Here is what you need to know on Tuesday, June 29:

We need to talk about delta and not the options type normally associated with financial markets. The delta variant of covid-19 is now the dominant strain in the UK and is spreading rapidly and will soon become the dominant strain globally. Current evidence from the UK suggests that the delta variant is considerably more contagious and causes greater hospitalization rates. The WHO says the delta strain is the fastest and fittest strain yet and will pick off the most vulnerable people. Equity markets generally take their time to digest information, acting like a supertanker when turning. Once turned, however, the market can speed alarmingly lower once fear sets in. Is the VIX at 15 the calm before the delta storm? Caution is certainly needed. The put-call ratio surged 20% yesterday, i.e. 20% more puts than calls were bought as investors are taking downside protection.

For now, sentiment remains bullish with the Eurozone sentiment index hitting 117.9 in May, a 21-year high. The dollar once again gathers ground for a push below 1.19 versus the euro, sitting just above at 1.1903. Gold is lower at $1,768, and Bitcoin is higher at $35,600. The 10-year yield is at 1.49%. Oil at $73.26 has retreated as oil traders worry over the spread of the delta variant, so equity traders take note.

European markets are all higher this morning with the Dax leading the way up 0.9%, the FTSE is up 0.1%, and the EuroStoxx is up 0.3%.

US Futures are flat, Nasdaq -0.1%, S&P -0.15 and Dow +0.1%.

Wall Street top news

German Chief of Staff to Merkel says they are very worried over delta variant spread.

Ireland is due to delay reopening due to fears over delta spread.

ECB member Jens Weidmann says the ECB stimulus program should be scaled back step by step. Weidman is a noted hawk (favours higher rates).

Cathie Wood wants to create a Bitcoin Exchange Traded Fund (EFT). Ticker ARKB.

General Electric (GE), Goldman Sachs names as a top idea.

Tesla (TSLA): UBS cuts price target.

Facebook (FB) joins trillion-dollar market cap club after a favourable antitrust court ruling.

Morgan Stanley (MS) up 3% premarket as it raises its dividend.

Wells Fargo (WFC) plans to double its dividend.

Goldman Sachs (GS), JPMorgan (JPM) and Bank of America (BAC) also increase dividends.

Jefferies Financial (JEF) beat forecasts on revenue and EPS and announced a 25% dividend increase.

Boeing (BA): United (UAL) says it is buying 200 Boeing 737 Max jets.

FedEx (FDX): Bank of America adds to top picks.

Herbalife (HLF) rated new buy at B.Riley Securities.

Iovance Bio (IOVA) down 6% premarket as LN-145 clinical trial data is released.

STEM: Credit Suisse starts coverage with an outperform rating. Entered Russell 2000 on Monday. Stock up 6% premarket.

Kratos Defense (KTOS) up 5% premarket. The company successfully tests turbine engine for cruise missiles.

Canadian Solar (CSIQ) up 4% premarket. Company secures 86 MW in Japan solar auction, investor optimism over President Biden's infrastructure plan and potential China IPO for a subsidiary.

MSTR, MARA, RIOT all up 4% as Bitcoin recovers.

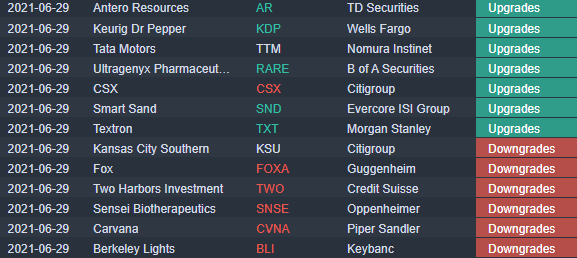

Carvana (CVNA) downgraded by Piper Sandler, stock down 2% premarket.

Upgrades, downgrades and premarket movers

Source: Benzinga Pro

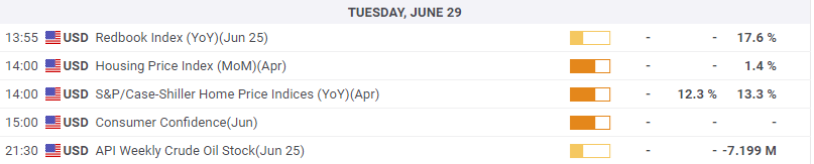

Economic releases

Like this article? Help us with some feedback by answering this survey:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.