Here is what you need to know on Wednesday, October 20:

Netflix (NFLX) has come and gone, and now it is on to Tesla (TSLA) reporting after the close this evening. We wanted to fade the rally into Netflix earnings, and we feel the same way about Tesla. Stay tuned. The picture has changed somewhat this morning as yields rise again, meaning stocks will find gains hard to come by. The recent rally in the stock market has not exactly been healthy anyway with falling breadth (stocks making new highs), and now we get to see if this market really has the stomach for a fight.

Currency markets are a bit discombobulated by the resignation of noted ECB hawk (higher rates) Jens Weidman. As one man steps away, another returns with Jack Ma of Alibaba (BABA) now seen in Europe following on from his Hong Kong sightings earlier this month. BABA shares have jumped again on that news, as well as the company making its own chips and UBS upgrading Chinese stocks.

The dollar has weakened on the ECB resignation at 1.1636 now, Bitcoin is booming at $64,300, and Oil is lower at $81.51.

See forex today.

European markets are mixed: Eurostoxx +0.1%, FTSE -0.1% and Dax flat.

US futures are flat.

Wall Street (SPY) (QQQ) news

UBS upgrades China stocks, saying the regulation risk is already priced in.

Novavax (NVAX) drops over 20% as a report in Politico says it is having trouble meeting FDA standards.

Facebook (FB) plans to change its name, according to The Verge.

Netflix (NFLX) beats on EPS, revenue in line, shares lower now having spiked on the numbers.

Nasdaq (NDAQ) beats on EPS and sales.

Verizon (VZ) beats EPS but revenue misses.

Biogen (BIIB) up 2% on EPS and revenue beat.

Anthem (ANTM) beats on revenue and EPS.

Winnebago (WG) beats on revenue and EPS.

United Airlines (UAL) reported an EPS loss of $1.02, better than expected. Shares up 1% premarket.

Alphabet (GOOGL): "A Swiss court has dismissed Google's bid to block the award of a government cloud computing contract worth up to 110 million Swiss francs to rival bidders."-Reuters.

Canadian National Railway (CNI) CEO to resign at the end of January after failed bid for KSU.

Exxon Mobil (XOM) workers reject the company's six-year labour contract.

WD-40 (WDFC) slides (too easy) after it misses on revenue.

Tesla (TSLA) reports earnings after the close.

Earnings and premarket movers

Source: Benzinga Pro

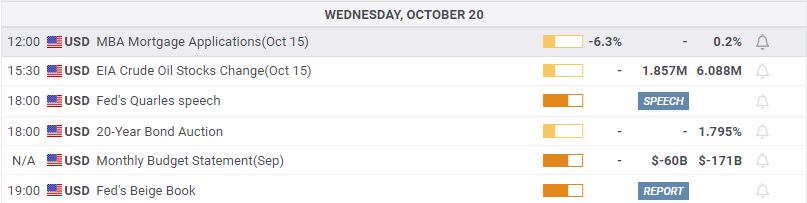

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.