Wake Up Wall Street (SPY) (QQQ): Fed day awaits as earnings season enters the last big week

Here is what you need to know on Tuesday, May 3:

Equity markets are in recovery mode on Tuesday as investors quickly reposition ahead of this week's Fed interest rate decision. While a 50bps rise is priced in and a near certainty, it is the outlook and related hawkishness that will concern equity investors. We feel a rally is soon imminent but we need a bit more downside just yet to flush out some early longs. All sentiment surveys are giving extremely bearish readings and liquidity and equity positioning are all one way, but the risk-reward is now skewed to the upside in our view.

The last week was a big one for earnings and the last big week of the quarter. With that and the Fed out of the way, it will be time for funds to reposition. The latest data shows hedge funds and mutual funds are all underweight equities.

The US dollar has also begun its overdue correction with the dollar index slipping back to 103.10. Gold is at $1862 and Bitcoin is at $38,400. Oil is lower at $103.

European markets are higher: Eurostoxx +0.5%, FTSE +0.8% and Dax +0.3%.

US futures are also higher: S&P +0.1%, Dow +0.2% and Nasdaq +0.3%.

Wall Street (SPY) (QQQ) top news

Fitch cuts China GDP growth estimate.

Australia raises rates more than expected.

US 10-year yield above 3%.

Tesla (TSLA): Reuters exclusive says Shanghai authorities helped Tesla reopen its gigafactory.

Alibaba (BABA) swings wildly in Hong Kong as mistaken identity sees rumour of Jack Ma being detained.

AMD earnings after the close. Intel forecast was bearish last week.

Logitech (LOGI) down on earnings.

MGM Resorts (MGM) beats on earnings.

Expedia (EXPE) also up on strong earnings beat.

RocketLab (RKLB) up on a successful test to catch a rocket. Yep!

BP takes a $25 billion charge for Russia but earnings were strong.

DuPont (DD) down on earnings outlook.

Western Digital (WDC) up on Elliot Investment letter to unlock value.

Estee Laude (EL) down 10% on earnings.

Avis (CAR) up 7% on earnings.

Docusign (DOCU) down on Wedbush downgrade.

Devon Energy (DVN) strong earnings and $2 billion extra to buyback program.

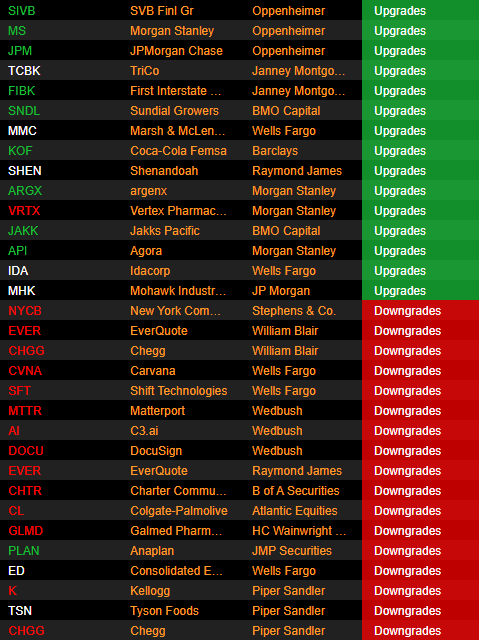

Upgrades and downgrades

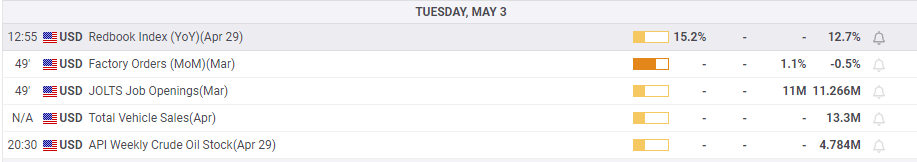

Economic releases

*The author is long BABA and short TSLA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.