Alibaba Stock News and Forecast: BABA falls as rumours of Jack Ma curbs spread

- Alibaba stock slides in Hong Kong on rumors of Jack Ma being placed under compulsory curbs.

- BABA stock then recovered as it appears to be a case of mistaken identity.

- BABA share price flat in premarket in NY having shed 9% in Hong Kong at one stage.

Alibaba shareholders were taken on a more volatile ride than usual on Tuesday morning as the stock slid 9% in Hong Kong. A report/rumor began circulating that someone with the name Ma was arrested in Hangzhou which coincidentally is the hometown of Alibaba founder Jack Ma, people began putting two and two together and getting 7 as rumors circulated that this Ma was indeed Jack Ma of Alibaba. The stock fell sharply.

Read more stock market research

Alibaba (BABA) stock news: Ma mistake triggers wild trading swings

Jack Ma is of course no stranger to the limelight having initially come to the attention of authorities just before the failed ANT Group spin-off. He criticized China's leadership and regulators in a speech that effectively ended the chances of the ANT Group IPO. He then disappeared from view for a few months and has remerged a much quieter and somber figure. So when initial reports surfaced, investors nervously rushed to dump Alibaba stock before police issued a clarification according to Bloomberg.

The initial sell-off is credited to a report appearing on state broadcaster CCTV. Hangzhou Police then issued a clarification stating that the man had a three-character surname in the Chinese language. Jack Ma has a two-character name. So BABA stock moved from being down 9% at one stage to more or less flat, wild trading. Thankfully your author was tucked up asleep while all this was going on and so avoided the stress on my portfolio! Yes, I am long Alibaba, I got in just as Charlie Munger of Berkshire Hathaway got out, what does he know anyway!

China though remains on a difficult path currently with covid lockdowns still in place in the manufacturing hub of Shanghai and the capital Bejing. This is hitting production and consumption at the same time in a double hit to economic growth. The Chinese authorities have embarked on monetary easing to boost the economy. Just as the rest of the world is embarking on policy tightening.

Alibaba (BABA) stock forecast: Bulls getting signs of hope

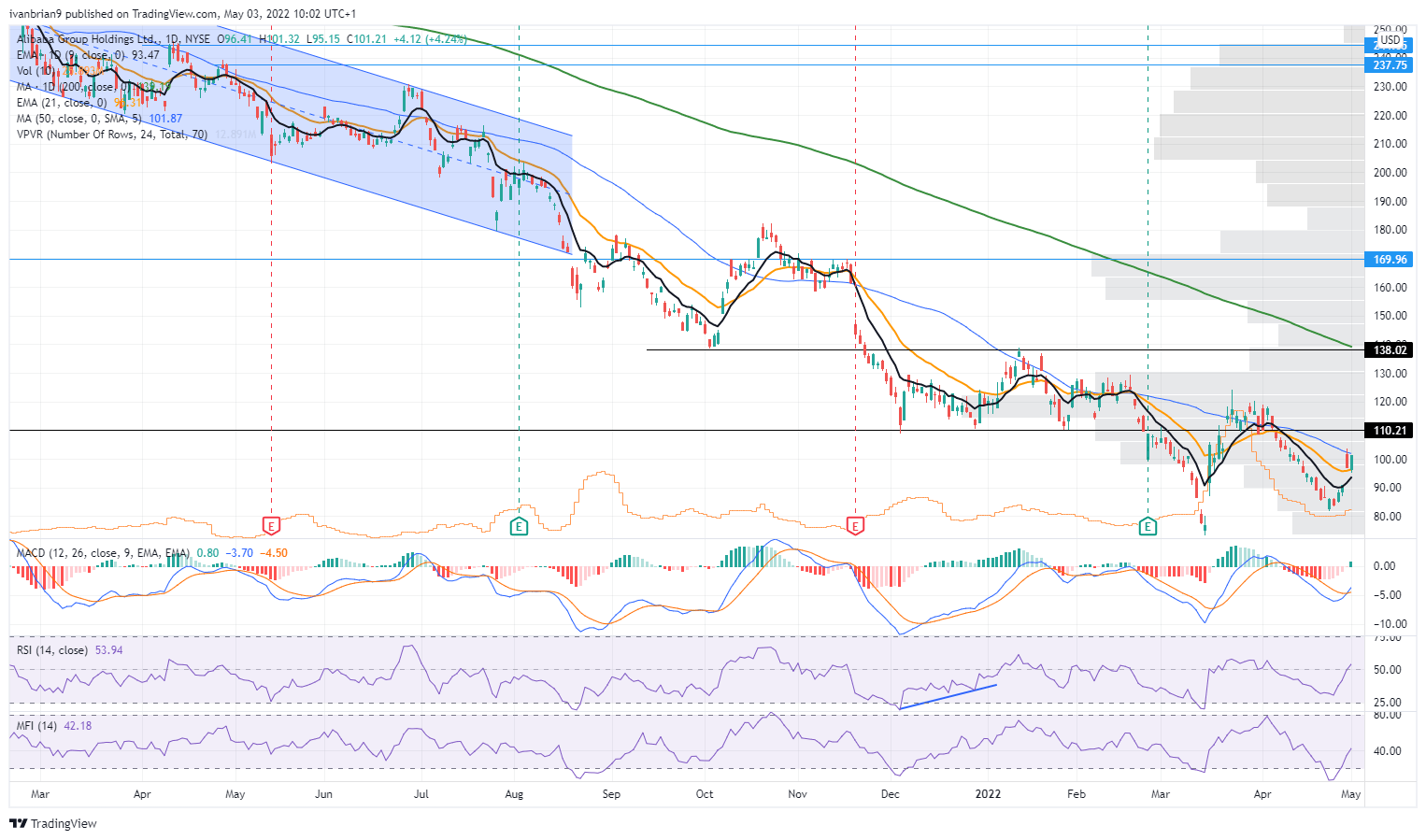

BABA stock remains in a powerful downtrend with a long way to go before it turns things bullish, but there are some signs of hope. We recently noticed both the MFI and RSI peeking back above 50 and the MACD has just given a bullish crossover. These are three positive developments.

BABA stock price has for now also set a higher low than previous. So, this $81.80 low is our short-term pivot. $110 and then the March high at $124 are important resistance levels to break.

BABA stock chart, daily

*The author is long BABA.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Ivan Brian

FXStreet

Ivan Brian started his career with AIB Bank in corporate finance and then worked for seven years at Baxter. He started as a macro analyst before becoming Head of Research and then CFO.