EUR/USD is on its back foot, awaiting US Manufacturing PMI data

- EUR/USD accelerates its downtrend with bears eyeing the 1.1700 area.

- Manufacturing activity contracted beyond expectations in the Eurozone in December.

- US PMI figures are expected to confirm a moderate expansion of the manufacturing sector's activity.

EUR/USD extends losses on Friday's European session, trading near 1.1720 heading into the US trading session, down from highs past 1.1800 in late December. The disappointing manufacturing activity figures in the Eurozone and some of its main economies have increased bearish pressure on the Euro, in an otherwise calm New Year's session.

From a wider perspective, however, the pair remains at a relatively short distance from the three-month highs at 1.1808 seen right before Christmas. The US Dollar USD) depreciated about 14% against the Euro in 2025, weighed by market concerns about US President Donald Trump's erratic trade policies, signs of deceleration in the US economy, and, lately, also the monetary policy divergence between the European Central Bank (ECB) and the US Federal Reserve (Fed).

The final German and Eurozone's HCOB Manufacturing Purchasing Managers Index (PMI) figures highlight the declining contribution of manufacturing activity in the regions' Gross Domestic Product. Investors are now looking at the final US S&P Manufacturing PMI release, which might provide some fresh impetus to the Greenback.

Euro Price Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Japanese Yen.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.21% | 0.12% | -0.02% | -0.05% | -0.35% | -0.34% | -0.03% | |

| EUR | -0.21% | -0.14% | -0.13% | -0.16% | -0.52% | -0.45% | -0.14% | |

| GBP | -0.12% | 0.14% | 0.00% | -0.06% | -0.38% | -0.31% | 0.00% | |

| JPY | 0.02% | 0.13% | 0.00% | -0.14% | -0.46% | -0.38% | -0.01% | |

| CAD | 0.05% | 0.16% | 0.06% | 0.14% | -0.33% | -0.24% | 0.03% | |

| AUD | 0.35% | 0.52% | 0.38% | 0.46% | 0.33% | 0.07% | 0.38% | |

| NZD | 0.34% | 0.45% | 0.31% | 0.38% | 0.24% | -0.07% | 0.31% | |

| CHF | 0.03% | 0.14% | -0.00% | 0.00% | -0.03% | -0.38% | -0.31% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

Daily Digest Market Movers: Euro dives following weak manufacturing data

- The Euro is losing ground against its main peers on Friday, following a string of weaker-than-expected manufacturing activity figures in Europe. Eurozone HCOB Manufacturing PMI has been revised down to 48.8 from the preliminary estimation of a 49.2 reading in December, reflecting a faster contraction from the 49.6 reading seen in November and the 50.0 in October.

- Likewise, the German HCOB Manufacturing PMI has shown a weaker-than-expected activity, as December's decline has been revised down to 47.0, from the 47.7 preliminary estimation, and from November's 48.2 reading.

- Italy's Manufacturing PMI dropped to 47.9 in December, from 50.6 in November, and Spain's manufacturing activity declined to 49.6 from 51.5. The positive exception has been the French Manufacturing PMI, which ticked up to 50.7 from 50.6 in November.

- Later on Friday, the focus will shift to the US S&P Global Manufacturing PMI, whose preliminary reading showed a slowdown to 51.8 in December from 52.2 in November. The figures are consistent with moderate business activity growth.

- Investors, however, are likely to be attentive to the release of the US Nonfarm Payrolls report, due at the end of next week, and the name of the person who will replace Chairman Jerome Pôwell at the Federal Reserve, which is expected to be disclosed in the coming weeks.

