- FOMC’s minutes suggests a rate hike at the next Fed meeting but no big surprises as stock indices rise.

- US President Trump said that the meeting with North Korean leader Jong Un scheduled for June 12 in Singapore “could very well happen.”

The three main US stock indices closed higher on Wednesday’s trading. The S&P 500 Index gained 0.32% to 2,733.29 while the Dow Jones Industrial Average rose 0.21% to 24,886.81. The Nasdaq Composite Index was up 0.64% to 7,424.96.

The main macroeconomic event was the release of the FOMC’s minutes. While the report suggested a rate hike at the next Fed meeting, stock investors were not too worried about galloping inflation and US indices rose.

Indeed, “most participants judged that if incoming information broadly confirmed their economic outlook, it would likely soon be appropriate for the FOMC to take another step in removing policy accommodation,” the minutes said.

"A few participants commented that recent news on inflation, against a background of continued prospects for a solid pace of economic growth, supported the view that inflation on a 12-month basis would likely move slightly above the Committee's 2% objective for a time," according to the minutes. "It was also noted that a temporary period of inflation modestly above 2% would be consistent with the Committee's symmetric inflation objective and could be helpful in anchoring longer-run inflation expectations at a level consistent with that objective."

But the minutes also said that many saw “little evidence of overheating of labor market with wage pressures still moderate.”

Looking back, after seven years of near-zero interest rates, the FOMC started raising rates in December 2015. The current target range is at 1.5% to 1.75%.

Earlier in the day, stock markets were concerned by geopolitical factors. The US President Trump said that he was not satisfied with the US-China trade talks. Additionally, he said that the meeting with the North Korean leader Jong Un scheduled for June in Singapore was likely to be canceled. However, the latest news reveals that the summit “could very well happen.” Further adding: “ if we go, I think it will be a great thing for North Korea," said Trump.

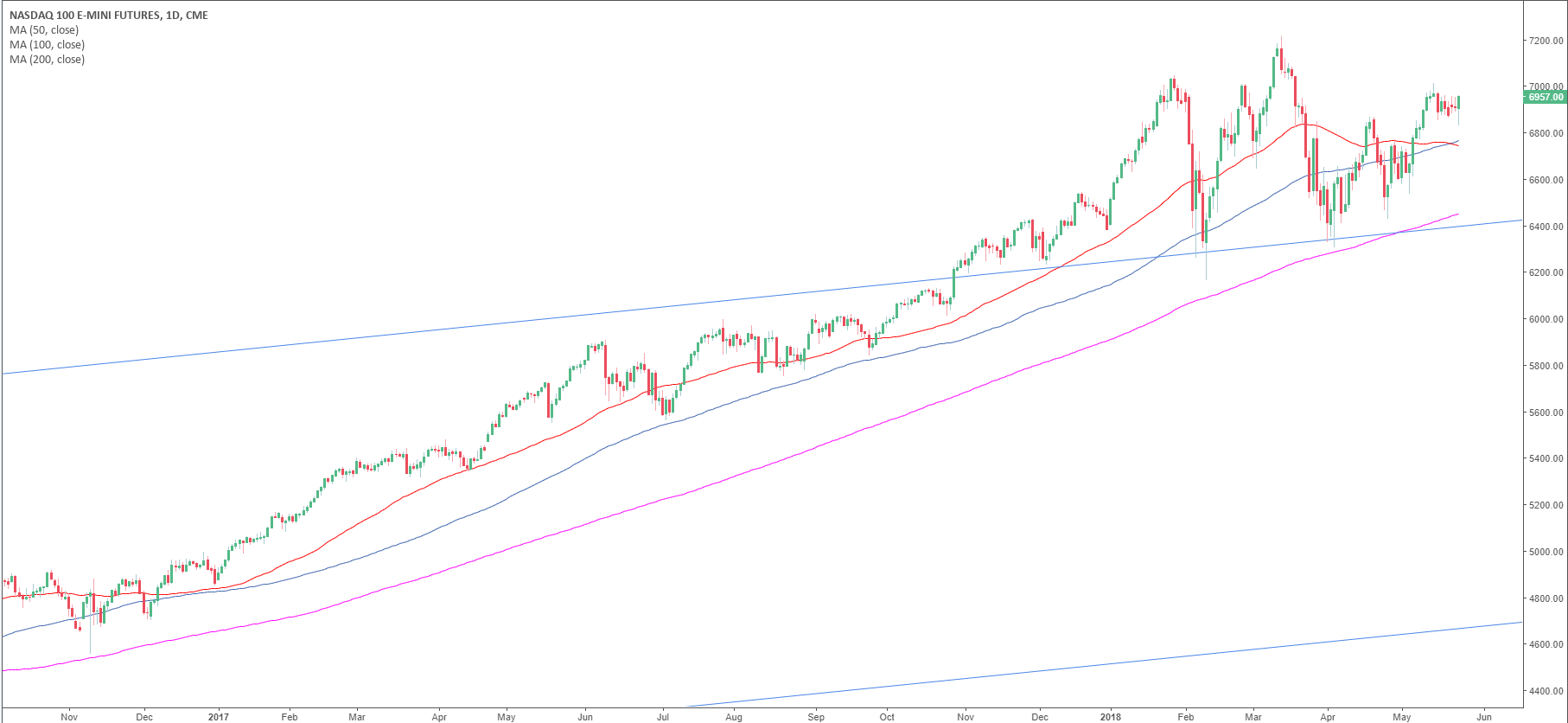

Nasdaq daily chart

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

USD/JPY pops and drops on BoJ's expected hold

USD/JPY reverses a knee-jerk spike to 142.80 and returns to the red below 142.50 after the Bank of Japan announced on Friday that it maintained the short-term rate target in the range of 0.15%-0.25%, as widely expected. Governor Ueda's press conference is next in focus.

AUD/USD bears attack 0.6800 amid PBOC's status-quo, cautious mood

AUD/USD attacks 0.6800 in Friday's Asian trading, extending its gradual retreat after the PBOC unexpectedly left mortgage lending rates unchanged in September. A cautious market mood also adds to the weight on the Aussie. Fedspeak eyed.

Gold consolidates near record high, bullish potential seems intact

Gold price regained positive traction on Thursday and rallied back closer to the all-time peak touched the previous day in reaction to the Federal Reserve's decision to start the policy easing cycle with an oversized rate cut.

Ethereum rallies over 6% following decision to split Pectra upgrade into two phases

In its Consensus Layer Call on Thursday, Ethereum developers decided to split the upcoming Pectra upgrade into two batches. The decision follows concerns about potential risks in shipping the previously approved series of Ethereum improvement proposals.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.