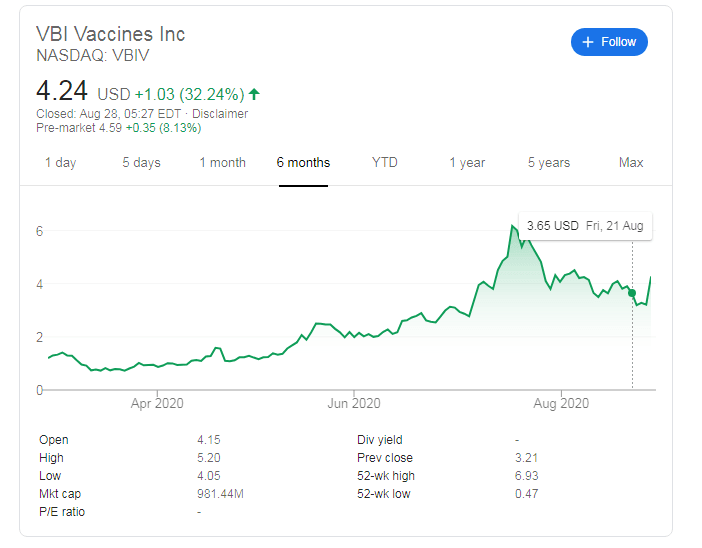

VBIV Stock Price: VBI Vaccines Inc surges as analyst says firm “could have the best coronavirus vaccine”

- NASDAQ: VBIV is set to surge to the highest levels in a month.

- Enthusiasm over VBI Vaccines Inc's potent pan-coronavirus immunization candidate is driving shares higher.

- In a highly competitive race for COVID-19 vaccines, quality may mark a difference.

Vaccinating against more than one coronavirus – and doing it better than competitors – is what VBI Vaccines is seeking. The Massachusets-based pharma firm has performed several preclinical trials on mice and claims that they have provoked a substantial creation of antibodies and other mechanisms to defend against coronaviruses.

The use of the plural is no mistake – one of the candidates is a "trivalent" pan-coronavirus vaccine, protecting against the raging SARS-Cov-2, the 2003-era SARS-CoV, and also MERS-CoV, which dates back to 2015.

Another advantage is that VBI's vaccine may require only one shot – allowing faster distribution of immunization to the world population.

Skeptics have noted that optimism in the preclinical stage may not necessarily translate into success with human subjects. Moreover, several large pharma firms are already conducting Phase 3 tests – injecting their solutions to around 30,000 subjects.

Nevertheless, the AstraZeneca/University of Oxford project – considered the most advanced – may work for only 12-24 months. With dozens of companies working on a solution – and limited production capacity – there is still time for smaller firms to provide potentially better solutions.

The high level of antibodies created – at least among mice – may be a differentiating factor. That has led Steven Seedhouse, an analyst with Raymond James, to upgrade the stock to "strong-buy", adding that "VBI may be in an entirely different ballpark for potency vs. any other vaccine we've seen."

VBIV Stock Forecast

NASDAQ: VBIV is quoted at around $4.50 in Friday's pre-market trading, building on top of its whopping 32% leap on Thursday. VBI Vaccines is on course to hit the highest since late July, a one-month high. The 52-week high of $6.83 is the bullish upside target. Support awaits at $3.19, August's low.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.