Here is what you need to know on Thursday, August 18:

Equity markets remained just about near recent elevated levels on Wednesday, but some concerning signals began to appear. Market breadth remains in decline, the put/call ratio is rising, and the meme stock rally looks to be stalling. So can things keep going? That remains to be seen, but we would expect things to begin to slow if not turn. The only concern is the growing chorus of others making a similar observation, and consensus is rarely the profitable place to be in trading. Nonetheless, the Fed minutes may have somewhat dampened dovish enthusiasm. The UK and Europe certainly have more to offer on the rate hiking cycle after this week's inflation readings. The key question remains just how detrimental to Wall Street does the Fed want to be ahead of mid-term elections. Going all conspiracy theorist here, maybe, but everyone else seems to have gone that way!

The dollar remains devoid of frenzy as it remains flat at 106.60. Oil is a bit of a mixed bag, 2% higher at $89 as a surprise draw in US reserves added to bullish commentary on supply constraints from OPEC. Bitcoin is $23,500, and Gold is at $1,768.

European markets are mixed: Eurostoxx flat, FTSE -0.1%, and Dax +0.8%.

US futures are higher: S&P +0.2%, Dow +0.2% and Nasdaq +0.3%.

Wall Street (SPY) (QQQ) top news

ECB member Schnabel says inflation concerns have not been alleviated.

Kohl's (KSS) down 5% on guidance cut.

Apple (AAPL) iPhone 14 release date looks to be September 7, according to Bloomberg.

Bed Bath & Beyond (BBBY): Ryan Cohen filing shows intent to sell some of his stake. Stock is lower in the premarket.

BJ's Wholesale (BJ) up 5% on strong earnings.

Cinemark (CINE) down 60% Wednesday on statement about deleveraging, restructuring, etc. Read across for AMC?

Tapestry (TPS): EPS beats, but revenue misses estimates.

Cisco (CSC) beats on top and bottom lines.

Wolfspeed (WOLF) beats on both top and bottom lines.

Bath & Body Works (BBWI) offers weak forecast as earnings beat.

Canadian Solar (CSIQ) issues strong guidance.

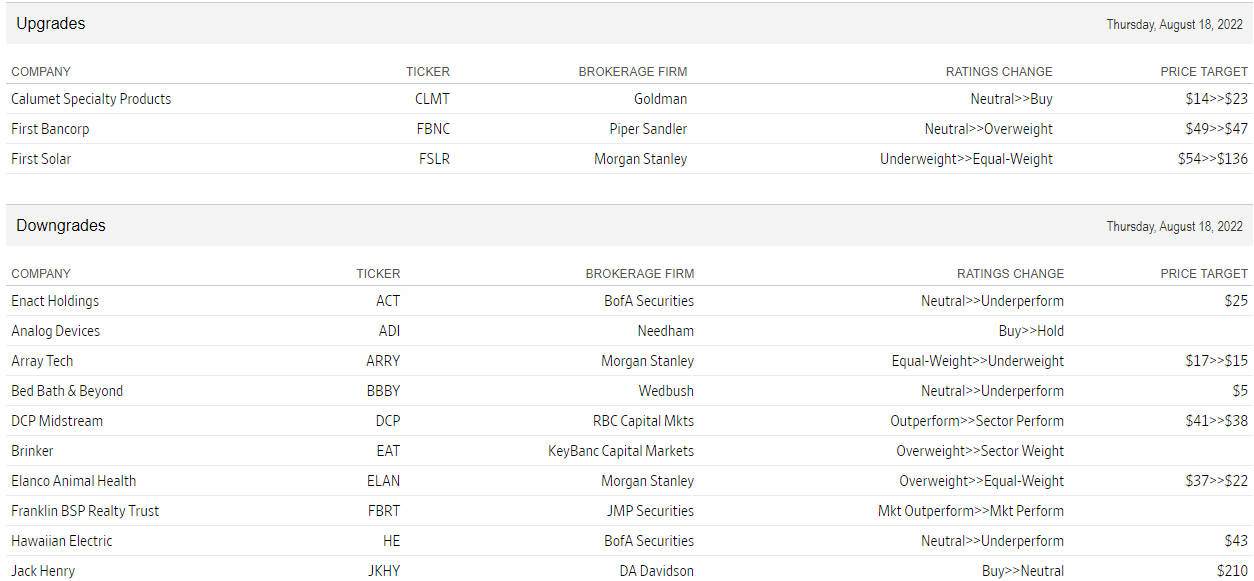

Upgrades and downgrades

Source: WSJ.com

Economic releases

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD alternates gains with losses near 1.0720 post-US PCE

The bullish tone in the Greenback motivates EUR/USD to maintain its daily range in the low 1.070s in the wake of firmer-than-estimated US inflation data measured by the PCE.

GBP/USD clings to gains just above 1.2500 on US PCE

GBP/USD keeps its uptrend unchanged and navigates the area beyond 1.2500 the figure amidst slight gains in the US Dollar following the release of US inflation tracked by the PCE.

Gold keeps its daily gains near $2,350 following US inflation

Gold prices maintain their constructive bias around $2,350 after US inflation data gauged by the PCE surpassed consensus in March and US yields trade with slight losses following recent peaks.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.