Here is what you need to know on Tuesday, August 3:

Equity markets look set for yet more all-time highs on Tuesday as the market shrugs off Monday's woes. Earnings continue on their strong trajectory with a slight wobble from big tech last week. That could be the canary in the coal mine leading us lower as Apple, Facebook and Amazon are not exactly names to ignore and all are now well shy of all-time highs. Other names are taking up the slack though, and perhaps it is time for the small-cap Russell 2000 (IWM) names to shine. Covid cases continue to surge globally with Sydney extending its lockdown, Wuhan testing the entire population and the CDC issuing fresh mask-wearing guidance. It would appear that lockdowns are not going to work for the Delta variant though with the latest evidence showing carriers have up to 1,000 more viral loads. Vaccines look to be the best bet, and certainly investors are thinking that way with Pfizer (PFE), Moderna (MRNA) and BioNTech (BNTX) all surging to record highs on Monday. BioNTech is up nearly 50% for July alone.

The summer lull has yet to set into the bond markets as Monday's wobble is offset by a recovery in 10-year yields today back to 1.18%. The dollar continues its recent weakening, this time consolidating just below 1.19, while Gold is at $1,810. Bitcoin is lower at $38,300.

European markets are mostly positive: FTSE +0.5%, Dax -0.1% and EuroStoxx +0.3%.

US futures are higher, S&P +0.2%, Nasdaq +0.2% and Dow +0.3%.

SPY stock forecast and news

Fed hawk Bullard says: "I want the end-of-crisis programs to start soon, so the Fed can move in smaller steps rather than risking a "scramble" if high inflation lingers.

China launches a probe into auto semiconductor chip dealers.

BP posts better than expected earnings and increases dividend and stock buyback program.

Conoco Phillips (COP) also beats EPS, $1.27 versus $1.13 estimate.

SolarEdge (SEDG) reported earnings ahead of estimates, shares up 13% premarket. Citi upgrades.

Clorox (CLX) missed on EPS and cut forecasts, shares down 11% premarket.

NetEase (NTES) down 7% on a negative article regarding China and online gaming. TCEHY -6% and BILI also down 6%.

Bausch Health Companies (BHC) down 6% premarket on missing estimates for Q2 sales and cutting guidance.

Stellantis (STLA) up 5% premarket after results.

Under Armour (UA) up 4% as results come in ahead of estimates and raises full-year forecast.

Eli Lilly (LLY) down 1% on missing EPS by 2 cents, revenue was ahead of forecasts.

Mariott (MAR) beat on EPS, but revenue slightly behind despite doubling YoY. Down 1% in premarket.

Li Auto (LI) down 2% premarket on company filing for a share offering.

Activision Blizzard (ATVI) down 2% on new co-leaders of the company.

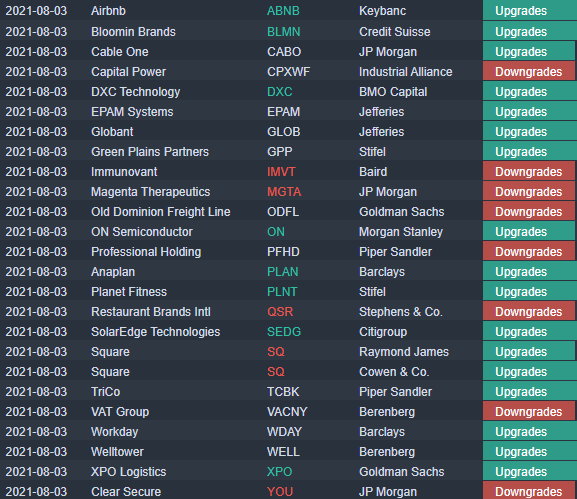

Square (SQ) upgraded by Raymond James and Cowen.

Airbnb (ABNB) Keybanc upgrades.

Upgrades, downgrades, premarket and earnings

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.