Here is what you need to know on Wednesday, July 7:

One day without gains and already Wall Street is panicking. Really? Have we become this immune to some setbacks? In Fed-pumped stock market land it seems so, but nothing can go up forever. Whether panic sets in is up to market participants. The longer we are immune from falls, the worse the panic selling will be as investors will not be used to the sensation. The Nasdaq continues to power on regardless while its Relative Strength Index (RSI) continues to head further into overbought territory. Traditionally, ISM is a leading indicator, and yesterday's poor numbers could be a harbinger of doom. European PMI numbers were themselves not too hot, and the ZEW was a shocker.

We could be in for a tough end of summer and Autumn as some threats come over the horizon. Oil harmony is out the window as Saudi Arabia raises prices and continues to haggle with the UAE. Oil prices continue to rise. The Delta variant of COVID-19 is now rampant across much of the EU and looks to spread across the globe. This one is by far the most transmissible, so economies without high levels of vaccination will likely see further lockdowns. Australia has just extended its lockdown, and Toyko looks set to announce a state of emergency to last through the Olympics. Global growth forecasts have not yet accounted for this.

Oil as mentioned is high but has dropped as the UAE hints at cashing in on high prices. Oil drops to $74. The dollar is calm at 1.1810 versus the euro, with Gold at $1,804 and Bitcoin at $34,850. The Vix is at 16, and the US 10-year yield is making four-month lows at 1.3%. The Nasdaq loves low yields.

European markets are higher, Dax +1%, FTSE +0.2% and Eurostoxx +0.7%.

US futures are higher, the Dow is flat, Nasdaq +0.5% and S&P +0.1%.

Wall Street top news

UAE wants to leverage an increase in oil production to subsidize sustainable energy sources.

Japan plans a state of emergency for Toyko until August 22.

EU lifts growth forecast from 4.3% to 4.8% for 2021.

BlackRock (largest fund manager in the world) Investment Institute has gone neutral on US stocks.

Full Truck Alliance (YMM) down again in premarket by 5%. DIDI down 4%.

AMC down 4% premarket. Yesterday, company pulled additional share raise.

SAP upgraded by Bank of America, up 4% premarket.

Monday.com (MNDY) does not have the blues as it rises 3% premarket on multiple strong ratings by investment banks starting coverage.

BigCommerce Holdings (BIGC) up 5% premarket on Amazon fulfillment news.

Clover Health (CLOV) up 5% premarket, top of WallStreetBets' list today.

GS, WFC, MS, BAC, USB all down as yields slump to four-month lows.

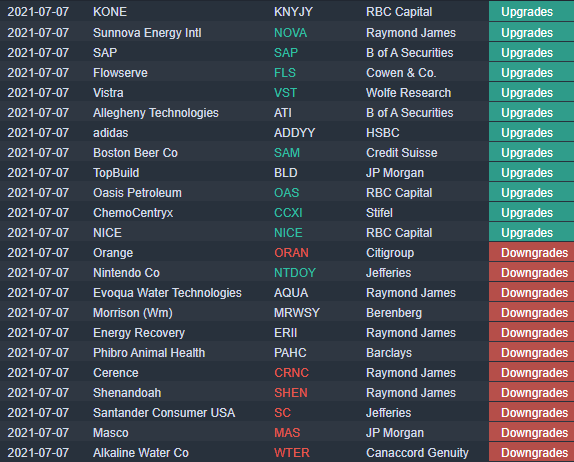

Upgrades, downgrades, premarket movers

Source: Benzinga Pro

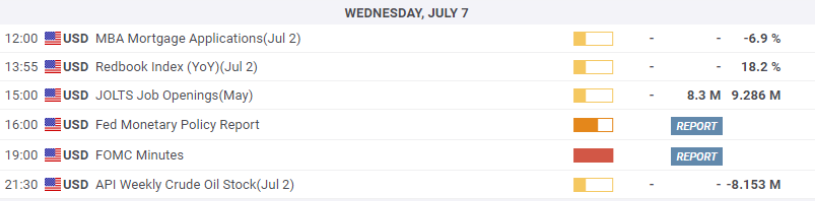

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.