USD/TRY Price Analysis: Recovery moves aim for 8.4400

- USD/TRY refreshes intraday top following the Turkish government action.

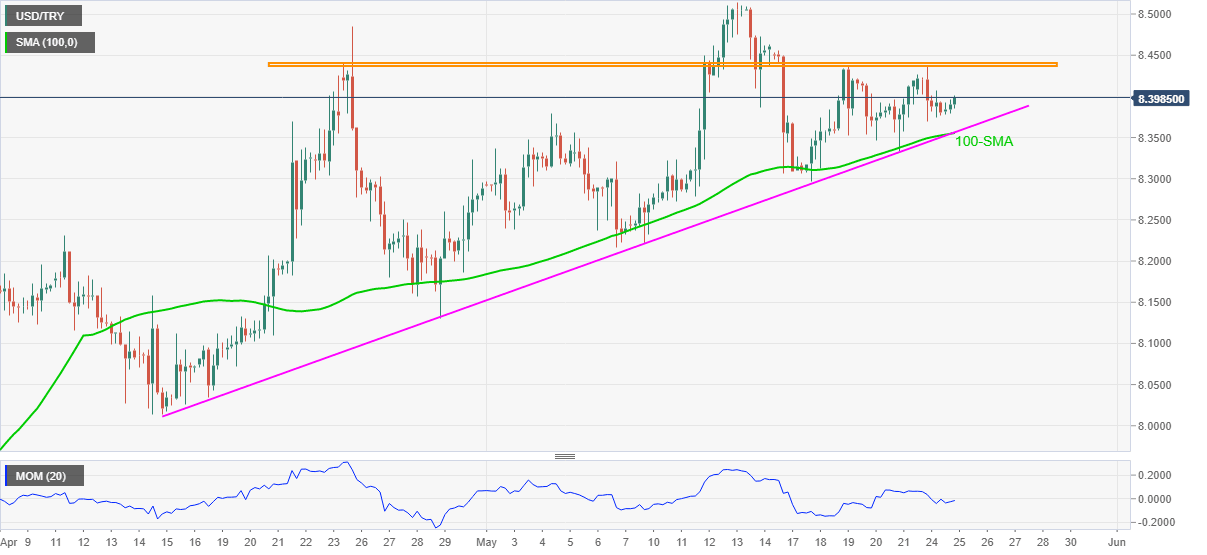

- Upbeat Momentum line, successful run-up above 100-day SMA, six-week-old support line favor buyers.

- Monthly horizontal area guards upside moves targeting monthly top.

USD/TRY justifies the Turkish government’s interference in central bank activities while taking the bids around 8.4000, up 0.13% intraday, heading into Tuesday’s European session.

Read: USD/TRY shrugs-off removal of one of four Turkish deputy central bank governors

In doing so, the quote backs the repeated bounces off 100-SMA, as well as price-positive Momentum, to direct USD/TRY buyers toward a horizontal area comprising multiple tops from late April, around 8.4400.

While the pair’s run-up beyond 8.4400 needs a strong push, a clear breakout won’t hesitate to challenge the monthly high, also the highest since November 2020, around 8.5150.

Meanwhile, a confluence of 100-SMA and an ascending support line from mid-April, near 8.3550, becomes crucial support for USD/TRY sellers to watch during the quote’s pullback moves.

Also acting as important support is the previous week’s low near 8.2960, a break of which will challenge the monthly low of 8.2160.

USD/TRY four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.