SPDR S&P 500 ETF Trust SPY Stock News and Forecast: Short-term rally likely but not just yet

- SPY continued a perfect setup on Monday with a lower low, breaking $410.

- The S&P 500 ETF now set up for a counter-trend rally with positioning and liquidity low.

- SPY though is likely to frustrate with another leg lower before then engaging a counter-rally.

The S&P 500 (SPY) set a perfect lower low in early trading on Monday before rallying into the close. This sets up the intriguing possibility of a bearish rally with some positions likely closing ahead of Wednesday's Federal Reserve meeting. Monday saw an outperformance from the Communication (XLC) and Technology (XLK) sectors while rate-sensitive sectors such as Real Estate (XLRE) remained mired as underperformers.

Read more stock market research

S&P 500 (SPY) news: Sentiment at lows ahead of the Fed

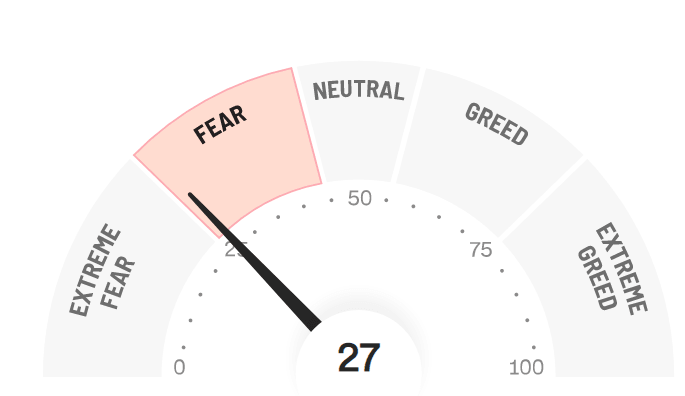

Various momentum indicators are now looking overbought in our view. The CNN fear-and-greed measure is at recent lows

Source: CNN.com

The American Association of Individual Investors (AAII) sentiment is also at a recent low as is the Investors Intelligence survey. The Market Ear also pointed out that Goldman Sachs's own sentiment indicator hit a noted low on Friday. So then, everyone is expecting the bounce. That's just when things are likely to get worse, then. We could get a frustration move lower just to exit everyone out before we can then get some room to rally. That's our view and we are sticking to it!

Naturally, the Fed may have something to do with it this week!

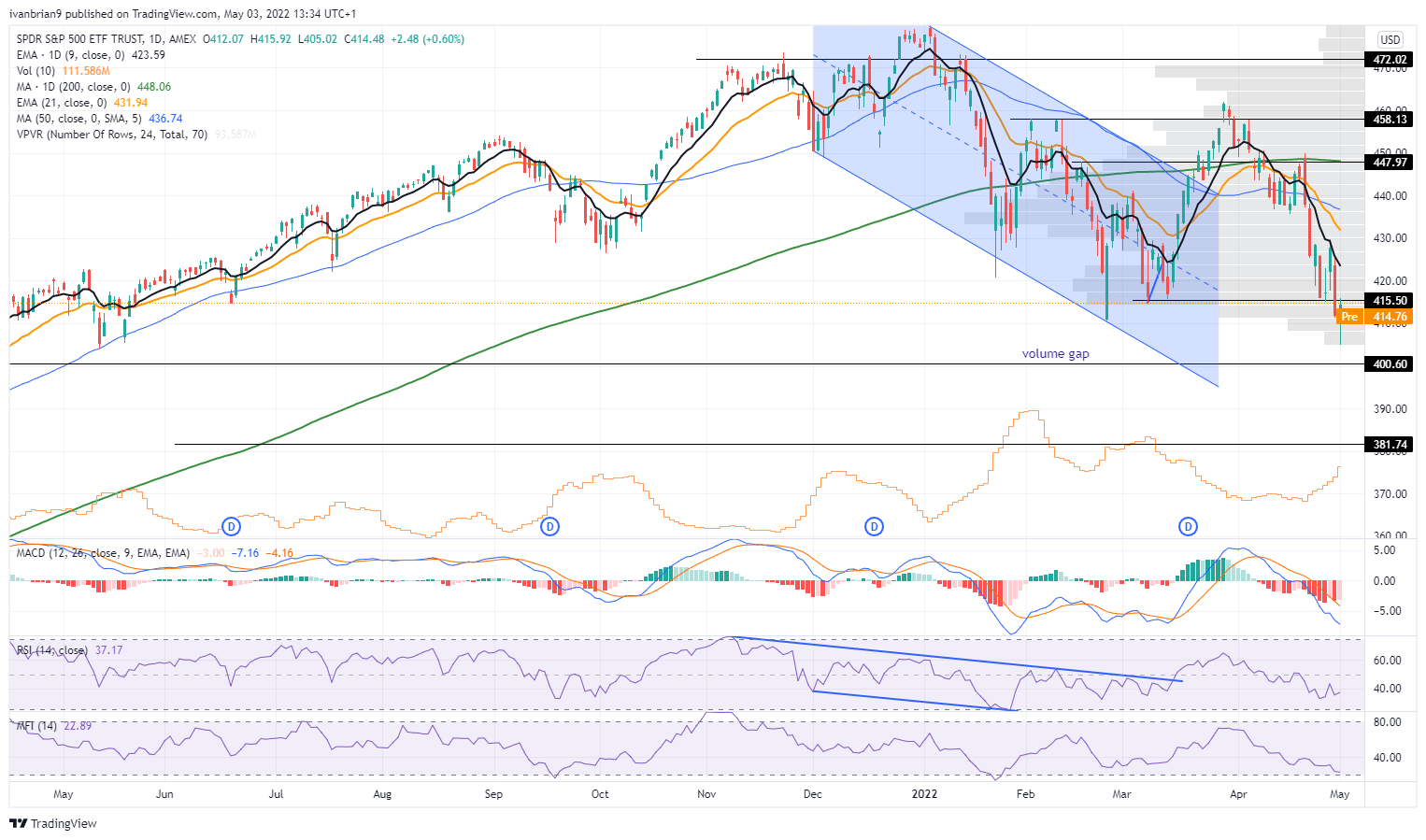

SPY stock forecast: Stop triggering before bear-market rally

As mentioned Monday saw SPY go on a perfect leg lower to set a lower low in this current downtrend. That has led to many already anticipating a recovery rally and positioning themselves accordingly. Equity markets are already strong in Europe this morning and US futures too are positive. We feel this is too early.

The Fed has yet to do its thing and we have some important earnings this week to get out of the way. Yes, positioning and sentiment are now overly loaded to the downside. Buybacks are beginning to restart which should provide some support to equity indices, but a move lower to trigger likely stops just under $400 is the more likely option in our view. Then let the bear-market rally begin.

SPY chart, daily

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.