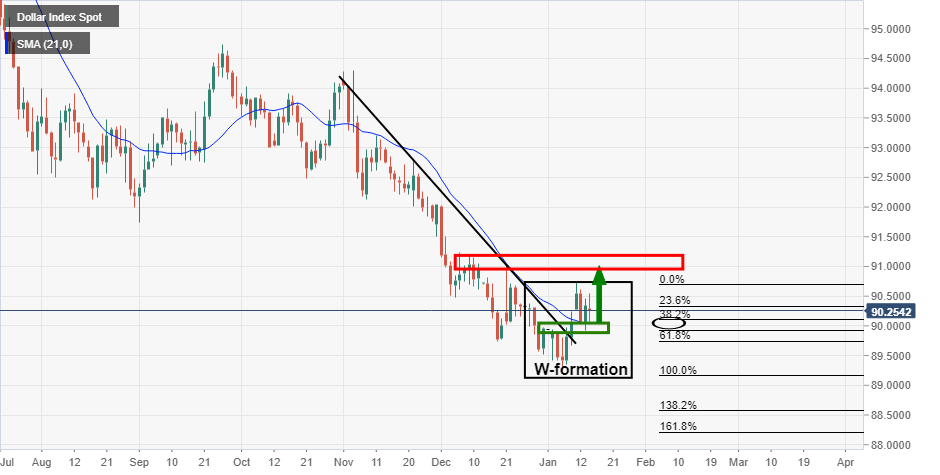

The US dollar is correcting higher as US yields run to the highest levels since March 2020 while investors bet on longer-term stronger economic growth and inflation.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD trades with negative bias, holds above 1.0700 as traders await US PCE Price Index

EUR/USD edges lower during the Asian session on Friday and moves away from a two-week high, around the 1.0740 area touched the previous day. Spot prices trade around the 1.0725-1.0720 region and remain at the mercy of the US Dollar price dynamics ahead of the crucial US data.

USD/JPY jumps above 156.00 on BoJ's steady policy

USD/JPY has come under intense buying pressure, surging past 156.00 after the Bank of Japan kept the key rate unchanged but tweaked its policy statement. The BoJ maintained its fiscal year 2024 and 2025 core inflation forecasts, disappointing the Japanese Yen buyers.

Gold price flatlines as traders look to US PCE Price Index for some meaningful impetus

Gold price lacks any firm intraday direction and is influenced by a combination of diverging forces. The weaker US GDP print and a rise in US inflation benefit the metal amid subdued USD demand. Hawkish Fed expectations cap the upside as traders await the release of the US PCE Price Index.

Sei Price Prediction: SEI is in the zone of interest after a 10% leap

Sei price has been in recovery mode for almost ten days now, following a fall of almost 65% beginning in mid-March. While the SEI bulls continue to show strength, the uptrend could prove premature as massive bearish sentiment hovers above the altcoin’s price.

US economy: Slower growth with stronger inflation

The US Dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.