Technical Analysis: EUR/USD approaches support at the 1.1700 area

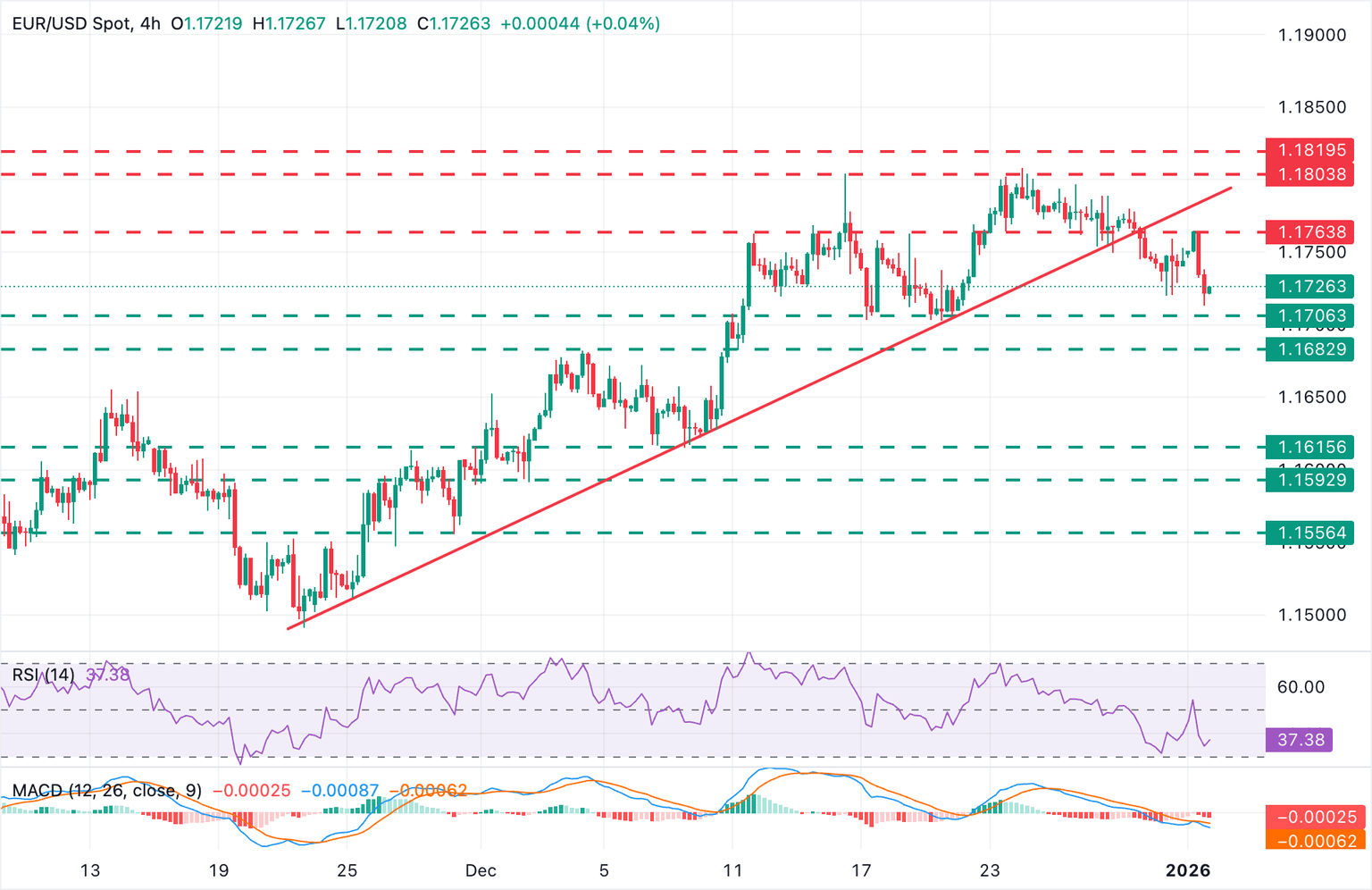

The EUR/USD's immediate trend remains bearish, after breaching the trendline support from mid-November lows. The 4-hour Relative Strength Index (RSI) has been rejected at the key 50 level, and the Moving Average Convergence Divergence (MACD) has turned lower after failing to cross the signal line, which highlights the growing bearish momentum.

Bears, however, need to break support at the December 17 and 19 lows, near 1.1700, to confirm the trend shift. In such a scenario, the focus would shift towards the December 4 high and December 11 low, around 1.1680, and the December 8 and 9 lows near 1.1615.

Upside attempts have been capped at 1.1764 earlier on the day. Further up, the reverse trendline, at 1.1785, and the December 16 and 24 highs above 1.1800 are likely to pose significant resistance.

Economic Indicator

S&P Global Manufacturing PMI

The S&P Global Manufacturing Purchasing Managers Index (PMI), released on a monthly basis, is a leading indicator gauging business activity in the US manufacturing sector. The data is derived from surveys of senior executives at private-sector companies from the manufacturing sector. Survey responses reflect the change, if any, in the current month compared to the previous month and can anticipate changing trends in official data series such as Gross Domestic Product (GDP), industrial production, employment and inflation. A reading above 50 indicates that the manufacturing economy is generally expanding, a bullish sign for the US Dollar (USD). Meanwhile, a reading below 50 signals that activity in the manufacturing sector is generally declining, which is seen as bearish for USD.

Read more.Last release: Tue Dec 16, 2025 14:45 (Prel)

Frequency: Monthly

Actual: 51.8

Consensus: 52

Previous: 52.2

Source: S&P Global

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.